- U.S. Government Accountability Office Report Found Employers Use Non-Competes to Protect Confidential Information, But Rarely Enforce Them

- USDOL Wage & Hour Division Issued PUMP Act Bulletin Explaining New Employer Obligations

- Focusing on Adverse Impact, U.S. EEOC Released a New Technical Assistance Document on Artificial Intelligence & Title VII

- U.S. Federal Trade Commission Now Jumps into Biometric Privacy Protection Even in the Absence of Any New Congressional Authorizing Law

- In Brief

- Looking Ahead: Upcoming Date Reminders

Tuesday, May 16, 2023: U.S. Government Accountability Office Report Found Employers Use Non-Competes to Protect Confidential Information, But Rarely Enforce Them

Non-Competes Restrict Job Mobility & May Affect Wages, GAO Also Noted

Why Did GAO Issue This Report & What Did They Review?

Six U.S. Senators – Chris Murphy (D-CT), Todd Young (R-IN), Elizabeth Warren (D-MA), Marco Rubio (R-FL), Ron Wyden (D-OR), and Tim Kaine (D-VA) – commissioned the Report in 2019. The Senators asked the GAO to review the use and effects of NCAs. The GAO provided the Report to its “Congressional Requesters” on May 11, but the agency did not publicly release it until Tuesday.

For the Report, the GAO conducted a comprehensive literature review of empirical studies on the prevalence and economic effects of NCAs and then identified 31 studies that met its research criteria for review. The agency also analyzed responses from 446 private sector employers to a nongeneralizable survey on the reasons they use and enforce NCAs. Further, the GAO conducted a separate survey of state attorney general offices on state statutes related to NCAs; 25 states and the District of Columbia responded. Finally, the GAO also interviewed stakeholders, such as worker advocates, employer groups, and researchers, and reviewed relevant federal laws.

What Did GAO Find?

The GAO’s key findings were:

Employers’ Use of NCAs Is Widespread. Eighteen percent of workers were subject to NCAs, according to two recent nationally representative studies the GAO reviewed. One of the studies estimated that 38 percent of workers had been subject to an NCA at some time in their careers. Over half of the 446 private sector employers responding to GAO’s survey reported that at least some of their workers had NCAs.

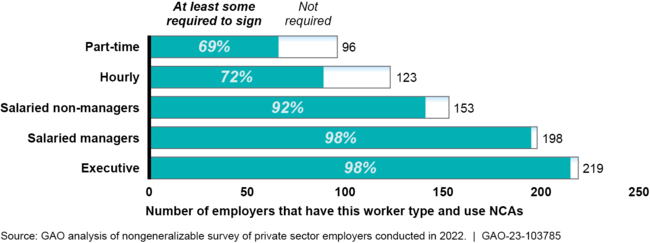

Employers Subject Both Executive and Hourly Workers to NCAs. Studies and the GAO’s employer survey also found that several different types of workers are required to sign NCAs, including executives and hourly workers. For example, over 70 percent of the respondents that use NCAs and that employed hourly workers used NCAs for at least some of them. The following chart illustrated these findings from the employer survey:

