- DOL Proposed Revisions to Joint Employer Regulations

- New WHD Opinion Letters

- EEOC Responded to EEO-1 Pay Data Reporting Deadline

- New Employer Tool to Understand Mental Health Issues

- New OFCCP Regional Director

- Head of Wage & Hour Confirmation…Getting Closer

- March Employment Situation

- Construction Compliance Check Letter

- Compliance Evaluation Check-In

Monday, April 1 2019: DOL Proposed Revisions to Joint Employer Regulations

The U.S. Department of Labor announced a Notice of Proposed Rulemaking (“NPRM”) to revise and clarify the responsibilities of employers and joint employers to employees in joint employer arrangements. The Department has not meaningfully revised its joint employer regulation since 1958.

The Department proposes a four-factor test that would consider whether the potential joint employer exercises power to:

- hire or fire the employee;

- supervise and control the employee’s work schedules or conditions of employment;

- determine the employee’s rate and method of payment; and

- maintain the employee’s employment records

The proposal also includes a set of examples for comment that would further help to clarify joint employer status.

Additional Information

- Fact Sheet: Notice of Proposed Rulemaking to Update the Regulations Governing Joint Employer Status under the FLSA

- FAQs about the Proposed Rule

- Examples Clarifying Joint Employment Status

When the Federal Register publishes the Rule (www.regulations.gov) in the rulemaking docket RIN 1235-AA26), the public will have 60 days thereafter to submit comments for those comments to be considered.

Tuesday, April 2, 2019: New WHD Opinion Letters

FLSA2019-3

Question: May a youth residential care facility implement an “8 and 80” overtime pay system?

- Under the “8 and 80” system, a hospital or residential care institution may, pursuant to a prior agreement or understanding with its employees, compute overtime over a consecutive 14-day period. If the employer uses this method of payment, the employer must then pay overtime for all hours worked over 8 in any workday and over 80 in a 14-day period. 29 C.F.R. § 778.601.

- WHD’s Field Operations Handbook (“FOH”) defines a residential care institution (other than a hospital) as “an institution primarily engaged in (i.e., more than 50 percent of the income is attributable to) providing domiciliary care to individuals who reside on the premises and who … have a disability or, if suffering from sickness of any kind, will require only general treatment or observation of a less critical nature than that provided by a hospital.” FOH 12g02. “Such institutions … include those institutions generally known as nursing homes, rest homes, convalescent homes, homes for the elderly, and the like.”

Opinion: Inconclusive. There is not enough information supplied to determine if the “youth residential care facility” is a “hospital or residential care institution.” However, definitions provided in the Letter should allow for a determination by those inquiring.

FLSA2019-4

Question: Whether “Nutritional Outreach Instructors” a land-grant public university employs are exempt from minimum wage and overtime pay requirements under the Fair Labor Standards Act (“FLSA”).

- FLSA section 13(a)(1) exempts from minimum wage and overtime “any employee employed in a bona fide executive, administrative, or professional capacity (including any employee employed in the capacity of … teacher in elementary or secondary schools)[.]” 29 U.S.C. § 213(a)(1).

Opinion: The “Nutritional Outreach Instructors” described in the letter qualify as teachers under section 13(a)(1) and are therefore exempt from the FLSA’s minimum wage and overtime pay requirements.

FLSA2019-5

Question: Whether a farm’s “light processing” activities (cutting or freezing its agricultural products) and additional activities of packing, storing, and delivering those products, are primary or secondary agriculture for purposes of the Fair Labor Standards Act’s (FLSA) section 13(b)(12) exemption from overtime pay.

- FLSA section 13(b)(12) exempts employees employed in agriculture from overtime pay. WHD regulations and relevant judicial precedent divide the definition of agriculture into two concepts: primary and secondary agriculture.

Opinion: Inconclusive. There is not enough information presented to determine whether the farm’s activities of cutting or freezing its fruit, vegetables, or meat are subordinate to its farming operations or amount to an independent business. However, if the activities are subordinate to farming operations and do not amount to an independent business, the activities are secondary agriculture, and the employees employed in the activities will be exempt from overtime pay under section 13(b)(12).

Wednesday, April 3, 2019: EEOC Responded to EEO-1 Pay Data Reporting Deadline

The Equal Employment Opportunity Commission (“EEOC”) met the April 3rd deadline, District of Columbia federal District Court Judge Tanya S. Chutkan had imposed, and filed a brief explaining that the EEOC could collect EEO-1 Survey ‘Component 2’ “pay data” on an expedited basis in a 2 ½ month window from July 15, 2019, to and through September 30, 2019.

