- Carnegie-Mellon Researchers Published Report on Statistical Uncertainty in Census Bureau Data

- Kotagal’s U.S. Senate Confirmation to EEOC In Trouble: Political Rugby Scrum in Progress

- Everything Old is New Again: NLRB Proposes Familiar-Looking Rule to Determine Joint Employer Status

- GAO Reported That the Office of the National Cyber Director’s Strategic Plan Is “Well Underway”

- In Brief

- Looking Ahead: Upcoming Date Reminders

Friday, August 26, 2022: Carnegie-Mellon Researchers Published Report on Statistical Uncertainty in Census Bureau Data

Experts Tell DE/WIR team that possible OFCCP compliance issues depend on what factors are considered

Background: The American Community Survey (ACS) and other Census Bureau data products contain many kinds of statistical uncertainties, but to what extent do those uncertainties matter for OFCCP compliance? It all depends on which factors are taken into account in conducting availability analyses for Protected Groups, a group of experts told the DirectEmployers (DE) WIR team in interviews this week.

Census Bureau uses data uncertainty as a means to protect privacy

Before the Census Bureau publishes any statistic, it applies safeguards designed to help prevent someone from tracing that statistic back to a specific respondent. On its “Statistical Safeguards” webpage the Census Bureau notes that:

“We call these safeguards “’disclosure avoidance,’” although these methods are also known as “’statistical disclosure controls’” or “’statistical disclosure limitations.’”

Although it might appear that a published table shows information about a specific individual, the Census Bureau has taken steps to disguise the original data in such a way that the results are still useful. These steps include using statistical methods such as “’data swapping’” and “’noise injection.’”

Carnegie-Mellon study examined differential privacy and the impacts of data uncertainty on federal policy goals

Addressing some aspects of this practice, researchers at Carnegie-Mellon University published a paper in the journal Science, entitled, “Policy impacts of statistical uncertainty and privacy.” The journal is one of several which the American Association for the Advancement of Science publishes. The researchers explained that a privacy protection system referred to in the scientific community as “differential privacy” is “the cornerstone of the Census Bureau’s updated disclosure avoidance system.” The Census Bureau states that it used differential privacy in the 2020 Decennial Census to keep pace with privacy threats emerging in the digital age.

But the researchers cautioned that “[i]f quantified and unquantified errors alike are not acknowledged and accounted for, policies that rely on census data sources may not distribute the impacts of uncertainty equally.”

The Carnegie-Mellon researchers explained how differential privacy and other data uncertainty impact Census Bureau data:

“Designed to rigorously prevent reconstruction, reidentification, and other attacks on personal data, differential privacy formally guarantees that published statistics are not sensitive to the presence or absence of any individual’s data by injecting transparently structured statistical uncertainty (noise). But even before differential privacy is applied, estimates from the Decennial Census, surveys such as the American Community Survey (ACS), and other Census Bureau data products used for critical policy decisions already contain many kinds of statistical uncertainty, including sampling, measurement, and other kinds of nonsampling error. Some amount of those errors is quantified, but numerous forms of error are not, including some nonresponses, misreporting, collection errors, and even hidden distortions introduced by previous disclosure avoidance measures such as data swapping.” [citations omitted].

In their article, the researchers examined several issues related to statistical uncertainty when sharing sensitive data. In the opening paragraph of their article, they explain:

“Differential privacy is an increasingly popular tool for preserving individuals’ privacy by adding statistical uncertainty when sharing sensitive data. Its introduction into US Census Bureau operations, however, has been controversial. Scholars, politicians, and activists have raised concerns about the integrity of census-guided democratic processes, from redistricting to voting rights. The debate raises important issues, yet most analyses of trade-offs around differential privacy overlook deeper uncertainties in census data. To illustrate, we examine how education policies that leverage census data misallocate funding because of statistical uncertainty, comparing the impacts of quantified data error and of a possible differentially private mechanism. We find that misallocations due to our differentially private mechanism occur on the margin of much larger misallocations due to existing data error that particularly disadvantage marginalized groups. But we also find that policy reforms can reduce the disparate impacts of both data error and privacy mechanisms” [citations omitted].

