The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

-

NLRB GC Asserted, Via Memo, That Employment Non-Compete Provisions Violate NLRA

-

U.S. Supreme Court Ruled NLRA Does Not Bar State Law Property Damage Claims Against Unions

-

Economy Added 339k Jobs in May, But the Unemployment Rate Nonetheless Rose to 3.7%

-

Debt Ceiling Increase Statute Became a Bill to Restrict Future Federal Budgets

- What The Budget Reforms In The Debt-Ceiling Bill Likely Mean For OFCCP and Other Federal Agencies

Tuesday, May 30, 2023: NLRB GC Asserted, Via Memo, That Employment Non-Compete Provisions Violate NLRA

GC Noted Some Exceptions for Certain Narrowly Tailored Agreements

According to GC Abruzzo, non-compete agreements are unlawful because they chill employees from exercising their rights under the NLRA. Specifically, Section 7 of the NLRA guarantees employees “the right to self-organization, to form, join, or assist labor organizations, to bargain collectively through representatives of their own choosing, and to engage in other concerted activities for the purpose of collective bargaining or other mutual aid or protection,” as well as the right “to refrain from any or all such activities” (see 29 U.S.C. § 157). GC Abruzzo maintains that non-competes violate Section 8(a)(1) of the NLRA, which makes it an unfair labor practice for an employer “to interfere with, restrain, or coerce employees in the exercise of the rights guaranteed in Section 7” of the Act (see 29 U.S.C. § 158).

In particular, GC Abruzzo asserted in the 6-page memo that these agreements interfere with employees’ ability to:

- concertedly threaten to resign to secure better working conditions;

- carry out concerted threats to resign or otherwise concertedly resign to secure improved working conditions;

- concertedly seek or accept employment with a local competitor to obtain better working conditions;

- solicit their co-workers to go work for a local competitor as part of a broader course of protected concerted activity; and

- seek employment, at least in part, to specifically engage in protected activity, including union organizing, with other workers at an employer’s workplace.

Limited Exceptions

However, GC Abruzzo stated that in some cases, non-compete agreements could be lawful if the provisions clearly restrict only individuals’ managerial or ownership interests in a competing business or true independent-contractor relationships. Moreover, there may be instances in which a narrowly tailored non-compete agreement’s “infringement on employee rights” is justified by special circumstances.

Enforcement Directions

GC Abruzzo concluded her memo by telling region officials that they “should seek make-whole relief for employees who, because of their employer’s unlawful maintenance of an overbroad non-compete provision, can demonstrate that they lost opportunities for other employment, even absent additional conduct by the employer to enforce the provision. In this regard, Regions should seek evidence of the impact of overbroad non-compete agreements on employees and, where applicable, present at trial evidence of any adverse consequences, including specific employment opportunities employees lost because of the agreements.”

How We Got Here

The NLRB General Counsel teamed up with the FTC to take “the point” in the Biden Administration’s attack on what the two agencies hope to together define to be “unfair” and “unlawful” employment practices” as we reported here back in July 2022. Both the FTC and the NLRB have made the decision to take aggressive “stretch” policy positions in the Biden Administration to be the thorns in the side of U.S. business interests. The FTC and NLRB attacks on non-compete agreements are the latest in this coordinated offensive. You may find the FTC’s “kick-off” position on non-competes here and here.

Only litigation is now going to stop these two agencies from banning the use of many non-competition agreements in the United States. One of the exotic litigation issues is whether the change of interpretation GC Abruzzo announced via a mere memorandum should have been accomplished via formal Administrative Procedure Act Notice and Comment to the public given that her memo changes “longstanding” NLRB enforcement interpretations. Close call.

Wednesday, May 31, 2023: JOLTS Report – Job Openings Increased by 358k in April as “Jobs Opening Rate” Jumped up .03% to 6.1% Signaling More Hard Work Ahead for Recruiters

NOTE: The increase in job openings along with continuing stubborn inflation just under 5% year-over-years led financial market pundits to wonder whether this relatively robust jobs number would drive the Federal Reserve to again raise interest rates at their coming June 13 meeting.