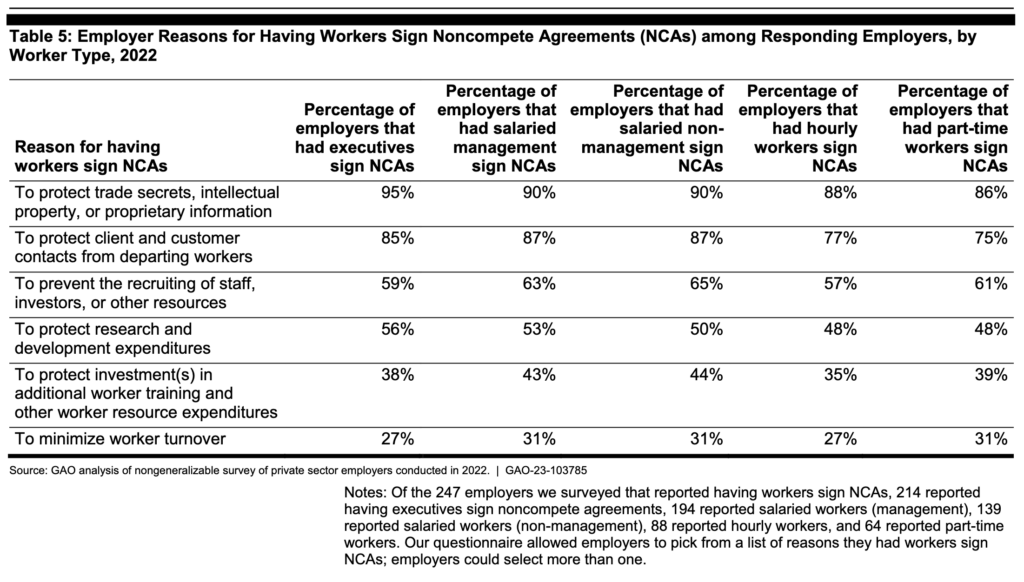

NCAs Used to Protect Confidential Information from Competitors. Employers the GAO surveyed most often reported using NCAs to protect certain confidential information from competitors, regardless of worker type. Yet, several stakeholders GAO interviewed said that lower-wage workers generally do not have access to such information. Below is an illustrative chart:

Few Workers Negotiate Terms of NCAs. Evidence suggests that workers who sign NCAs often do so as a condition of employment, the GAO pointed out. Moreover, the evidence also suggests that few workers who sign NCAs negotiate the terms because they are unaware of what NCAs are, they want the job regardless, or the NCA is introduced after a job is accepted.

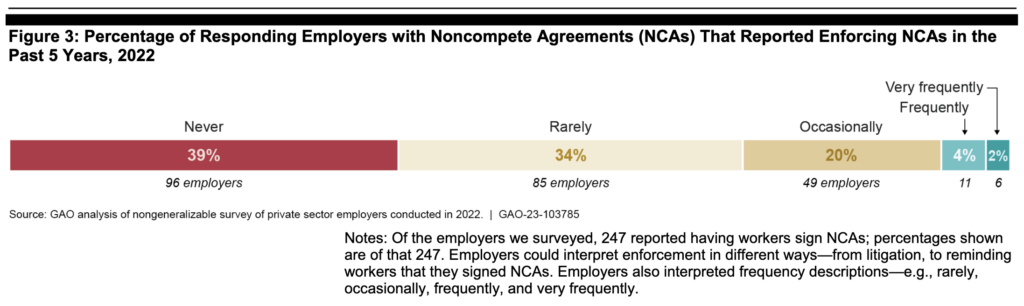

Employers rarely enforce NCAs. Most surveyed employers reported rarely or never enforcing NCAs in the past five years.