Lead researcher Ryan Steed told WIR that uncertainty may impact availability calculations, depending on a variety of factors

Saturday, September 3, 2022: Kotagal’s U.S. Senate Confirmation to EEOC In Trouble: Political Rugby Scrum in Progress

First, on Saturday (September 3), a coalition of 93 civil rights and gender equality advocates blanketed the U.S. Senate with this “Dear Senator” letter to express “strong support” for Ms. Kotagal:

“The undersigned 93 civil rights, workers’ rights, and gender equality organizations write to express our strong support for the nomination of Kalpana Kotagal to serve as a Commissioner on the U.S. Equal Employment Opportunity Commission (EEOC). Ms. Kotagal is an exceptionally qualified civil rights lawyer who has dedicated the bulk of her career to helping everyday working people enforce their rights under federal employment and anti-discrimination laws. Her deep knowledge of the law and her experience addressing systemic discrimination make her an outstanding choice to help lead the EEOC in its work to prevent and remedy unlawful employment discrimination and promote equal opportunity for all in workplaces that are respectful and inclusive. ….”

Then Senators Shelley Moore Capito (R-WV) and Mike Braun (R-IN) pushed back in an Op-Ed piece which ran in many newspapers last week:

“The nomination of Kalpana Kotagal to be a member of the Equal Employment Opportunity Commission is a significant one. Her appointment would shift the balance of the five-member EEOC from its current makeup to one that would stifle economic growth, especially on the fossil fuel industry. It is sobering to think about what one vote could do on the EEOC. It is also important to remember what one vote could do in the U.S. Senate as well. Her nomination was deadlocked in committee, and thus would require every Democrat, in addition to the vice president, to advance the nomination. One Democrat voicing opposition would keep her from advancing and changing the makeup of the EEOC.”

Why All the Public Fireworks?

Political disputes typically boil over into the public domain over stalled nominees when one or two Senators necessary to confirmation express diffidence about the candidate. Then, the Senate Majority Leader (Senator Mike Schumer (D-NY) in this case), who is responsible to schedule the Nominee’s Confirmation for a full Senate Floor Vote makes it known he is not going to advance the candidate without the 51 votes in-hand needed to confirm the President’s Nominee. Then, the political campaigns begin for the hearts and minds of the “fence-sitting” Senator(s) in the U.S. Senate.

So, who could the fence sitter(s) be Senators Capito and Braun wish to influence to continue to stand fast against Ms. Kotagal’s nomination, and why? The 50 U.S. Senate Republicans look rock solid in opposition, so it must be a Democrat Senator. NOTE: Liberal Republican Senator Susan Collins (R-ME) and Senator Lisa Murkowski (R-AK), who have been known to vote with the Democrats on selected Presidential Nominees, have already voted against Ms. Kotagal’s nomination. Both Senator Collins and Senator Murkowski sit on the Senate Health Employment and Pensions (“HELP”) Committee and voted against Ms. Kotagal at her Confirmation Hearing before the Committee. While that earlier Confirmation Hearing vote does not “tie their hands” and force them to vote against Ms. Kotagal on the Senate Floor, it would be highly unusual for either one of them to now have a change of heart.

So, let’s count heads on the Democrat side. The rumor on Capitol Hill is that Senator Manchin (D-WV) is not on board with the Democrats on the Kotagal nomination, and that is a good bet. First, Senator Manchin has repeatedly broken ranks with the Democrats on many policy issues both large and small. And while he has usually supported The President’s Nominees in Senate Floor votes, he has not always done so. And, it appears that Senator Capito (R-WV) wrote the above-quoted passage from her Op-Ed piece to a party of one: her Senatorial colleague from West Virginia, Senator Manchin. How else does one make sense of this point: that Kotagal “would stifle economic growth, especially on the fossil fuel industry…”? As an EEOC Commissioner? Coal industry energy policy-maker?