Hires (Increased slightly, but the hires rate held steady)

In April, the number of hires was little changed at 6,115,000 million compared to the adjusted 6,066,000 number for March. The hires rate (the number of hires as a percent of total employment) held steady at 3.9 percent. Hires decreased in information services (-37,000).

Separations (Involuntary terminations and quits both decreased)

Signaling that both employers and employees were holding on to their employees and jobs, the number of total separations decreased to 5,708,000 million, down 286,000 from 5,994,000 (adjusted) in March. The April termination rate (the number of involuntary terminations and voluntary quits) of 3.7 percent was down an entire .02% from March’s adjusted 3.9 percent rate. In April, the number of total separations changed only a little bit across all industries (so wide but thin across all industries).

BLS posted interactive graphs here.

Summary Chart of Recent Job Openings

Our below table reports the number of available jobs (as taken from the revised JOLTS reports) from the last four months of available data, as revised.

| Reports | January | February | March | April |

| JOLTS available jobs | 10,563,000 | 9,974,000 | 9,745,000 | 10,103,000 |

| Prior/mo. comparison | (671,000 < December*) | (589,000 < January) | (229,000 < February) | (358,000 > March) |

*December Job Openings were 11,234,000

Note: BLS has scheduled the release of the JOLTS Report for May 2023 on Thursday, July 6, 2023.

Thursday, June 1, 2023: U.S. Supreme Court Ruled NLRA Does Not Bar State Law Property Damage Claims Against Unions

What Happened Here?

The company, which sells and distributes ready-mix concrete, filed a lawsuit in Washington State court accusing the local Teamsters union of intentional property destruction during a 2017 strike. The union called for a work stoppage when it knew the company was in the process of mixing substantial amounts of concrete, loading batches into ready-mix trucks, and making deliveries. Following the union’s direction to ignore the company’s instructions to finish deliveries in progress, at least 16 drivers who had already set out for deliveries returned with fully loaded trucks. Even though the drivers kept their mixing drums rotating to delay the concrete from hardening and causing significant damage to the trucks, all the concrete mixed that day hardened, and the company had to discard the unused product.

The company brought state common-law property damage claims (conversion and trespass to chattels) against the union. In 2021, the Washington state Supreme Court, agreeing with the union, ruled that the company’s claims were preempted by the NLRA, saying the company’s loss of concrete during the strike was incidental to a strike that could be considered arguably protected under federal labor law.

SCOTUS Majority Found Union Failed to Take Reasonable Precautions

The U.S. Supreme Court majority disagreed. Justice Amy Coney Barrett wrote the 12-page majority ruling, stating that the union’s actions strongly suggested that it failed to take reasonable precautions to avoid foreseeable, aggravated, and imminent harm to the company’s property. “Because the union took affirmative steps to endanger [the company’s] property rather than reasonable precautions to mitigate that risk, the NLRA does not arguably protect its conduct,” Barrett wrote.

Justice Jackson Said Court Should Have Waited for Resolution of Pending NLRB Action

In her 27-page dissent, Justice Jackson stated that the majority misstepped by applying the NLRB’s decisions to “fact-sensitive issues that Congress plainly intended for the [NLRB] to address after an investigation.” She pointed out that there is currently an action pending before the NLRB claiming that the company engaged in unfair labor practices when it disciplined some of the drivers involved in the strike. The Supreme Court should have suspended its adjudication of this case until the NLRB had resolved the unfair labor practices allegations, according to Justice Jackson.

