What follows are summaries and selected highlights from each of the extensive presentations.

Story references are to DE’s OFCCP Week in Review Blog.

DE Members may view the presentation slides for all the DEAMcon 2024 sessions at this link: https://deamcon.org/slides/

- Lantz, Gill, & Krefft Illustrated How Accessibility & Belonging Are Vital to DEI Practices

- Let Me Tell You a Secret: Employer Legal Obligations Related to Disclosing Employee Pay Data

- Robinson & Huth Explored How SMBs Can Use AI Hiring Tech in Inclusive Ways

- Making Your Disposition Codes a “Big Easy” Your Practical Guide to Implementation

- DEAMcon24 Ended with Gratitude for the Audience, Presenters, Underwriters, and DE Marketing Team

Lantz, Gill, & Krefft Illustrated How Accessibility & Belonging Are Vital to DEI Practices

Day Three of the conference began with a look at disability employment. The key to true diversity, equity, and inclusion (“DEI”) is also creating a sense of belonging, pointed out Ashlea Lantz Senior Policy Advisor at The Harkin Institute, during a panel presentation covering how accessibility and belonging are essential to DEI efforts. Joining Ashlea were Michelle Krefft, Director of Community and Business Engagement at Iowa Vocational Rehabilitation Services (“IVRS”), and Molly Gill, Product Manager at John Deere Financial (“JDF”).

Sense of Belonging

She then turned to the concept of belonging. She asked the audience to “think about a time where you felt like you belonged,” and conversely “to think about a time . . . where you felt like you did not belong.” Next, she requested the audience to “think about when we create that sense of belonging in the workplace, disability or not. It is a benefit [because when people] bring their best selves to work, [they] are more productive, and turnover is down.” She continued, “When we [create a space where] people feel valued and heard, that strengthens, and that future proofs, our business [by bringing] together different perspectives.”

She cited research showing that employees who felt a strong sense of belonging (1) have a 50 percent lower turnover rate, (2) use 75 percent fewer sick days, and (3) a 56 percent increase in job performance.

Value Proposition of Disability Employment

“The disability community has the combined spending power of $13 trillion,” Ashlea said. “If you are not tapping into your workforce of people who have disabilities, you are missing a market,” she added. Moreover, she cited research reporting that “inclusive companies are twice as likely to have higher total shareholder return, 28 percent higher value, [and] 30 percent higher profit margins than their peers [thus, it makes] a difference in the future-proofing of your company … for new markets and innovating products that meet human needs,” she noted. To illustrate, she pointed out that many modern conveniences are rooted in disability innovation, including audiobooks, cruise control, and the typewriter, all designed by and for people with disabilities.

In the context of talent acquisition, organizations should not limit their considerations to just the unemployment numbers of workers with disabilities. “The number that we have to look at is those not in the labor force because there are hundreds of thousands of people with disabilities that want to be working and contributing,” Ashlea stated. “They want to be in the workforce, but they are not captured in that percentage of unemployed . . . [T]here is an entire untapped labor pool,” she said.

Competitive, Integrated Employment

“Competitive, integrated employment is at the core of the Harkin Institute’s work on disability policy,” Ashlea said. This means that persons with disabilities:

- Can access all employment opportunities;

- Earn the same pay as their colleagues;

- Have the same prospects for advancement, mentorship, and personal growth;

- Are treated as a driver of innovation and business opportunity rather than charity; and

- Are represented at every level of the organization.

“We often see that [workers with disabilities] are missing out or not being seen for advancement, because maybe they compete in the labor market in a different way [than what we use for] traditional metrics,” Ashlea observed. “Oftentimes, we unintentionally are using metrics that do not capture somebody at their best, particularly if somebody is neuro-diverse, [and] too often, we only see [inclusion efforts] at entry-level positions,” she added.

Competitive, integrated employment requires measurement connected to business strategy, and at the Harkin Institute, they collaborate with companies to help bring this about, Ashlea reported.

“Recruiting people with disabilities [involves] recognizing that equity is not just providing the same process for everyone but providing a variety of ways to get your foot in the door. It is not using the same measurement of gauging whether or not you will be a great employee based on the impact of your handshake or the amount of contact that you are making,” Ashlea pointed out.

