Monday, January 6, 2020: Yearlong Celebration Activities – ADA is 30!

The U.S. Department of Labor’s Office of Disability Employment Policy (ODEP) announced plans for a yearlong celebration of the 30th anniversary of the Americans with Disabilities Act (ADA). The ADA was signed into law on July 26, 1990, by President George H.W. Bush.

The U.S. Department of Labor’s Office of Disability Employment Policy (ODEP) announced plans for a yearlong celebration of the 30th anniversary of the Americans with Disabilities Act (ADA). The ADA was signed into law on July 26, 1990, by President George H.W. Bush.

“The Americans with Disabilities Act broke down barriers to opportunity for millions of American workers,” U.S. Secretary of Labor Eugene Scalia said. “On this anniversary, we recognize and celebrate the access to opportunity created by the ADA. Together with our strong economy, the Act has led to historically low unemployment for American workers with disabilities.”

The theme of the celebration is “Increasing Access and Opportunity,” and activities will include events, speeches, and new compliance assistance resources. The ADA’s anniversary will serve as a key component of the National Disability Employment Awareness Month (NDEAM) observance in October.

Friday, January 10, 2020: December Employment Situation

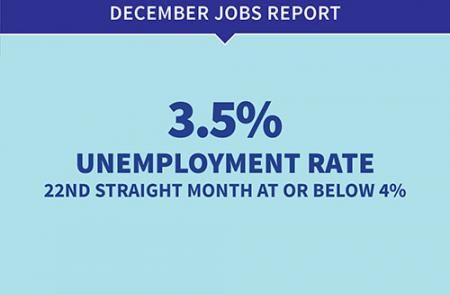

The release of December’s Employment Situation shows the national unemployment rate remained at the 50-year low of 3.5%. U.S. Secretary of Labor Eugene Scalia spotlighted that:

The release of December’s Employment Situation shows the national unemployment rate remained at the 50-year low of 3.5%. U.S. Secretary of Labor Eugene Scalia spotlighted that:

“In 2019, the American economy saw record low unemployment rates for many groups, including African Americans, Hispanic Americans, Asian Americans, Americans with less than a high school diploma, and Americans with disabilities.”

| Unemployment Rate | December 2019 | December 2018 |

| National (Seasonally adjusted) | 3.5% | 3.9% |

| Veterans (Not seasonally adjusted) | 2.8% | 3.2% |

| Individuals with Disabilities (Not seasonally adjusted) | 7.0% | 7.9% |

Sunday, January 12, 2020: USDOL Announced its Controversial “Joint Employer” Final Rule

The U.S. Department of Labor (DOL) Wage-Hour Division (WHD) announced its final “Joint Employer” rule (“Final Rule”). The Rule identifies the circumstances under which a business, such as a franchisor or staffing company, may be found to jointly employ a group of workers under the federal Fair Labor Standards Act (FLSA). This is significant because “joint employers” may share liability for many financial liabilities, including federal wage-hour violations related to the non-payment of wages. The new Final Rule returns the WHD’s policy back to what it was before the Obama Administration.

The U.S. Department of Labor (DOL) Wage-Hour Division (WHD) announced its final “Joint Employer” rule (“Final Rule”). The Rule identifies the circumstances under which a business, such as a franchisor or staffing company, may be found to jointly employ a group of workers under the federal Fair Labor Standards Act (FLSA). This is significant because “joint employers” may share liability for many financial liabilities, including federal wage-hour violations related to the non-payment of wages. The new Final Rule returns the WHD’s policy back to what it was before the Obama Administration.

Scheduled to take effect on March 16, 2020, the WHD adopts a four-factor balancing test derived from Bonnette v. California Health & Welfare Agency, 704 F.2d 1465 (9th Cir. 1983), to assess whether a business or person is a “joint employer.” Specifically, to be a “joint employer” in situations where an employee has an employer who suffers, permits, or otherwise employs an employee to work and another person or entity simultaneously benefits from that work, the new Rule codifies that the other business or person is a joint employer if BOTH entities actually, directly or indirectly: (1) hired or fired the employee; (2) supervised and controls the employee’s work schedule or conditions of employment to a substantial degree (rejecting the commenters’ suggestion that evidence of supervision on a day-to-day basis alone indicates the existence of a “joint employer”); (3) determined the employee’s rate and method of payment; and (4) maintained the employee’s employment records (“employment records” defined as payroll records that reflect, relate to, or otherwise record information pertaining to hiring or firing, supervision and control of the work schedules or conditions of employment, or determining the rate and method of payment). The new Rule instructs the public that no single factor is dispositive and the weight to give each factor will vary depending on the circumstances; all four factors need not necessarily be satisfied for an entity to be deemed a joint employer (though the maintenance of employment records alone does not establish a joint employer relationship).