Friday, June 2, 2023: Economy Added 339k Jobs in May, But the Unemployment Rate Nonetheless Rose to 3.7%

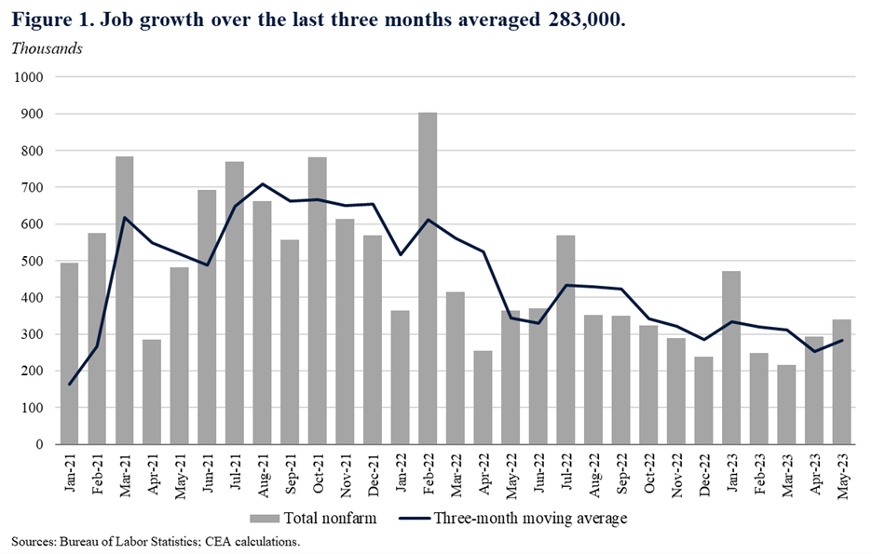

Moreover, revisions to the March and April numbers added another 93,000 jobs, explained the White House Counsel of Economic Advisers in a related blog. Over the past three months, monthly job gains have averaged 283,000, as illustrated by the chart below:

Long-term Unemployment Numbers

The number of unemployed persons rose by 440,000 in May to 6.1 million. The number of job losers and persons who completed temporary jobs increased by 318,000 to 3.0 million, offsetting a decrease in April.

In May, the number of people jobless for less than 5 weeks edged up by 217,000 to 2.1 million, partially offsetting a decrease in the prior month. The number of persons jobless for 15 to 26 weeks increased by 179,000 to 858,000 in May. The number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 1.2 million and accounted for 19.8 percent of the total unemployed.

Labor Force Participation

The labor force participation rate held at 62.6 percent in May, and the employment-population ratio, at 60.3 percent, was little changed. The number of persons employed part-time for economic reasons, at 3.7 million, changed little in May. (Recruiters: think about recruitment campaigns aimed at these millions of part-timers interested in converting to full-time work.) Those not in the labor force who currently want a job numbered 5.5 million in May, not much different from the prior month. Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force changed little at 1.5 million in May. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, was little changed over the month at 422,000.

Major Worker Groups

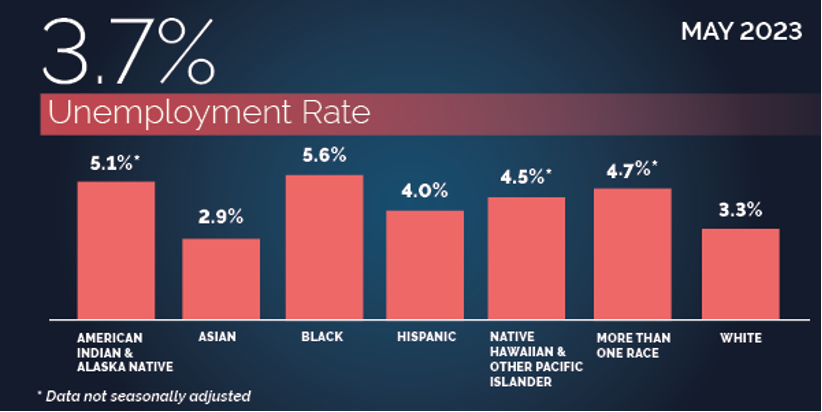

Among the major worker groups, the unemployment rates for adult women (3.3 percent) and Blacks (5.6 percent) rose in May. The jobless rates for adult men (3.5 percent), teenagers (10.3 percent), Whites (3.3 percent), Asians (2.9 percent), and Hispanics (4.0 percent) showed little change over the month.