An Example of Success at John Deere Financial

Molly told the story of how one of her daughters lost her hearing as a child and how she worried about that daughter’s employment prospects. Connecting that to her work at JDF, she mentioned a job at the company for which she had to create software to automate the process. This job was also one that the company had difficulty filling. After speaking to someone performing the job functions, it occurred to her that they should have deaf people do this job. “They would kill it because it is a visual-based job,” she reasoned.

From there, Molly began looking for ways to do that. She found that help at an August 2021 Harkin Institute summit on disability employment. The following month, she began engaging with the company’s user experience (“UX”) team to find ways to make the job accessible.

Ashlea helped them with ideas on how they could do some disability-specific hiring. In the meantime, Molly learned that one of the managers on the UX team had a daughter with autism. They arrived at the idea of opening up half of the twelve positions they had to fill for neuro-divergent candidates. They also consulted with a vocational rehab counselor who reviewed their application as a deaf individual. Applying that feedback, they then went on to form a test group and began onboarding their neuro-divergent users in March through May of 2022. “It has been super successful,” Molly reported.

During “this whole hiring journey together [they learned] that we really needed our internal resources of the product organization and the user experience group to come together and come up with a great design,” Molly said. They also need to collaborate with the people doing the actual hiring and “external partners to help us find the candidates,” she added.

Next Molly moved on to detailing how IVRS assisted them in this process. They had “a really eye-opening session” meeting with IVRS to review their job descriptions, she said. Most companies have their “own language” and “we discovered that the way that we were wording things [was] really confusing for external folks,” she noted. Therefore, they reworked their job descriptions to clarify their “must-haves” versus what makes a job candidate stand out and they “got rid of any acronyms.” IVRS also helped them assess the work content of the positions, considering factors such as motivational fit, user interface design feedback, and accommodations. In addition, IVRS introduced them to the concept of the “working interview,” where IVRS will cover the pay for a job candidate up to 320 hours. The candidate will complete their job training period instead of a traditional interview.

Their efforts to produce an accessible design for the software and parameters for the position increased accuracy and reduced training time, leading to a better user experience for everyone, including their customers, Molly pointed out.

How a State’s Vocational Rehabilitation Program Can Help in Finding Talent

Then their staff meets one-on-one with jobseekers to help them prepare for work. They discuss the essential functions of a position and explore accommodations, if necessary. From there, they ensure that onboarding is successful and help organizations with retention. “What is most important to us is that our jobseekers are still employed years later,” Michelle said.

Your state’s Vocational Rehab office can assist you with inclusive language and job descriptions, Michelle told the audience. They can “look at your website and publications to make sure they are accessible for all users” as well as evaluate your hiring processes to make suggestions for attracting a larger talent pool. As to compliance with the Americans with Disabilities Act, they do safety assessments of both an organization’s physical building and programmatic materials.

Michelle illustrated a couple of success stories at John Deere. One worker, Libby, started as a material handler and, after she earned her MBA, the company promoted her to supply management specialist. “That is a good showcase of upscaling and bringing somebody with a disability in and having them learn the job and get more education and then growing within the [organization], Michelle noted.

Another success story involved using the working interview. Michelle read the following quote from John Deere employee Joe:

“This opportunity meant a lot to me because it allowed me to gain experience within the accounting and financial fields of work. And, if I am being truly honest, if it was not for the assistance of Iowa Vocational Rehabilitation Services, I would not have had this opportunity. My advice to others looking for opportunity within finance and accounting and working for a large company like John Deere is to soak it all in like a sponge. It was a great opportunity to learn what you like and what you did not like about the job.”

Let Me Tell You a Secret: Employer Legal Obligations Related to Disclosing Employee Pay Data

Following up on his presentation at DEAMcon23 on state and federal transparency laws, Jay J. Wang, Partner at Fox, Wang & Morgan P.C. returned with an update on the current state of employer obligations to disclose pay data. He said that two types of laws that result in employers having to review or disclose employee salary information: (1) pay transparency laws, and (2) pay data reporting laws. Jay began with a discussion of pay transparency laws.

Continuing Trend of Disclosing Salary Ranges

This trend has some benefits, Jay noted. He cited a ZipRecruiter survey that found 75 percent of employers agreed pay transparency helped attract quality candidates and that 61 percent of employers agreed that pay transparency makes recruitment “more efficient” as it reduces questions regarding compensation. There are also legal compliance benefits due to improved pay equity and employee retention.