The Play-By-Play

- Acting EEOC Chair, Victoria Lipnic, explained that she was exercising her Title VII administrative authority to adjust the collection deadline to end September 30, 2019, to accommodate the significant practical challenges for the EEOC to collect Component 2 data in response to the Court’s Order. The proposed timeline includes data collection which would occur from a snapshot date between July 1, 2018 – September 30, 2018.

- The EEOC determined that modifying its current processes is not currently a viable option to more quickly collect Component 2 data from employers (it would take nine months to modify existing processes). Instead, the EEOC determined that using a data and analytics contractor to build a one-use (throw-away) collection tool would be the only alternative to collect the at-issue pay data before the end of this federal Fiscal Year 2019 (ending September 30, 2019).

- That EEOC’s data collection contractor would come at a cost of almost $3 million, and the EEOC’s Chief Data Officer, Samuel (Chris) Haffner, wrote in a Declaration to the Court that, “The proposed timeline for undertaking and closing a collection of Component 2 data by September 30, 2019, raises significant issues with data validity and data reliability.”

The Bottom Line

The EEOC is saying it could rush to get a collection of pay data for 2018 into this 2019 federal government Fiscal Year but it would be costly (a little under $3M) to build and buy reporting tools that the EEOC would then discard and the Agency could not vouch for the validity or reliability of the data.

It seems like the Commission is hinting at the same conclusion at which a majority of the respondents to the DE Member Survey last week arrived: this year is now lost for an “hours worked” and “pay data” collection. To undertake a pay data collection EEO-1 Survey with any hope of gathering valid results in a professional manner in the regular course of business, the parties ought to look to a March 2020 Survey, at the earliest.

So What’s Next?

- DirectEmployers (as reported last Monday in our most recent WIR) and the American Society of Employers in Detroit filed an Amicus Curiae Brief (i.e., “Friend of the Court”) attaching the results of the DE Member confidential Survey reporting the earliest dates Members could file the Component 2 “hours worked” and “pay data” Survey information. The next day, the U.S. Chamber filed a brief on its behalf and several other trade associations arguing that the reporting was burdensome and costly.

The plaintiffs in the case have until Monday, April 8, 2019, to respond to the EEOC’s filing and then presumably Judge Chutkan will issue a Final Order.

Wednesday, April 3 2019: New Employer Tool to Understand Mental Health Issues

Created in coordination with the Department’s Office of Disability Employment Policy (“ODEP”) and its Employer Assistance and Resource Network on Disability Inclusion (“EARN”), the Mental Health Toolkit is an online gateway to background, tools, and resources for employers. It provides valuable information and guidance for employers seeking to offer a mental health-friendly workplace.

“By some estimates, one in five American adults experiences a mental health condition each year and work plays an important role in their wellness,” said Deputy Assistant Secretary of Labor for Disability Employment Policy Jennifer Sheehy. “Employers that understand the importance of providing a supportive environment that empowers these employees are doing what’s right for their employees and for their businesses.”