In arguing that one Senate vote could stop Ms. Kotagal, Senators Capito and Braun are really making the point that it is worth one Democrat Senator stopping Kotagal to stop the EEOC from switching from a Republican majority to a Democrat majority. So what, you might ask? Without Kotagal on the Commission, the Biden White House cannot push forward its hope for the EEOC to impose another almost Billion Dollar cost on employers to report EEO-1 Component 2 Hours Worked and Pay data, which every independent technician, scholar, and discrimination lawyer has concluded does nothing (not a little bit: nothing) to advance the enforcement of non-discriminatory pay in America.

If Ms. Kotagal fails to be confirmed in the next about 40 Legislative days left between now and the end of this Congress on January 3, 2023, her nomination will time out. At the same time, Republican EEOC Commissioner Janet Dhillon (R) will also time out and will rotate off the Commission, leaving a 2-2 Republican-Democrat deadlock. If control of the U.S. Senate switches to Republicans on January 3, 2023, no nomination to the EEOC will occur in the remainder of President Biden’s first term. Not only would a replacement nominee be unlikely to get out of the HELP Committee if the Senate were Republican-controlled, but the Republican Senate Majority Leader also would simply not schedule a Senate Floor vote to vote on the nomination. In that case, the EEOC would remain deadlocked 2-2 until the next Presidential election in 2024.

On the other hand, if Democrats hold control of the Senate following the mid-term elections in November of this year, President Biden would have a chance to nominate another Democrat candidate to sit on the EEOC. However, even if that candidate were successfully seated on the Commission, it would take many months deep into 2023. And then Rulemaking on a new EEO-1 Component 2 Hours Worked and Pay Data Rule would ensue and eat up another great length of time with Republicans trying to delay the President until Republicans get another chance at a regime change.

Does the Kotagal opposition, though, signal Republican concern that they are not confident now about winning the Senate back? If Republicans were confident of taking back control of The Senate, they would feel comfortable to just swat down any untoward Democrat-controlled EEOC initiative pursuant to the Congressional Review Act. But the rejoinder to that is that any new Republican Legislature wants to put their policy agenda forward, not play a never-ending game of “Whack-a-Mole” knocking down one over-reaching EEOC policy after another. It is the difference between playing “offense” or “defense.” New political regimes would rather be on the offense…scoring points…not stopping the other team’s attempted policy initiatives.

Senators Capito and Braun had it right: “It is sobering to think about what one vote could do on the EEOC.”

Tuesday, September 6, 2022: Everything Old is New Again: NLRB Proposes Familiar-Looking Rule to Determine Joint Employer Status

The Return of the Obama Era “Indirect,” or “Reserved control” Test Is Sufficient to Prove Up Joint Employer Status

If the proposed rule seems familiar to our readers, it is because we should all be familiar by now with the recent tortured history related to the question of who qualifies as a “joint employer” pursuant to the NLRA. The constant upheaval pertaining to this Rule has now spanned the most recent three presidential administrations. We were torn over possible alternative headlines;

Back To the Future: What is Old Is New

Its Déjà Vu All Over Again

Say What? Another Political Flip-Flop NLRB Decision?

Two Political Parties Interpreting the Very Same Congressional Statutory Language Really Came for The Fourth Time to Diametrically Opposite Interpretations?

We Don’t Need Lawyers: Just Tell Me Which Political Party is In Power and My Crystal Ball Can Predict Any NLRB Decision

Running In Circles and Getting Nowhere but Dizzy

Where We Are Now, Or At Least For the Moment: The New Proposed Rule, Same as the Old Rule

With the advent of a Democrat-led Executive Branch beginning in January 2021, the NLRB soon thereafter once again boasted a 3-2 voting block of Democrat Board Members. As a result, the NLRB has now issued the Proposed Rule referenced above seeking to overturn the Trump NLRB’s 2020 Final Rule. The Trump NLRB Rule currently requires an employer to have “direct and immediate control” to be a “joint employer” pursuant to the NLRA. Specifically, the NLRB proposes, instead, that “indirect control” or what is oftentimes called (contractually) “reserved control” alone is sufficient to prove “joint employer” status. In other words, welcome back to the Browning-Ferris Rule for Joint Employer status!