Still, there are unintended consequences, Jay said. There is a study that suggested that pay transparency results in a reduction in salaries overall. However, [w]e have not seen that practically play out, and I would suggest […] that it is a morale issue if you try to implement that sort of strategy to bring everybody on an equal level,” he told the audience. Pay transparency might reveal a conflict with current employee compensation. On this point, he reiterated his advice from last year that “HR and talent acquisition need to talk to each other” to ensure that the salary posted in the job advertisement is consistent with what the current employees are making. Jobseekers also tend to assume that their pay would be at the top of any pay range disclosed. Jay suggested that during the application process, employers discuss with jobseekers the qualities, skills, and traits necessary to earn the top market salary that is listed in the job advertisement.

Federal Salary Transparency Laws

In January, the Federal Acquisition Regulation (“FAR”) Council proposed a rule on “Pay Equity and Transparency in Federal Contracting.” If finalized, the proposal would amend the Federal Acquisition Regulations to prohibit federal contractors and subcontractors from seeking and considering information about job applicant’s compensation history when hiring or setting pay for personnel working on or in connection with a government contract. It would also require federal contractors and subcontractors to disclose expected salary ranges in job postings. (For more details, see our story here.)

This proposal “is now bringing pay transparency to federal contractors,” Jay observed, noting that thus far, there are not any federal laws requiring employers to publicly publish their pay ranges in advertising or job listings, only state law requirements. He predicted that the federal contractor proposal will be finalized later this year.

State Salary Transparency Law Update

Currently, 17 jurisdictions have pay transparency requirements. Eleven of those require salary ranges in job listings and six require the employer to disclose salary information during the application process or upon request by an applicant.

Detailed spreadsheets available for DE Members. Jay noted the detailed Excel spreadsheet he has prepared for DE Member companies cataloging and digesting salary transparency laws. Also available is a spreadsheet regarding state laws as to independent contractor rights. “Independent contractors are starting to get rights similar to those of employees,” in some states, he said. Jay’s law partner Alexa Morgan also prepared a spreadsheet detailing termination laws across the states.

New laws. Since last year, three new jurisdictions have imposed salary transparency requirements for job advertisements. Those are:

- the District of Columbia (effective 6/30/24). The D.C. law requires all employers employing at least one person in D.C. to advertise any openings, promotions, or transfers. An employer must provide the minimum and maximum salary or hourly pay and schedule of benefits, including stocks and nonmonetary remuneration. This law also prohibits screening applicants based on wage history and requires posting a notice of rights in the workplace.

- Hawaii (effective 1/1/24). Employers with 50 or more employees must include the hourly rate or salary range in advertisements for an open position. This law does not apply to internal transfers or promotions.

- Illinois (effective 1/1/25). Employers with 15 or more employees must include pay scale and benefits in any advertisement for openings performed in part in Illinois or physically performed outside Illinois if the employee reports to a supervisor, office, or worksite in Illinois. If an employer does not run a job advertisement for an open position, the employer must still provide its pay scale and benefits information prior to any offer of employment or the employer must discuss compensation upon an employee’s request. Employers must announce, post, or otherwise make known all promotion opportunities to current employees no later than 14 calendar days after external posting. Under this statute, liability can extend to third-party vendors who post jobs but fail to report a job’s pay scale and benefits.

Updates to existing laws. Since last year, Colorado updated its salary transparency law to provide that employers must now include an application deadline (employers may amend that date) and how to apply information with pay range and benefits data. These new requirements apply also to employee notice of promotions or transfers. Colorado also updated the law to clarify that the pay transparency obligation does not apply to non-Colorado employees or “in-line” promotions. Employers must also make available to employees any requirements for career progression. Finally, within 30 days after filling a new opening, an employer must inform employees who will work with the new hire about the new hire’s information and how employees may demonstrate interest in similar jobs in the future. The one exception to this requirement is that if the new hire, on his/her initiative, requests that his/her personal information not be disclosed, an employer may withhold personal information.

Practical lessons from violation citations. Jay noted the following lessons from violation citations:

- Document and evidence “good faith” for pay ranges. He mentioned a couple of New York citations on this point. “If you’re going to list a pay range, you need to explain and be able to document why those pay ranges are what they are,” he advised.

- Verify the inclusion of salary range information with your vendors and create contractual provisions with vendors who are listing or posting job advertisements. Some states do not impose third-party liability, Jay cautioned. “Colorado, for example, has excluded third-party vendors from being liable for what they include [on Indeed or LinkedIn], he noted.