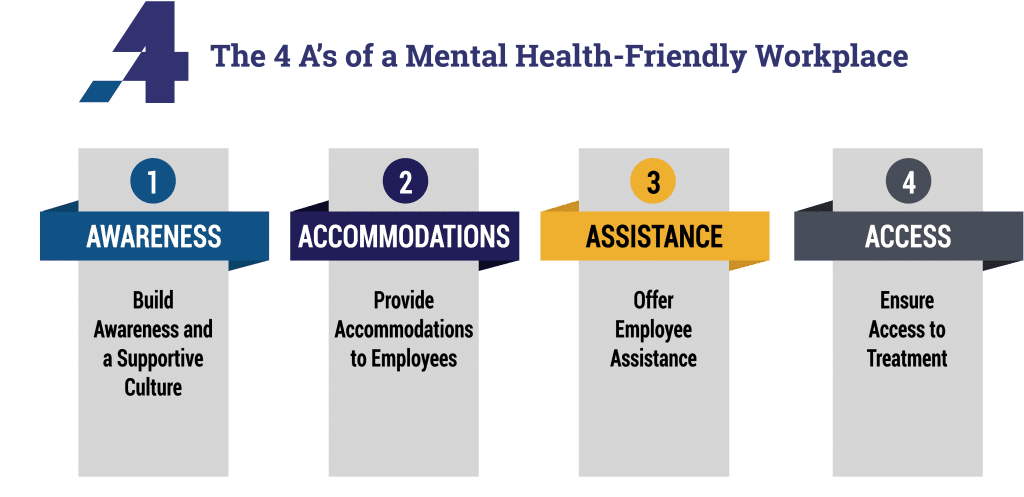

The Mental Health Toolkit provides summaries of research on workplace mental health, descriptions of mental-health initiatives implemented by companies of varying sizes and industries, and links to ready-to-use resources employers can use to start their own. It also presents an easy-to-follow framework for fostering a mental health-friendly workplace, all built around the “4 A’s”: Awareness, Accommodations, Assistance, and Access.

Funded by ODEP, EARN educates employers on strategies to recruit, hire, retain, and advance people with disabilities in the workplace.

Wednesday, April 3, 2019: New OFCCP Regional Director

a District Director. She takes over the position Janette Wipper vacated last May.

There is still no word on a selection for the Midwest (Chicago) Regional Director position since it was re-posted.

Thursday, April 4, 2019: Head of Wage & Hour Confirmation…Getting Closer

The cloture rule (Rule 22) is the only formal procedure Senate rules provide to break a filibuster. A filibuster is an attempt to block or delay Senate action on a bill or other matter. Under cloture, the Senate may limit consideration of a pending matter to 30 additional hours of debate.

Stanton is one of several of President Trump’s nominees waiting for their turns for Senate confirmation.

Friday, April 5, 2019: March Employment Situation

The Bureau of Labor Statistics (“BLS”) released March’s “Employment Situation.” Job numbers again showed slight declines for Americans with disabilities, in contrast with modest gains for Americans without disabilities. Veterans unemployment hit its lowest March rate since 2000.

| Unemployment Rate | March 2019 | March 2018 |

| National (Seasonally adjusted) | 3.8% (same in Feb) | 4.0% |

| Veterans (Not seasonally adjusted) | 2.9% (up from 2.7% in Feb) | 4.1% |

| Individuals with Disabilities (Not seasonally adjusted) | 7.9% (down from 9.1% in Feb) | 8.2% |

U.S. Secretary of Labor Alexander Acosta stressed that “The unemployment rate held steady at 3.8%, marking the thirteenth straight month the unemployment rate was at or below 4.0%.”

Monday, April 8, 2019: Construction Compliance Check Letter

OFCCP published a Notice in the Federal Register seeking

comments surrounding new information collection on a

“Construction Compliance Check Letter.” They look for feedback

to:

- Evaluate whether the proposed collection of information is necessary for the enforcement and compliance assistance functions of the agency that support the agency’s compliance mission, including whether the information will have practical utility;

- Evaluate the accuracy of the agency’s estimate of the burden of the proposed collection of information, including the validity of the methodology and assumptions used;

- Enhance the quality, utility and clarity of the information to be collected; and

- Minimize the burden of the collection of information by permitting electronic submissions of responses.

Note: At the time of publication, neither OFCCP nor OMB had published the proposed Letter.

Monday, April 8, 2019: Compliance Evaluation Check-In

By now, most of our readers know that OFCCP posted a CSAL in recent weeks. Our Member Engagement Team has personally notified DE Members on the List. We have received various inquiries about the types of “audits” and what to expect. Below is a quick overview to assist in audit-readiness! DE Members will find links to additional support items in the DE Connect Community.

OFCCP may publish audit Scheduling Letters as early as May 9, 2019.

| “Audit” Type | Deliverables / Resources |

|

1) Establishment Review

|

|

|

2) Compliance Check

|

|

|

3) Section 503 Focused Review

|

DE Members:

|

|

4) Corporate Management Compliance Evaluations (“CMCEs”)

|

|

| 5) Functional Affirmative Action Plans (“FAAPs”) |

|

REF:

Title 41 CFR §60-1.20 Compliance evaluations.

Title 41 CFR §60-2.30 Corporate management compliance evaluations.

Additional Resource

Federal Contract Compliance Manual: This manual provides Compliance Officers (COs) the procedural framework to execute quality and timely compliance evaluations and complaint investigations. NOTE: OFCCP is updating the manual with no release date known.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.