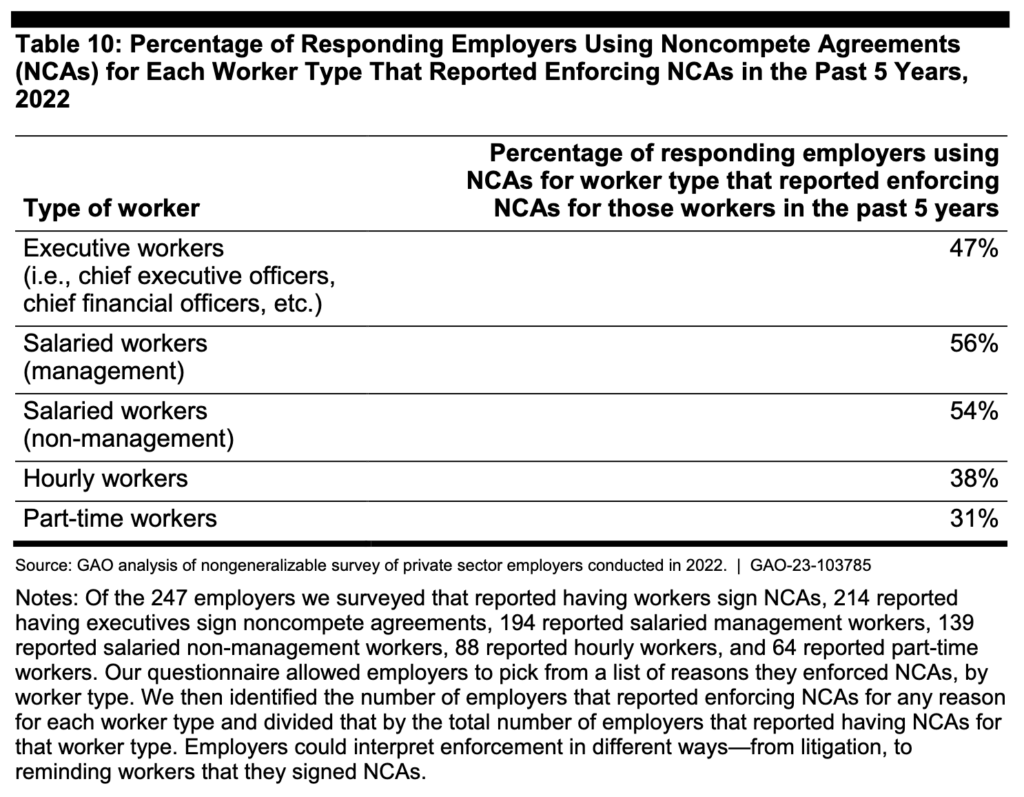

Employers that reported enforcing NCAs reported doing so for all worker types, though most often for executives and managers.

NCAs Restrict Job Mobility & May Reduce Wages & New Firm Creation. By design, NCAs limit workers’ ability to move from one job to another. The GAO stated that job mobility can be a significant source of wage increases for workers, as they find higher-paying jobs or leverage job offers to negotiate wage increases with their current employer. Inhibiting job mobility with NCAs thus may reduce future wages, as workers cannot freely seek higher paying employment opportunities or bargain for raises in their current job. On the other hand, studies suggest that by allowing workers and employers to commit to longer job stability, NCAs, in principle, may encourage employers to increase investments in human capital (e.g., through training). Such investments could, under certain circumstances, result in workers having longer tenures and higher wages in their current job.

State Law Impact. The GAO found that workers’ job mobility is reduced in states that are more likely to enforce NCAs, while state bans on NCAs for certain workers increased workers’ wages, on average. The studies reviewed by the GAO also showed that enforcement of NCAs may restrain the creation of new businesses, especially in the tech and science industries, because of the increased probability of litigation and greater costs of recruiting and hiring staff.

Furthermore, two of these studies the GAO reviewed found that even when NCAs are not legally enforceable in a state, NCAs reduce job mobility and workers with NCAs are less likely to search for new jobs. Studies also found that on average, NCAs lower workers’ earnings, though certain groups like executives may experience mixed effects. In addition, studies found that NCAs may discourage workers from starting new firms.

Of the 26 attorney general offices that responded to the GAO’s survey, six reported not having NCA-related statutes, three reported a statute that generally allows NCAs, and one reported a statute that generally does not allow NCAs. In addition, 16 reported a statute that allows NCAs, subject to certain provisions; for example, exempting workers who earn less than a certain wage from NCAs or requiring employers to provide written notice of an NCA to workers before they start a job.

FTC Involvement & Pending Proposal to Ban NCAs

The Department of Justice and Federal Trade Commission (“FTC”) provided technical comments on the Report, which the GAO incorporated, as it deemed appropriate. The FTC also provided a comment letter with additional context from its research on NCAs.

As readers know, in January, the FTC published a Proposed Rule that would: (1) prohibit employers (nationwide) from using non-compete clauses in their contracts with employees, independent contractors, and “volunteers,” and (2) require employers to rescind existing NCAs and actively inform workers that they are no longer in effect. The proposal would also make it illegal for an employer to represent to a worker that the worker is subject to an NCA where the employer lacks a good faith basis to believe that the worker is subject to an enforceable non-compete clause. Moreover, the proposed Rule would preempt all state laws providing lesser protections. The public comment period for the proposal closed on April 19 with almost 20,350 comments submitted. When the FTC first published its proposal in January, we discussed its provisions here. See also our related content here, here, here, and here.