- Colorado is very willing to collaborate with contractors to help them meet their obligations. Indeed, Colorado allows a “first pass” to allow employers an opportunity to fix what they got wrong.

Which states are next?

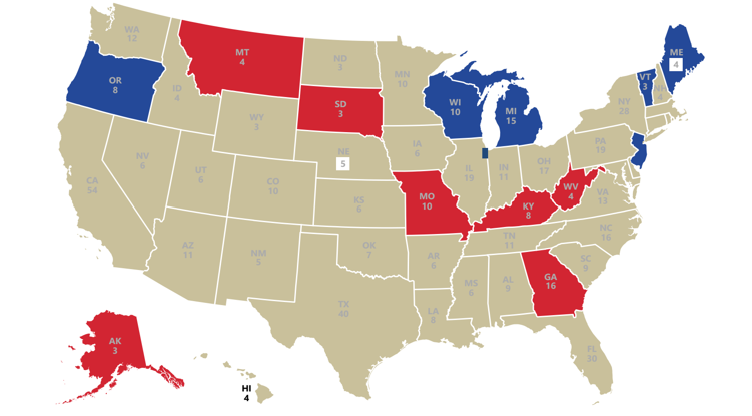

Jay shared a map of jurisdictions proposing salary transparency laws in 2023:

Again, Jay emphasized that these laws are not enacted or pending in just blue states. “This covers the political spectrum,” he said. Currently, Massachusetts has a bill requiring both pay transparency and pay data reporting that is awaiting the Governor’s signature. However, Virginia’s governor vetoed a salary transparency measure on March 15, 2024.

Pay Data Reporting Requirements

Jay then turned to a discussion of pending and current pay data reporting requirements.

OFCCP Scheduling Letter. OFCCP’s latest, controversial revisions to its audit Scheduling Letter and Itemized Listing took effect on August 24, 2023. (See our stories here, here, and here for details on the changes to the Scheduling Letter and Itemized Listing). The revised OFCCP audit Scheduling Letter places greater emphasis on pay data collections at the Desk Audit stage of an investigation. In particular, Itemized Listing #19 requests employee-level compensation data. However, there is no requirement for contractors to “create” a compensation report.

A contractor need only provide the data IF the contractor maintains the data OFCCP requests, Jay pointed out. Nevertheless, contractors will have to provide what data they do have such as a list that shows how much the contractor’s employees make. Moreover, contractors will have to provide their written policies and documents related to compensation. “This is not just your pay policies, that will be job descriptions. job advertisements or job listings that would include pay range,” Jay said, plus documents from compensation committees or market research. “Item 19 is all-inclusive and that is why I think you will spend hundreds of hours to try and satisfy the obligation in that regard,” he stated.

Itemized Listing #22 requires contractors to submit documentation that the contractor has satisfied its obligation to evaluate its “compensation system(s) to determine whether there are gender-, race-, or ethnicity-based disparities.” Jay reminded the audience of the various defenses that they could apply as mentioned in other presentations by Jay and his law partner, John Fox. He also went over the pros and cons regarding the appropriate stage of an audit a contractor should raise such defenses.

Is EEO-1 Component 2 coming back?

Will the “Component 2” Pay Data Reporting requirement return on the EEO-1 Survey? It all depends on the upcoming election, Jay said. It will likely come back if Joe Biden wins reelection, but probably will not if Donald Trump is elected. (See our recent related story here.)

State pay data reporting

Jay then detailed a few notable changes to existing state pay data laws. California’s changes to its pay data report include a requirement to report remote worker locations and to provide an organization’s Secretary of State number. California companies must now also provide gender and race/ethnicity information for all labor contractor employees – no “unknowns” allowed. In addition, employers “should,” but are not required to report non-compliant labor contractors.

Illinois requires private businesses with 100 or more employees in the state to apply to obtain an Equal Pay Registration Certificate (“EPRC”) by providing certain pay, demographic, and other data to the Illinois Department of Labor (“IDOL”) by March 24, 2024 (if not previously requested by IDOL), and to recertify every two years after the first submission. Jay recommended the following three resources for information on this requirement (1) IDOL FAQs; (2) IDOL training slides for filers; and (3) Illinois Administrative Code Title 56 §§ 320.800 et seq.

Closing thoughts

Wrapping up his presentation, Jay added some general thoughts:

- “Employee compensation is not a trade secret, really it is not. The second you have to disclose by law, you cannot explain why it is being kept confidential,” Jay said.