However, the NLRB’s Proposed Rule does make one change to the Browning-Ferris standard (from the Obama NLRB, discussed below) in a nod to the D.C. Circuit Court of Appeals decision in 2018: it defines the “essential terms and conditions of employment” as generally including, but not limited to, “wages, benefits, and other compensation; hours of work and scheduling; hiring and discharge; discipline; workplace health and safety; supervision; assignment; and work rules and directions governing the manner, means, or methods of work performance.” The proposed language is meant to address the D.C. Circuit’s admonition in 2018 that the 2015 Browning-Ferris holding was overbroad as to what factors were directly related to the terms and conditions of employment within the meaning of the NLRA.

The scope of the NLRB’s proposed list of “terms and conditions of employment” subject to joint control may be an area for employers to comment to the NLRB, especially as it pertains to the Board’s proposed “not limited to” language. That expansive language could later allow mischief to occur were the NLRB to later “interpret” that (“not limited to”) language to “open the door” and not limit the NLRB to the list of employer terms and conditions of employment the NLRB has published in the proposed Rule.

Assuming the Proposed Rule eventually moves to Final form and becomes binding law under the NLRA, employers should anticipate the NLRB enforcing the original Browning-Ferris standard in hopes of expanding employer coverage to additional entities and businesses in the context of the NLRA. President Biden is fond of reminding the public that he ran for President both on a commitment to unions and employee rights, but also to make his Administration the most pro-union Administration ever. Expansion of the definition of which companies enjoy a “joint-employer” relationship delivers on that promise to the nation’s unions. Of course, given the recent spate of partisan litigation, the effect of this Proposed Rule, once it becomes Final, will most likely be limited pending court rulings in the predictable employer lawsuits seeking to enjoin enforcement of any new Joint Employer Rule in the predictable Texas federal courts.

Moreover, the NLRB’s Final Rule could (and would, we predict) be overturned pursuant to the Congressional Review Act if Republicans win control of both the U.S. House and U.S. Senate beginning January 3, 2023, following the November 2022 “midterm” elections. But Republicans must win the Senate, even if only by 1 vote…not just crush the Democrats in the House races.

How We Got Here: The Convoluted Recent History of the NLRB’s “Joint Employer” Rule

As readers may recall, in 2015 the NLRB issued a decision in Browning-Ferris Industries of California, Inc., 362 NLRB 1599 (2015). In that case decision, the NLRB expanded the definition of “joint employer” in furtherance of employee rights. In the initial Browning-Ferris ruling, the NLRB held that two companies were joint employers of sorters, screen cleaners, and housekeepers whom the union petitioned to represent. Specifically, the Democrat-controlled NLRB reset the legal standard for joint employment as follows:

“The Board may find that two or more entities are joint employers of a single work force if they are both employers within the meaning of the common law, and if they share or codetermine those matters governing the essential terms and conditions of employment. In evaluating the allocation and exercise of control in the workplace, we will consider the various ways in which joint employers may ‘share’ control over terms and conditions of employment or ‘codetermine’ them…”

As we explained in reporting on that decision, Browning-Ferris (the waste recycler company) had reserved general limitations and protocols in its service contract with Leadpoint Business Services (the staffing agency). The contract running between the two companies was the “reserved control” which animated the union because Browning-Ferris set some terms and conditions of employment for Leadpoint about which the union could not bargain with Leadpoint since Browning-Ferris had set those conditions. For example, the contract established when work and breaks would start and end since Leadpoint employees had to work at Browning-Ferris’ recycling facility, follow BF’s security rules, and work alongside B-F employees when they reported for work and returned from breaks. As a result, the reservation of what the NLRB found to be terms and conditions of work of the Leadpoint employees embedded in Leadpoint’s contract with B-F warranted a finding that the waste recycler company had the ability to share or codetermine who supervised, hired, fired, disciplined, and paid the staffing agency’s employees. The NLRB in the 2015 Browning-Ferris decision therefore altered the prior Bush NLRB standard finding a putative joint employer relationship only if both entities exercised actual control over essential terms and conditions of employment. Browning-Ferris then appealed to the D.C. Circuit Court of Appeals.