Wednesday, May 17, 2023: USDOL Wage & Hour Division Issued PUMP Act Bulletin Explaining New Employer Obligations

There is also a new FLSA Poster & Other Web Resources for Employers

While this new Bulletin does not have the force or effect of law, it does represent the WHD’s interpretation of the PUMP Act the Congress has directed WHD to enforce. As we reported last December, the PUMP Act amended the Fair Labor Standards Act (“FLSA”) to require employers to provide breastfeeding accommodations in the workplace. Specifically, it requires a private location other than a bathroom and the necessary, reasonable break time for one year following the birth of a child. It expands on a 2010 amendment to the FLSA, which requires employers to provide these accommodations to non-exempt nursing employees. The new law expanded these rights to salaried employees. The Act contains several exemptions, including those for employers with fewer than 50 employees if compliance would impose an undue hardship, and specific exemptions for crewmembers of air carriers, train crews of rail carriers, and certain motorcoach services.

Most of the provisions of the PUMP Act took effect on its enactment date. However, certain remedy provisions did not take effect until April 27, 2023.

Among other aspects of the new law, the enforcement memo addresses:

- Break Time Requirements – The FLSA requires employers to provide nursing employees with a reasonable break time each time such an employee needs to pump breast milk at work for one year after the child’s birth. An employee and employer may agree to a certain schedule based on the nursing employee’s need to pump, but an employer cannot require an employee to adhere to a fixed schedule that does not meet the employee’s need for break time each time the employee needs to pump. Furthermore, any agreed-upon schedule may need to be adjusted over time if the nursing employee’s pumping needs change. Employees who telework are also eligible to take pump breaks under the FLSA on the same basis as if they were working on-site.

- Compensation – Unless otherwise required by federal, state, or local laws, the PUMP Act does not require that employees be compensated for break time needed to pump breast milk. However, break time to pump will be considered hours worked under the FLSA if an employee is not completely relieved from duty during the entirety of the break. Short breaks, usually 20 minutes or less, provided by the employer must be counted as hours worked. Further, if the employer provides paid break time, and the nursing employee chooses to use that time to pump, the employee must be compensated in the same way that other employees are compensated for break time. To determine how an employee’s break time to pump will impact the worker’s pay, it is necessary to consider these principles in the context of the exempt/nonexempt compensation standards of the FLSA and other applicable laws.

- Space/Privacy Requirements –The FLSA requires that nursing employees have access to a place to pump breast milk at work that is (1) shielded from view, (2) free from intrusion from coworkers and the public, (3) available each time it is needed by the employee, and (4) not a bathroom. The spot must also be functional as a space for pumping. An employer’s temporary creation or conversion of space to meet these requirements is legally sufficient. For privacy, the WHD suggests that an employer display a sign when the space is in use or a lock on the door. Also, employees who telework must be free from observation from a computer camera or other similar device while pumping.

- Small Employer Exemption – To assert the exemption for small employers, the employer must be able to demonstrate that the employee’s specific needs for pumping at work are an undue hardship due to the difficulty or expense of compliance in light of the size, financial resources, nature, and structure of the employer’s business.

- Prohibited Retaliation – As with most other labor and employment laws, the FLSA prohibits retaliation against any worker who has engaged in protected activity, including those newly protected by the PUMP Act. For instance, employers cannot hold time the employee took for pump breaks against them for purposes of sales or production quotas or require employees to work additional hours to make up for the time missed due to pump breaks.

- Timing of Complaints and Lawsuits – Employees or other parties are not subject to any waiting time or special procedure to (1) file a complaint with the WHD about violations of any PUMP Act protections or (2) bring a private suit to enforce the reasonable break time requirement. An employee may file a private suit regarding an employer’s failure to provide a space to pump if the employee has notified the employer of the need for space and has allowed 10 days for the employer to come into compliance. However, the employee is not required to provide this notice (1) if the worker has been fired for requesting reasonable break time or space, (2) if the worker has been fired for opposing employer conduct related to FLSA pump at work rights, or (3) where the employer has expressed a refusal to comply.