The BLS/DOL charts below illustrate the numbers by race and ethnicity:

Our table below compares the major worker groups’ numbers from the last three months of available data:

| The Employment Situation – May 2023 | ||||

|---|---|---|---|---|

| Unemployment Rate | March 2023 | April 2023 | May 2023 | Feb 2020 Pre-Pandemic |

| National (Seasonally adjusted) | 3.5% | 3.4% | 3.7% | 3.5% |

| White | 3.2% | 3.1% | 3.3% | 3.0% |

| Black | 5.0% | 4.7% | 5.6% | 6.0% |

| Asian | 2.8% | 2.8% | 2.9% | 2.5% |

| Hispanic (Seasonally adjusted) | 4.6% | 4.4% | 4.0% | 4.4% |

| Native Hawaiians & Other Pacific Islanders | 1.2% | 3.4% | 4.5% | 2.7% |

| Two or More Races (Not seasonally adjusted) | 4.7% | 4.4% | 4.7% | 6.1% |

| Men (20+) | 3.4% | 3.3% | 3.5% | 3.2% |

| Women (20+) (Seasonally adjusted) | 3.1% | 3.1% | 3.3% | 3.1% |

| Veteran (Not seasonally adjusted) | 2.4% | 2.1% | 2.5% | 3.7% |

| Individuals with Disabilities (Not seasonally adjusted) | 8.2% | 6.3% | 7.8% | 7.8% |

BLS has additional, interactive graphs available here.

See Also:

- President Biden’s remarks

- USDOL Assistant Secretary for Public Affairs Julie McClain Downey’s remarks (Acting Secretary of Labor Julie Su did not issue a statement.)

- USDOL video short illustrating the report

- White House Counsel of Economic Advisers’ blog

Saturday, June 3, 2023: Debt Ceiling Increase Statute Became a Bill to Restrict Future Federal Budgets

No Budget Clawbacks for USDOL, OFCCP, or EEOC

However, the big news was that the debt-limit increase law also established new discretionary budget spending limits, rescinded certain unobligated (i.e., not yet spent) budgeted funds, and expanded work requirements for some federal welfare programs.

See the related side-bar WIR story discussing the expected impacts on OFCCP’s future budgets and what they mean for federal contractors here.

On Thursday, the Senate voted 63-36 to pass the bill, with 46 Democrats and 17 Republicans voting for it. The House passed the bill – 314 -117 – on Wednesday, with 149 Republican and 165 Democrat votes.

Republican dissenters were distressed that future budget cuts did not go far enough to restrain the record federal deficit (of $31.4 Trillion which is estimated to rise to almost $35 Trillion by January 1, 2025. Interest on the U.S. debt is currently $1.3 Billion dollars per day without any increased spending.) Democrats opposing the bill were distressed about “work-for-welfare” requirements, that environmental restrictions on certain petroleum projects were not installed, and that federal spending on social programs was not increased or exempted from future budget restrictions.

Republicans and Democrats voting against the bill also pinned their hopes on the coming intervening November 2024 Presidential and Congressional elections (to occur just before the next federal debt limit showdown on January 1, 2025) to allow their respective parties to win more Congressional seats and/or the White House to further change federal spending either up (Democrats) or down (Republicans).

The new debt limit bill establishes new discretionary spending limits for fiscal year (“FY”) 2024, i.e., next year (which starts October 1, 2023) and FY 2025 (which starts October 1, 2024) that will be enforced with sequestration (i.e., automatic spending cuts). It also changes budget limits to 1 percent below the FY 2023 base funding levels if an agreed-upon Continuing Resolution issues on or after January 1, 2024, or on or after January 1, 2025, because all 12 regular appropriations bills are not enacted by the end of the prior calendar year. The bill’s text does not specifically mention budget allocations for agencies such as OFCCP, the Department of Labor, or the Equal Employment Opportunity Commission which escaped future specific draconian budget treatments not exacted from all other federal agencies.