During the pendency of that appeal, Republicans won the White House following the election of 2016. In 2017, upon Donald Trump’s assumption of the Presidency and his subsequent appointment of a Republican majority to the National Labor Relations Board, the NLRB overruled the Obama NLRB’s Browning-Ferris standard. In Hy-Brand Industrial Contractors, Ltd., 365 NLRB 156 (2017), the NLRB reinstated the former Bush NLRB test determining when a “joint employer” relationship existed. The Bush NLRB standard had found a “joint-employer” relationship only if an entity exercised actual control over the essential terms of another company’s employees. This required direct and immediate exercise of control “in a manner that is not limited and routine.” The NLRB further asked the D.C. Circuit to remand the Browning-Ferris appeal back to the NLRB so it could adopt the new joint employer standard set forth in Hy-Brand.

However, in 2018, the NLRB returned once again to the Browning-Ferris standard after the NLRB’s Designated Agency Ethics Official determined one of the NLRB Members should have been disqualified from participating in the 2017 Hy-Brand decision. This resulted in the NLRB having to set aside the Hy-Brand decision in 2018 due to the improper participation by the NLRB Board Member. Readers may recall a timeline chart provided in a previous WIR outlining the see-saw changes as to the “joint employer” rule resulting from the withdrawal of the Hy-Brand decision.

Because Hy-Brand no longer applied, the NLRB filed a motion with the D.C. Circuit Court of Appeals to re-open the Browning-Ferris appeal to review the 2015 standard that was now back before the NLRB. Instead, and unfortunately for employers, in December 2018 the D.C. Circuit Court of Appeals upheld large portions of the 2015 NLRB decision. See Browning-Ferris Indus. of Cal., Inc. v. NLRB, 911 F.3d 1195 (D.C. Cir. 2018). Specifically, the Court ruled that the NLRB’s interpretation of the joint-employer test was appropriate. That interpretation required the Board and courts to consider both an employer’s reserved right to control as well as its indirect control over an employee’s terms and conditions of employment as part of the calculus to determine whether a joint-employer relationship existed between the two corporate entities of interest.

As we wrote at the time, the Court agreed with the Obama Administration NLRB decision that an entity did not have to exercise actual control to be a joint employer. The Court issued this decision while the NLRB was nonetheless in the process of issuing a new joint-employer rule to the contrary. These actions lent the impression to employers of a “circus tent” atmosphere surrounding the “joint-employer” test (with employers caught in the political tug-of-war without clear direction either way).

In February 2020, the Trump NLRB then issued a “joint-employer” Final Rule rejecting the Obama NLRB Browning-Ferris standard, countering the D.C. Circuit’s ruling, and angering unions that had pressed for a broad definition rendering two companies involved in the same business activity using each other’s employees for a common objective to be “joint employers”. As we noted at the time, the NLRB defined the act of employers to “share or codetermine” the essential terms or conditions of employment (i.e., the standard the D.C. Circuit adopted from the 2015 Browning-Ferris NLRB decision) to require an entity to possess and exercise “substantial direct and immediate control over one or more essential terms or conditions of their employment as would warrant finding that the entity meaningfully affects matters relating to the employment relationship with those employees.” As expected, the Final Rule became subject to a legal challenge that remains pending. SEIU v. NLRB, Case No. 1:21-cv-02443 (D.C.C. September 17, 2021).

Given all the foregoing machinations, what happened with that original Browning-Ferris case that spawned all this back-and-forth? In July 2020, following the D.C. Circuit Court of Appeals’ remand to the NLRB, the Trump-era NLRB overturned the 2015 Browning-Ferris NLRB decision and found that Browning-Ferris was not a joint employer of employees in the petitioned-for unit. Specifically, the NLRB held that the 2015 decision introduced a new legal standard not previously known or applied in the case. As such, retroactive application of the new standard, the Trump NLRB reasoned would be manifestly unjust. Accordingly, the Trump NLRB held that whether Browning-Ferris was a “joint employer” was a question which should have been considered under the previous, longstanding “joint employer” rule that the 2015 decision attempted to overturn. Unfortunately for employers, however, the D.C. Circuit Court of Appeals this past July struck down this Trump-era NLRB decision for not obeying the Court’s previous remand decision, as we reported.