- “HR and talent acquisition need to coordinate and make sure that the pay information being provided is appropriate and correct,” he advised. Moreover, a “latticework approach” to providing pay information likely is not going to work anymore in light of the growing trend of states adding pay transparency requirements and the impending FAR Council Rule to require federal contractors and subcontractors to disclose expected salary ranges in job postings.

Robinson & Huth Explored How SMBs Can Use AI Hiring Tech in Inclusive Ways

Avoiding the use of Artificial Intelligence (“AI”) tools in recruiting and hiring can cause employers to miss job candidates with the skills an employer may need to succeed. Small and midsized businesses (“SMBs”) may already use AI-enabled hiring technologies without even knowing it. John Robinson, President and CEO at Our Ability, and Lex Huth, Director of Communications at Partnership on Employment & Accessible Technology (“PEAT”), teamed up to discuss how people with disabilities are leading the way to more inclusive AI hiring technologies and how SMBs can maximize the benefits they get from AI-powered tools.

“[At Our Ability] we have made a conscious decision to use artificial intelligence to add people with disabilities into the data set,” John said. He started Our Ability about 13 years ago with the goal of mentoring people with disabilities toward employment. “[P]eople with disabilities still want to be included and be a part of an inclusive workforce and that story has not diminished,” he stated.

“[Disability inclusion] is not just the right thing to do or the good thing to do. It actually does make [business] sense,” Lex said, citing a 2023 report by Accenture that found companies that have led on key disability inclusion criteria during the time frame of the study had 1.6 times more revenue, 2.6 times more net income, and 2 times more economic profit than other participants in Disability:IN’s annual benchmark survey.

Background on AI

“We have to make sure that we are doing the right thing with the technology instead of just letting it run out there and run wild because tools that are not designed with equity in mind can lead to discriminatory outcomes for people with disabilities, but also intersectional identities and other underrepresented groups,” Lex said.

AI may be used to assist humans but may also be used to assess humans; it can open new possibilities but can also exacerbate or introduce new risks or harms, Lex pointed out. She shared two slides with some examples of various AI functions, including communication, collaboration, assistive technologies, recruiting and hiring, surveillance, and training. Lex also shared some of her favorite assistive technologies as a visually impaired person with obsessive-compulsive disorder.

Using AI for a given function, such as surveillance, may be problematic for individuals with certain disabilities, but a welcome tool for individuals with other types of disabilities. “You just have to mindfully implement these tools,” she stated.

Lex then invited the audience to share what benefits they have gained from using AI tools. Examples included an individual with dyslexia using AI to help sort out information which helps her work more efficiently. Another person described how a younger HR assistant helped acquaint them with AI tools for captioning which increased efficiency.

AI in Hiring Risks and How to Manage Them

Lex then turned to hiring risks when using AI. These may include:

- The data available on employees is usually flawed;

- AI takes shortcuts whenever possible. It looks for easy correlations in data and can quickly become more biased than its training data;

- AI reflects implicit biases of people who design it; and

- Many vendors consider the inner workings of their technology to be proprietary. Consequently, it can be impossible to know how AI is making decisions.

So, how may employers address these risks? Lex highlighted the following abridged takeaways from PEAT’s 2023 Inclusive AI in Hiring Think Tank Report.

- Involve people with disabilities in technology design and use. We must ensure people with diverse lived experiences are in the loop at every stage to provide human oversight, while always considering who is not in the room and working to include them. “Inclusion is not just inviting them to the table and saying well, we have checked the box; it is actually listening to people with disabilities,” Lex said.

- Share risk management duties across organizations. We cannot expect one group of vendors, employers, or policymakers to manage all risk management responsibilities on their own.

- Notify end users about AI tools and hold organizations accountable. Offering plain language notices can help end users learn how AI tools work, speak up about potential harms, and choose whether to opt-out.

- Staff at all levels need to support a culture of AI fairness. When they adopt AI hiring tools, organizations cannot simply check a box and consider them inclusive. Instead, leadership and staff need to champion fairness by establishing processes to continually evaluate their use.

“You really need to make sure that AI is not making the final decision for you,” Lex advised. “Be transparent with stakeholders and let everybody know what AI is doing, how they are doing it, and how they can get accommodations. Focus on accessibility in every aspect of everything you do.”