The legislation also includes provisions that:

- set limits on most discretionary funding for each year from 2026 through 2029 that would be enforced using Congress’ procedures to consider budgetary legislation; (e., no firm limits)

- rescind about $47 Billion in unobligated funds that were provided to address COVID-19 (~$27 Billion) and to the Internal Revenue Service (~$20 Billion of the $80 Billion the IRS earlier obtained to hire ~20,000 new IRS agents);

- provide funding for the Department of Veterans Affairs Cost of War Toxic Exposure Fund;

- provide funding for the Department of Commerce Nonrecurring Expenses Fund;

- provide statutory authority through 2024 for the requirement for agencies that propose certain administrative actions that will increase direct spending to also propose at least one administrative action that will decrease direct spending by at least the same amount (commonly known as administrative pay-as-you-go rules);

- terminate the suspension of federal student loan payments;

- expand the work requirements for the Supplemental Nutrition Assistance Program (SNAP) and the Temporary Assistance for Needy Families (TANF) program; and

- expedite the permitting process for certain energy projects.

“Together, these cuts constitute the single largest rescission of federal spending in American history,” according to a Wednesday statement by Representative Andy Barr (R-KY).

On Tuesday, May 30, the Congressional Budget Office published a 17-page “Estimate of the Budgetary Effects of H.R. 3746,” which provides additional details.

What is the Debt Ceiling?

A Congressional Research Service report, updated on January 10, 2023, explains “Debt Limit Legislation” as follows:

“When the receipts collected by the federal government are not sufficient to cover outlays, it is necessary for the Treasury to finance the shortfall through the sale of various types of debt instruments to the public and federal agencies. Federal borrowing is subject to a statutory limit on public debt (referred to as the debt limit or debt ceiling). When the federal government operates with a budget deficit, or otherwise increases the level of debt necessary (such as to allow federal trust funds to hold surpluses), the response has been for the public debt limit to be increased to meet that need. The frequency of congressional action to raise the debt limit has ranged in the past from several times in one year to once in several years. In recent years, Congress has chosen to suspend the debt limit for a set amount of time instead of raising the debt limit by a fixed dollar amount. When a suspension period ends, the debt limit is reestablished at a dollar level that accommodates the level of federal debt issued during the suspension period.”

Legislation to raise the public debt limit falls under the jurisdiction of the House Ways and Means Committee and the Senate Finance Committee.

What The Budget Reforms In The Debt-Ceiling Bill Likely Mean For OFCCP and Other Federal Agencies

Fewer OFCCP Employee Headcounts, Fewer OFCCP Audits of Contractors, The Continuing Poor Experience with the Contractor Portal, and lack of Training All Likely Lie Ahead

While the employment law agencies did not suffer any budget clawbacks, they have difficult budget battles now looming. Remember, the debt-ceiling bill did NOT set either FY 2024 or FY 2025 budgets. The budget bill negotiations still lie ahead. However, in an effort to incentivize itself to timely submit the federal budget to the President, Congress agreed to potentially two budget penalties if it does not submit to the President one or more of the 12 discretionary spending bills which collectively comprise what we call “the Federal Budget” BEFORE the end of 2023 (for the FY 2024 budget which begins October 1, 2023: hold that thought) AND ALSO by December 31, 2024, for the FY 2025 budget.

Specifically, Congress agreed in the debt-limit bill to a minus 1% budget DECREASE in EACH of FY 2024 and FY 2025 (for all federal agencies) IF the Congress is unable to agree upon a budget for either Fiscal Year by the end of the calendar year in which each Fiscal Year begins. (In other words, using the FY 2024 budget as an example, if any one or more of the 12 discretionary spending bills the Congress negotiates and submits to the President are not submitted by December 31, 2023, for the FY 2024 budget year (which begins October 1, 2023) an automatic Continuing Resolution will kick-in freezing the agency’s budget at the prior year’s level but with a 1% reduction to the prior year’s budget. By the way, this was a significant “win” for Republicans because it now puts a sharper knife at the throats of Democrats if the parties cannot agree on a federal budget. Without this agreement, an impasse in budget negotiations would otherwise in the normal course lead to a “Continuing Resolution” which maintains the same agency budget as in the prior year so the agencies may continue to have a budget to operate.)