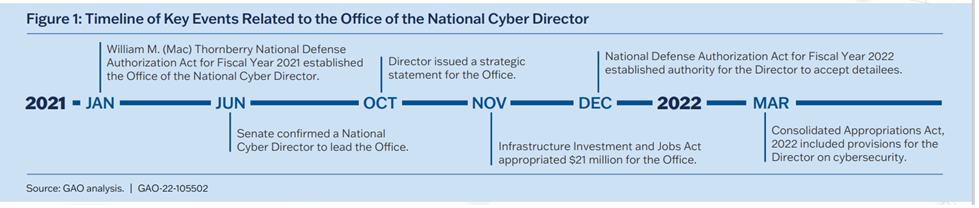

Tuesday, September 6, 2022: GAO Reported That the Office of the National Cyber Director’s Strategic Plan Is “Well Underway”

Nation-state actors and criminals stealing Americans’ personal information due to social engineering are some examples of threats in cyberspace. Recognizing that the federal government needed to develop and implement a comprehensive strategy to overcome cyber threats, Congress, in January 2021, established the Office of the National Cyber Director within the Executive Office of the President. In June 2021, the Senate confirmed Chris Inglis to serve as the inaugural National Cyber Director.

See also WIR: White House Memo Accentuated Importance of Federal Zero Trust Security and IT Modernization Goals

In Brief

Friday, September 9, 2022: USDOL’s Office of Disability Employment Policy Announced National Disability Employment Awareness Month Poster, Other Resources Available

Looking Ahead:

Upcoming Date Reminders

Tuesday, September 13, 2022 (1:00 – 2:30 PM EDT): EEOC and OFCCP Roundtable on Artificial Intelligence, “Decoded: Can Technology Advance Equitable Recruiting and Hiring?”

Thursday, September 15, 2022 (2:00 – 3:00 PM EDT): DirectEmployers webinar on “The Truth About 10 Common Background Check Mix-Ups”

Thursday, September 15, 2022: First Office of Management and Budget virtual Listening Session on the overhaul of federal data collections of race and ethnicity

Monday, September 19, 2022: Deadline to submit objections to OFCCP regarding EEO-1 Data (Component 1, Type 2) FOIA disclosure request – https://www.dol.gov/agencies/ofccp/submitter-notice-response-portal

Monday, September 19, 2022: Deadline to comment on USDOL Wage and Hour Division’s unchanged paid sick leave recordkeeping requirements for federal contractors – https://www.federalregister.gov/documents/2022/07/19/2022-15313/agency-information-collection-activities-comment-request-establishing-paid-sick-leave-for-federal

Monday, September 19, 2022 (10:00 AM EST): OFCCP webinar on “Prohibiting Pay Secrecy Policies”

Thursday, September 22, 2022: DE Masterclass Roundtable #9: “No Longer a Secret: State Salary Transparency Laws for Private Employers”

Friday, September 30, 2022: 2022 VETS-4212 filing deadline. The reporting cycle began on August 1, 2022 – https://www.dol.gov/agencies/vets/programs/vets4212

Tuesday, October 18, 2022: Deadline to submit comments on FAR Council’s proposed Rule mandating Project Labor Agreements on large federal construction projects – https://www.regulations.gov/document/FAR-2022-0003-0001

Tuesday, November 1, 2022: Deadline to submit comments on US General Services Administration’s future rulemaking regarding union solicitations of federal contractor employees in GSA-controlled buildings – https://www.regulations.gov/docket/GSA-FMR-2022-0011

Wednesday, April 12 – Friday, April 14, 2023: DEAMcon23 Chicago

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.