Lex shared these additional AI-related resources from PEAT:

- Chart: Elements of Procuring & Tailoring Al Systems to Reduce Bias

- Beginner’s Checklist for Inclusive AI

- Podcast: DEIA Driven by AI

- Reduce Bias & Increase Inclusion in Your AI Hiring Technology Blog Post

- Artificial Intelligence (AI) Resource Library

Optimizing Your Job Descriptions

He talked about his organization’s collaboration with Syracuse University and Microsoft where they used machine learning to build Jobs Ability, a generative AI-driven system that matches people with disabilities to any of Our Ability’s 50,000+ jobs. A major goal in developing this system was to do so without bias.

In the process of building this system, a couple of things happened, John said. “One is that we became a technology company without meaning to be . . . The second thing [was] that his contact at Microsoft disclosed that he was blind, and that person eventually ended up working for, and acquiring part ownership in, Our Ability.

One major task they undertook in building the Jobs Ability System was to examine employers’ job descriptions and revising them to remove things such as ableist language which tends to deter individuals with disabilities from applying. To that end, they built a language detector that finds ableist language in job descriptions. They also review job descriptions for any legacy job duties or requirements that are no longer applicable to the essential functions of a given job. Another thing they did was to build a plain language translation model to make job descriptions accessible for the neuro-diverse and the intellectual/developmental disability communities.

If your job descriptions are not inclusive of people with disabilities you are potentially excluding 1/5 of potential talent, John pointed out. Companies such as Microsoft, which are including input from individuals with disabilities in their hiring process are reaping the benefits of increased profitability, he said, circling back to the numbers Lex cited at the beginning of the presentation.

Making Your Disposition Codes a “Big Easy” Your Practical Guide to Implementation

The strategic use of disposition codes is a crucial element to meet OFCCP compliance obligations. Brandy Luna, Director, Corporate Recruiting at Nelnet, joined DE Executive Director Candee Chambers and Attorney John C. Fox of Fox, Wang & Morgan P.C. to tackle this topic for the final presentation of the conference.

Why Do Employers Have Disposition Codes?

Employers create and document their use of disposition codes to gather and preserve evidence of the “legitimate non-discriminatory explanation(s)” for the adverse action in question, Candee explained.

John began to recommend that his clients use disposition codes to document Offers and rejections in hiring decisions because of “the enormous number of audits that the Carter administration was bringing through OFCCP” coming on the heels of the United States Supreme Court’s Hazelwood and Teamsters case decisions in 1977. John recommended that employers now use disposition codes to document adverse promotion and compensation decisions because of the OFCCP’s renewed recent interest to investigate unlawful discrimination in promotions and the continuing trend of enforcement agencies to focus on investigations of corporate compensation policies and practices.

Accordingly, if there is a statistically meaningful disparity in selections (for hire/promotion, etc.), an employer’s selection managers/talent acquisition staff must have their documentation as to the “legitimate non-discriminatory explanation(s)” as to why they rejected protected group members disproportionally. Otherwise, they will face a court finding, or OFCCP determination, of liability and be subject to paying damages and other remedies. “If you fail [to provide a legitimate, non-discriminatory explanation], the company fails,” John cautioned.

Reiterating a point made during Candee and John’s presentation the previous day, Candee told the audience that, when they run their Disparity Analyses Report (as required by OFCCP’s Rules), “you really should not have any disparities, it should be 0.00, because everybody should be documenting a legitimate non-discriminatory [explanation] to show that you did your job appropriately.”

Employers Must Create Their Own Unique Disposition Codes

While employers must create their disposition codes for themselves, Title VII and Executive Order 11246 law does not limit the kind and number of disposition codes an employer may use, John explained.

But be careful; employers should never recycle the disposition codes of other companies. “You have to design them for your job and your selection process,” he said. People often ask Candee and John for “the” list of disposition codes. But there is no generally applicable list. “They will be unique to you and different than Jonathan’s and different than Brandy’s,” John noted.

Brandy provided an example. Some positions for which her company hires require “a government security clearance, and to get a government security clearance, you have to be a U.S. citizen. [Accordingly,] one of our codes is that they don’t meet that criteria which may not be appropriate for other organizations to use,” she explained.

Who Should Document a Company’s Disposition Codes?

“Our recruiters document [our disposition codes],” using Workday’s Applicant Tracking System (“ATS”), Brandy said. They are assigned based on the stage of the hiring process, she added.