NOTE: Presumably the way this would play out is that if there is NOT agreement on a federal budget for FY 2024 by October 1, 2023, a Continuing Resolution will occur freezing ALL federal agency budgets at the prior year’s budget level. Then, if no budget agreement is had by December 31, 2023, the 1% further budget reduction would then attach to federal agency budgets beginning January 2, 2024.

By the way, Congress has not agreed to a federal budget on time (before October 1 of the year) since 2017.

So, the Federal Agencies Are Potentially Looking At About A 6% Reduction To Their Spending Power in FY 2024

How so? First, there is the potential for the minus 1% budget penalty if Congress cannot agree on all 12 budgets by the end of this calendar year. Second, inflation is still running rampant and is currently, while shrinking, at almost 5% annually. Inflation, of course, erodes the agency’s spending power by the level of that inflation of costs federal agencies incur. And, remember, federal agencies just received an 8.7% payroll increase after the last federal budget. Note: federal agency payrolls are often the largest part of their budget (just over 70% of OFCCP’s budget, for example: about $78M of its $110M authorized budget). So, 1% + 5% = a potential 6% shrinkage of OFCCP’s spending power in FY 2024.

So, these days, OFCCP personnel and benefits costs are about $157,000 per employee, on average (495 employees consuming about $78M in pay and benefits costs), or about six “average” employees per $1M of OFCCP budget. OFCCP’s current budget is ~$111,000,000 (See OFCCP’s FY 2024 Budget Justification.)

If OFCCP’s spending power were to shrink 6% in FY 2024, however, that would result in a loss of about $6.6 million, or 42 OFCCP employees. (We say at least 42, since that is the number of employees OFCCP would have to lose to shrink back down into its budget except that OFCCP would likely not fill lower-level Compliance Officer positions (paid less than OFCCP’s higher “average” salaries and benefits super-weighted with more expensive manager costs). So, OFCCP would have to not fill more than 42 Compliance Officer positions to get down $6.6M in personnel costs.)

By the way, OFCCP rarely in modern history has had to undertake lay-offs to fit within its annual budget. Rather, OFCCP each year suffers a very high quit rate of (sometimes) as much as 25% (usually in the first year of employment). Accordingly, OFCCP uses employee “attrition” to balance its books through reduced payroll and benefits costs.

Consequences to OFCCP and Contractors

Potential Outcome # 1: Fewer OFCCP audits. OFCCP is currently at an all-time low for the number of audits it undertakes, but it could, and will, go lower absent a budget for FY 2024 sufficient to at least keep its authorized employee headcount at 495 FTEs. (OFCCP employs part-time employees, so not all employees are “Full-Time”…hence the computation expressed as FTEs.)

OFCCP completed only 899 Compliance Evaluations by whatever name in FY 2023 (last year): 866 Supply and Service Contractor audits and 33 Construction Contractor (quickie) audits. See OFCCP By The Numbers for FY 2023. That is about 1.6 audits per year per OFCCP employee. (That is down, by the way for context, from about 12 audits per year per Compliance Officer (alone) following 3–4-day on-site investigations, typically accomplished through 4-8 Compliance Officers, in OFCCP audits conducted during the Reagan Administration. So, there is great room for productivity improvements at OFCCP as another way to increase its number of audits.)

However, at its current level of productivity, the loss of another 42 (or let’s round it up to 50 Compliance Officers since that is more likely) would mean the loss of another 80 audits per Fiscal Year. That would drop OFCCP in FY 2024 to close to only about 800 audits per year (899-80=819).