Bad news for HR

Joint Employer decisions cannot now be reduced to simple “yes”/“no” litmus paper test conclusions. A lawyer is going to again have to gather many relevant facts and undertake the called for “weighing and balancing” of facts against the four-part legal standard the Final Rule lays down to derive an answer as to whether joint employment exists.

Furthermore, the Rule specifically warns that another business or person’s reserved right to act (a so-called mere “right to control” which has not yet blossomed into “actual control”) written into a contract as to an employee, may play some role in determining joint employer status (though actual exercise of control must still exist). Actual control can be either direct control or indirect control that flows from the potential joint employer through the intermediary employer to the employee. For indirect control to rise to the level of actual control, there must be evidence the potential joint employer directed the intermediary employer to hire or fire an employee, set an employee’s schedule, or determine an employee’s pay (i.e., mandatory directions to the intermediary employer). [NOTE: If the intermediary employer merely agreed to the other company’s request or recommendation, that evidence alone is insufficient to establish indirect control.]

Significantly, the Final Rule adopts the very controversial position that rejects the prior presumption that evidence of an employee being “economically dependent” on the potential joint employer is relevant to determine the potential joint employer’s liability under the FLSA. The Final Rule nonetheless does acknowledge that other longstanding additional factors may be relevant for determination purposes, but only if those other factors show that the potential joint employer exercised significant control over the terms and conditions of the employee’s work, or that the potential joint employer acted directly or indirectly in the interest of the employer in relation to the employee.

To help clarify how the WHD will apply the four factors to determine joint employer status, the Final Rule provides illustrative examples applying the four-part legal test to specific identified fact patterns. Additionally, the Final Rule cautions that certain business models, business practices, and contractual agreements do not make a joint employer status more or less likely just because they exist.

This recent development, along with the National Labor Relations Board’s (NLRB) ruling in McDonald’s USA, LLC, a joint employer, et al., 368 N.L.R.B. No. 134 (December 12, 2019), furthers the Trump Administration’s efforts to rollback the expansive “joint employer” definition the Obama Administration had adopted. [NOTE: This “piecemeal” approach conforms with the DOL rejecting commenters who suggested the DOL adopt the joint employer standard that once existed under the National Labor Relations Act (“NLRA”). Because the NLRA defines “employer” differently from the FLSA, and the DOL has no role in enforcing the NLRA, the DOL felt it appropriate to proceed separately from the NLRB].

The Obama Administration had expanded the entities that would bear responsibility for labor and employment law violations. The point of view of the Obama Administration labor law agencies was that other businesses could be an employer to a worker based on the reserved but unexercised right to control contained in contracts between the worker’s employer and the other businesses which could potentially be a joint employer. With this new Final Rule, the Trump Administration’s efforts to return employment law to the status in which President Obama found it as he took office is bearing fruit almost weekly at this point in time.

Thanks to Jay J. Wang, Esq. from Fox, Wang & Morgan, P.C. for contributing this article.

Reminder: Invitation To Self-ID Due This Month For Those With Calendar Year AAPs For Individuals With Disabilities

“The contractor shall invite each of its employees to voluntarily inform the contractor whether the employee believes that he or she is an individual with a disability as defined in §60-741.2(g)(1)(i) or (ii). This invitation shall be extended the first year the contractor becomes subject to the requirements of this section and at five year intervals, thereafter, using the language and manner prescribed by the Director and published on the OFCCP Web site. At least once during the intervening years between these invitations, the contractor must remind their employees that they may voluntarily update their disability status.” (emphasis added)

Notes

- Contractors must use an OFCCP mandated Self-Identification form known as CC-305, which we recently reported OMB is reviewing.

- The five-year “invitation” to employees to self-identify and the mid-term “reminder” to employees that they may update any self-ID form currently on file or to complete a first-ever self-identification form continues indefinitely.

- Accordingly, mark your calendars now for your next invitation to occur within five years after your first such five-year invitation.

- Also, mark your calendars now for the “reminder” you must issue to your employees, which OFCCP Rules also require sometime between the end of your first five-year invitation and your second five-year invitation.

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.

Mr. Wang is a Partner at Fox, Wang & Morgan P.C. where he focuses on employment litigation that includes civil claims involving wrongful termination, harassment, unpaid wages, discrimination, trade secrets and workplace violence claims.