Candee and John both asked the audience, does your ATS give you the ability to customize your disposition codes? About 70% of the audience confirmed that they used their company’s ATS to document and maintain their disposition codes.

“You need to know that [an ATS comes] with a factory setting and then if you have enough budget,” you need to have the vendor customize your disposition codes or have your in-house engineer do that, John advised. “Every ATS is adaptable and the question is only how you do it and how much money it will take to do it,” he added.

Candee noted the problem of ATS software updates that fail to include the customization the employer has added.

Documenting & Preserving Disposition Codes

“You need to train your managers on what they can put in the interview notes and what they better never put in the interview notes,” Candee added.

While an employer may think they have everything digitized, they often do not, John pointed out. He cited an instance in which a client stored many of its disposition code documents in a “brown box,” rather than scanning them into their company’s sophisticated and robust 7-figure ATS system.

“Should a company quality control check its use/completion/accuracy and/or retention of its disposition codes?” Candee asked. “Absolutely,” Brandy said, adding that they try to run their quality control checks monthly, but not less often than quarterly.

“My recommendation is that you always use a disposition code that somebody completely outside of the process can look at it, and say oh, it is obvious that Joe did not have as many years of experience as what was required in the job description,” Candee advised. “You don’t want it to be left trying to figure out three months later how and why the selection decision was resolved.”

“You operate at your peril, in my experience, if you do not have a quality control check,” John said, recommending that employers do so monthly.

What Disposition Codes Should an Employer Have?

Employers may find it helpful to organize their disposition code by the kind of rejection, John suggested. An initial consideration is whether a “jobseeker” is even an “Applicant” as the law uniquely defines that term. Were they interested in the open position, and did they sustain their interest? Were they minimally qualified? Also consider, what was the available job? “If it was closed or you have a Data Management Technique operating to limit the consideration of more Jobseekers, you need to have a code for that, because you stopped considering somebody in that pool at some point,” John said.

Each of these “legitimate reasons” for your adverse action could have many different disposition codes to describe them. For example, there are many ways Jobseekers lose interest, such as not returning phone calls, not showing up for the interview, or by taking a competing job.

How Many Disposition Codes Must/Should an Employer Have?

You want as few as you may, but as many as you must, to explain the legitimate non-discriminatory explanation(s) for (each) rejection, John and Candee advised.

“This is not a lawyer decision,” John said, “this needs to be worked out by the people on the ground [i.e.,] compliance, legal, and [talent acquisition].” He added that “the human condition will just not allow for a lot of disposition codes. As a lawyer, I would probably like to have 40 or 50, but that is unrealistic.”

“Most of you will live between five and 15 and most [talent acquisition] people will find their favorite four,” John observed.

“We probably have a total of 40 or 50, but they are broken out into each application stage, and so they are a smaller subset, but in total, we probably have 40 or 50 and a lot of them repeat,” Brandy said.

What Not to Do

Brandy reported that, while they still use “not best qualified,” a reason must be added, such as education or work experience, etc.

John highly recommended having a disposition code for offers made and declined because, legally, a declined offer equals a “hire.”

Employers should not have a “Hired” disposition code because they are never accurate, John noted. “I have never in my life found a single applicant flow log or ATS log of hires to be accurate,” he said. You can use payroll records to determine which applicants actually hit payroll. “Payroll records are almost always accurate,” John observed.

Closing Thoughts

If an employer has several explanations/reasons for a decision, it should document all of them, John and Candee recommended. That is because OFCCP or a court may not be persuaded by one disposition code but may accept the second or third explanation as valid.

The presenters also noted the importance of training recruiters with disposition codes against each other. Also, if an employer uses talent acquisition staff to prescreen or select candidates for hire, that recruiter must also have training on the employer’s disposition codes.

“And when you disable or activate a new disposition code, train them immediately,” John said. “Do not assume that they are just going somewhere out there in the ether to figure this out. Train them.”

DEAMcon24 Ended with Gratitude for the Audience, Presenters, Underwriters, and DE Marketing Team

Candee closed out the conference by thanking the audience, presenters, underwriters, sponsors, and the DE marketing team that made it all possible. She also welcomed everyone to attend DEAMcon25 next May 2025 in Scottsdale, Arizona! Want to be a part of our amazing program next year? Our Call for Presenters submission period is open, now through Friday, August 9, 2024.

Day 3 Recap

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.