NOTE: OFCCP’s audit numbers could also INCREASE artificially in FY 2024 if the agency changes the mix towards a heavier diet of Construction Contractor audits. (Construction audits require substantially fewer OFCCP hours than Supply & Service Contractor audits to complete. Typically Construction Contractor audits occupy only about 1/3rd the number of OFCCP hours it takes to complete a Supply & Service audit. As a benchmark for comparison, as recently as the Obama Administration, OFCCP used to annually complete 500 Construction Contractors audits per Fiscal Year.)

Potential Outcome # 2: The Underperforming OFCCP Contractor Portal (for Supply & Service Contractors) is not likely to get fixed in the next year absent a budget substantially higher than the agency’s about $111M FY 2023 budget. The Contractor Portal has many critics and few defenders, if any: “a trainwreck”; “a complete clusterf _ _ _”; “not ready for prime time”; “should have never been released to the public”; “ I cannot believe the hundreds of hours we have had to put into that monstrosity of a Portal”; “embarrassing”, “doesn’t work”; “not well thought out”. “OFCCP should have consulted the contractor community before they designed that mess”, etc., etc., etc.

And now, many contractors that voluntarily certified their AAPs in the Contractor Portal during its maiden voyage last year are reconsidering whether to do so this year. (44% did not participate in the Portal Certification invitation OFCCP issued last year when it inaugurated the partially built-out Contractor Portal to certify AAPs. By all accounts, that percentage of contractors avoiding the Contractor Portal to certify their AAPs will be higher this year following the Contractor Portal’s difficult debut.)

It takes both money and design leadership. The money is most likely not to be there, so contractors expecting a repaired and user-friendly interface are likely to continue to be disappointed and frustrated.

Potential Outcome # 3: While not crystal clear, it is likely that OFCCP has some money earmarked for it from the 2021 $ 1.7 trillion Bi-Partisan Infrastructure Bill to undertake construction audits. OFCCP was hoping for these monies to add staff to conduct Construction Contractor audits and to train its Compliance Officers in Construction Contractor audits. The new wrinkle is that the Debt-Ceiling statute the President just signed also contains a provision (that we reported in our main story reporting the signing of this new statute on Saturday) that will require an agency spending MORE than its budgeted amount to offset those additional spendings with cuts to the agency’s existing budget.

These are arcane and unique statutory entitlements and restrictions. But, if it turns out that the Budget Increase statute nullifies OFCCP’s infusion of Infrastructure Act monies, or the agency does not, in fact, receive additional Infrastructure Act monies, it will not be further ahead on its $111M FT 2023 annual budget.

Potential Outcome # 4: Training OFCCP staff. Forget about it. Not happening.

In Brief

Tuesday, May 30, 2023: WHD: Holidays During Employee’s Normal Workweek Do Not Reduce the Employee’s FMLA Leave Entitlement Unless the Employee is Required to Work the Holiday

If a holiday occurs during an employee’s workweek, and the employee works for part of the week and uses FMLA leave for part of the week, the holiday does not reduce the amount of the employee’s FMLA leave entitlement, unless the employee was required to report for work on the holiday, according to the WHD. Therefore, if the employee was not expected or scheduled to work on the holiday, the fraction of the workweek of leave used would be the amount of FMLA leave taken (which would not include the holiday) divided by the total workweek (which would include the holiday), the agency stated.

Wednesday, May 31, 2023: Acting U.S. Labor Secretary Su Scheduled to Testify Before House Education & Workforce Committee on June 7

How We Got Here

On April 26, 2023, the U.S. Senate Health, Education, Labor, and Pensions (“HELP”) Committee voted along party lines to advance the controversial nomination of Ms. Su to be U.S. Secretary of Labor for an eventual full Senate vote. Ms. Su has been serving as the Acting Secretary of Labor since former Labor Secretary Marty Walsh left the Department of Labor in March.

It remains unclear whether Ms. Su’s nomination will win a full Senate vote, and Senate Majority Leader Chuck Schumer (D-NY) has yet to indicate when he will schedule that vote, if ever. Senate Republicans are staunchly against the nomination. While Senator Dianne Feinstein (D-CA) has returned from her health-related absence, at least four Senators who are Democrats, or caucus with the Democrats, are still uncommitted as to how they will vote. With the Senate closely divided between Democrats and Republicans, Democrats cannot afford to lose more than two votes or else Ms. Su’s nomination will fail.