- Updated Posting Requirement – The WHD published an updated FLSA poster (April 2023) that reflects current pump-at-work requirements. This poster may be used to meet the FLSA posting requirement and employers should ensure that they are posting the current version of the poster.

The WHD also has a PUMP Act landing webpage with a “Fact Sheet” and other resources, including an FAQ and a pre-recorded webinar.

Thursday, May 18, 2023: Focusing on Adverse Impact, U.S. EEOC Released a New Technical Assistance Document on Artificial Intelligence & Title VII

The EEOC’s new document, which includes a seven item Q&A section, focuses on the concept of adverse (a/k/a disparate) impact resulting from the use of AI tools. The new guidance does not, however, address issues of intentional discrimination involving AI-driven tools in employment selection decisions/procedures. Whether a selection tool violates Title VII’s adverse impact prohibitions (or Executive Order 11246’ prohibition) is generally informed by the Uniform Guidelines on Employee Selection Procedures (UGESP). (UGESP also lacks the binding force and effect of law but does contain the interpretation of unlawful adverse impact discrimination all federal discrimination law agencies share).

The EEOC’s new guidance is simple and straightforward and acts primarily as a reminder that employers should consider whether any new AI selection tools they rely upon violate Title VII’s adverse impact prohibitions. There is nothing new here which relates to the specific context of selection tools relying upon either predictive or generative AI technologies. Rather, the new guidance is generally applicable to all employer selection tools which rely upon a “neutral,” “specific” and “particular” employer policy or practice and which produces a legally meaningful statistical disparity in results when applied to two or more groups of applicants, employees or former employees Title VII protects.

Key takeaways from the new technical assistance document include:

- The UGESP applies to algorithmic decision-making tools when they are used to make or inform decisions about whether to hire, promote, terminate, or take other adverse actions toward applicants or current employees, the EEOC maintains.

- If the use of an algorithmic decision-making tool has an adverse impact on individuals of a particular race, color, religion, sex, or national origin, or on individuals with a particular combination of such characteristics, then the use of the tool will violate Title VII unless the employer can show that such use is “job-related and consistent with business necessity.”

- In many cases, an employer is responsible under Title VII for its use of algorithmic decision-making tools even if the tools are designed or administered by another entity, such as a software vendor. In addition, employers may be held responsible for the actions of their agents, which may include entities such as software vendors, if the employer has given them authority to act on the employer’s behalf. This may include situations where an employer relies on the results of a selection procedure that an agent administers on its behalf. Further, if the vendor is incorrect about its own assessment and the tool does result in either disparate impact discrimination or disparate treatment discrimination, the employer could still be liable.

- Employers that are deciding whether to rely on a vendor to develop or administer an algorithmic decision-making tool may want to ask the vendor specifically whether it relied on the four-fifths rule of thumb when determining whether the use of the tool might have an adverse impact on the basis of a characteristic protected by Title VII, or whether it relied on a standard such as statistical significance that is often used by courts, the EEOC recommended.

- Generally, if an employer is in the process of developing a selection tool and discovers that the use of the tool would have an adverse impact on individuals of a particular sex, race, or other group protected by Title VII, it can take steps to reduce the impact or select a different tool to avoid engaging in a practice that violates Title VII. One advantage of algorithmic decision-making tools is that the process of developing the tool may itself produce a variety of comparably effective alternative algorithms. Failure to adopt a less discriminatory algorithm that was considered during the development process therefore may give rise to liability.

This new technical assistance document builds on previous EEOC releases of technical assistance on AI and the Americans with Disabilities Act and a joint agency pledge (see our stories here and here). It also coincides with the agency’s AI and Algorithmic Fairness Initiative. That initiative is intended to ensure that the use of software, including AI and other emerging technologies used in employment decisions, complies with the federal civil rights laws that the EEOC enforces.

Thursday, May 18, 2023: U.S. Federal Trade Commission Now Jumps into Biometric Privacy Protection Even in the Absence of Any New Congressional Authorizing Law

“Unfair methods of competition in or affecting commerce, and unfair or deceptive acts or practices in or affecting commerce, are hereby declared unlawful.”

The Congress passed the FTC Act as part of President Franklin D. Roosevelt’s “New Deal” program. The FTC was instantly the target of corporate dislike, even before the federal government built an imposing building for the Commission on a prominent part of Pennsylvania Avenue with close proximity to the White House. Corporate America’s dislike for the FTC then further grew when the FTC provocatively commissioned and installed a now famous neo-Socialist statue (titled “Man Restraining Trade”) near the front entrance to its building depicting a powerfully muscled common man grabbing the bridle of an immense and equally heavily muscled galloping horse, restraining its head, and turning the stampeding stallion to a standstill.

The FTC last week unanimously (3-0) approved its 12-page Policy Statement during a public meeting. (The Commission is composed of five bi-partisan Commissioners but currently has no Republican Commissioners).

Policy Statement Lists Factors the FTC Will Consider When Assessing Biometric “Violations”

The Commission’s new Policy Statement defines “biometric information” as “data that depict or describe physical, biological, or behavioral traits, characteristics, or measurements of or relating to an identified or identifiable person’s body.” The Policy also explains that the Commission’s view is “[b]iometric information includes, but is not limited to, depictions, images, descriptions, or recordings of an individual’s facial features, iris or retina, finger or handprints, voice, genetics, or characteristic movements or gestures (e.g., gait or typing pattern). Biometric information also includes data derived from such depictions, images, descriptions, or recordings, to the extent that it would be reasonably possible to identify the person from whose information the data had been derived.”

According to the FTC, “false or unsubstantiated claims about the accuracy or efficacy of biometric information technologies or about the collection and use of biometric information may violate the FTC Act.” Determining whether a business’ use of biometric information or biometric information technology violates Section 5 “requires a holistic assessment of the business’s relevant practices,” the statement provides. The FTC will consider several factors to determine whether a business’ use of biometric information or biometric information technology could violate the FTC Act including:

- Failing to assess foreseeable harms to consumers before collecting biometric information;

- Failing to promptly address known or foreseeable risks and identify and implement tools for reducing or eliminating those risks;

- Engaging in surreptitious and unexpected collection or use of biometric information;

- Failing to evaluate the practices and capabilities of third parties, including affiliates, vendors, and end users, who will be given access to consumers’ biometric information or will be charged with operating biometric information technologies;

- Failing to provide appropriate training for employees and contractors whose job duties involve interacting with biometric information or technologies that use such information; and

- Failing to conduct ongoing monitoring of technologies that the business develops, offers for sale, or uses, in connection with biometric information to ensure that the technologies are functioning as anticipated and that the technologies are not likely to harm consumers.

Related: We earlier reported here that the Illinois Supreme Court had handed down an opinion with its first interpretation of the recently passed Illinois Biometric Information Privacy Act (IBIPA). Lawyers in that case on both sides believe the result of the Court’s decision will impose damages on remand against the defendant company White Castle System, Inc. of not less than $17 Billion. NOTE: In 2022, public data for White Castle System, Inc. reported that revenues were (only) ~$720M.

In Brief

Monday, May 15: 2023: In Light of the End of the Public Health Emergency, the U.S. EEOC Updated Its COVID-19 Technical Assistance

Don’t Forget Either Existing Accommodations or Long COVID-19 sufferers

- Item D.20 – The end of the COVID-19 public health emergency does not mean employers can automatically terminate reasonable accommodations that were provided due to pandemic-related circumstances. However, employers may evaluate accommodations granted during the public health emergency, and, in consultation with the employee, assess whether there continues to be a need for reasonable accommodation based on individualized circumstances.

- Item D.19 – For employees with Long COVID-19, the updates include common examples of possible reasonable accommodations, including a quiet workspace, use of noise-canceling work time devices, and uninterrupted worktime to address brain fog; alternative lighting and reducing glare to address headaches; rest breaks to address joint pain or shortness of breath; a flexible schedule or telework to address fatigue; and removal of “marginal functions” that involve physical exertion to address shortness of breath. Many of these are low or no-cost accommodations.

- Item E. 2 – For employers, the updates include tips about remaining alert for COVID-19-related harassment of applicants or employees with a disability-related need to continue wearing a face mask or take other COVID-19 precautions at work.

Looking Ahead:

Upcoming Date Reminders

December 2022: U.S. DOL WHD’s (now overdue) target date to publish a Notice of Proposed Rulemaking to Analyze Public Comments on its proposed rule regarding Nondisplacement of Qualified Workers Under Service Contracts (RIN: 1235-AA42)

December 2022: U.S. OSHA’s (now overdue) target date to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36) (OSHA submitted this Final Rule to OMB on December 7, 2022)

December 2022: U.S. DOL’s OASAM’s (now overdue) target date to publish Proposed Rule on “Revision of the Regulations Implementing Section 188 of the Workforce Innovation and Opportunity Act (WIOA) to Clarify Nondiscrimination and Equal Opportunity Requirements and Obligations Related to Sex” (RIN: 1291-AA44)

February 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Updating the Davis-Bacon and Related Acts Regulations (RIN: 1235-AA40)

March 2023: OFCCP’s (now overdue) target date for its Notice of Proposed Rulemaking to Require Reporting of Subcontractors (RIN: 1250-AA15)

March 2023: OFCCP’s (now overdue) target date for its Final Rule on Pre-Enforcement Notice & Conciliation Procedures (RIN: 1250-AA14)

March 2023: OFCCP’s (now overdue) target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

April 2023: OFCCP’s (now overdue) target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

May 2023: U.S. DOL WHD’s target date for its Notice of Proposed Rulemaking on Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Computer Employees (RIN: 1235-AA39)

May 2023: U.S. DOL WHD’s target date for its Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act (RIN: 1235-AA43)

Tuesday, May 30, 2023: Public comment deadline on OFCCP’s proposal to modify its complaint intake procedures – https://www.regulations.gov/commenton/DOL_FRDOC_0001-2088

Thursday, June 1, 2023: Deadline to submit comments on U.S. EEOC’s proposal to eliminate counting employees to determine filing “type” for EEO-1 Survey Component 1 – https://www.regulations.gov/commenton/EEOC_FRDOC_0001-0310

Tuesday, June 6, 2023: Comments due on Proposed OMB Circular No. A-4, “Regulatory Analysis” – https://www.regulations.gov/commenton/OMB_FRDOC_0001-0337

Tuesday, June 6, 2023: Deadline for comments due on proposed revisions to OMB Circular A-94 (Guidelines and Discount Rates for Benefit-Cost Analysis of Federal Programs) – https://www.regulations.gov/commenton/OMB-2023-0011-0001

Tuesday, June 6, 2023: Comments due on OMB’s implementation of Section 2(e) of the “Modernizing Regulatory Review” E.O. – https://www.regulations.gov/commenton/OMB_FRDOC_0001-0333

Monday, June 12, 2023: Public comments due on the U.S. Office of Personnel Management’s Proposed Rule on “Advancing Pay Equity in Governmentwide Pay Systems” – https://www.regulations.gov/commenton/OPM_FRDOC_0001-2514

Thursday, June 29, 2023: Deadline for covered federal contractors and subcontractors to certify, via OFCCP’s online Contractor Portal, that they have developed and maintained affirmative action programs for each establishment or functional unit – https://www.dol.gov/newsroom/releases/ofccp/ofccp20230320

August 2023: U.S. NLRB’s target date for its Final Rule on Standard for Determining Joint-Employer Status (under the NLRA) (RIN: 3142-AA21)

August 2023: U.S. NLRB’s target date for its Final Election Protection Rule (RIN: 3142-AA22)

Friday, August 11, 2023: Deadline for Presenter Proposal Submissions for DEAMCon 2024 – https://deamcon.org/call-for-presenters/

Wednesday, April 3 – Friday, April 5, 2023: DEAMcon24 New Orleans

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.