Wednesday, May 31, 2023: U.S. EEOC Chair Burrows Issued Report on EEO in the Construction Industry

The recent federal infrastructure investments “provide a once-in-a-generation opportunity to break down barriers and expand opportunity in the construction industry,” Chair Burrows said in a statement. “Although the EEOC has had considerable success in its investigations and litigation on behalf of construction workers who experience discrimination,” she asserted, “these enforcement efforts must be coupled with thoughtful and effective preventive measures to ensure the industry’s significant opportunities are equally open to all qualified workers.”

Friday, June 2, 2023: President Biden Nominated Wilcox for Another NLRB Term

Looking Ahead:

Upcoming Date Reminders

December 2022: U.S. DOL WHD’s (now overdue) target date to publish a Notice of Proposed Rulemaking to Analyze Public Comments on its proposed rule regarding Nondisplacement of Qualified Workers Under Service Contracts (RIN: 1235-AA42)

December 2022: U.S. OSHA’s (now overdue) target date to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36) (OSHA submitted this Final Rule to OMB on December 7, 2022)

December 2022: U.S. DOL’s OASAM’s (now overdue) target date to publish Proposed Rule on “Revision of the Regulations Implementing Section 188 of the Workforce Innovation and Opportunity Act (WIOA) to Clarify Nondiscrimination and Equal Opportunity Requirements and Obligations Related to Sex” (RIN: 1291-AA44)

February 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Updating the Davis-Bacon and Related Acts Regulations (RIN: 1235-AA40)

March 2023: OFCCP’s (now overdue) target date for its Notice of Proposed Rulemaking to Require Reporting of Subcontractors (RIN: 1250-AA15)

March 2023: OFCCP’s (now overdue) target date for its Final Rule on Pre-Enforcement Notice & Conciliation Procedures (RIN: 1250-AA14)

March 2023: OFCCP’s (now overdue) target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

April 2023: OFCCP’s (now overdue) target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

May 2023: U.S. DOL WHD’s (now overdue) target date for its Notice of Proposed Rulemaking on Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales and Computer Employees (RIN: 1235-AA39)

May 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act (RIN: 1235-AA43)

Tuesday, June 6, 2023: Comments due on Proposed OMB Circular No. A-4, “Regulatory Analysis” – https://www.regulations.gov/commenton/OMB_FRDOC_0001-0337

Tuesday, June 6, 2023: Deadline for comments due on proposed revisions to OMB Circular A-94 (Guidelines and Discount Rates for Benefit-Cost Analysis of Federal Programs) – https://www.regulations.gov/commenton/OMB-2023-0011-0001

Tuesday, June 6, 2023: Comments due on OMB’s implementation of Section 2(e) of the “Modernizing Regulatory Review” E.O. – https://www.regulations.gov/commenton/OMB_FRDOC_0001-0333

Monday, June 12, 2023: Public comments due on the U.S. Office of Personnel Management’s Proposed Rule on “Advancing Pay Equity in Governmentwide Pay Systems” – https://www.regulations.gov/commenton/OPM_FRDOC_0001-2514

Monday, June 19-Thursday June 22, 2023: The Workforce Metrics Retreat in White Sulphur Springs, West Virginia: “This retreat will bring together equal employment opportunity/affirmative action (EEO/AA); diversity, equity, inclusion, belonging and access professionals (DEIBA+); subject matter experts and corporate voices for candid conversations related to the seemingly endless resistance and rollback on several fronts related to AA and DEIAB+ initiatives.”

New Tuesday, June 27, 2023: The federal Pregnant Workers Fairness Act takes effect.

Thursday, June 29, 2023: Deadline for covered federal contractors and subcontractors to certify, via OFCCP’s online Contractor Portal, that they have developed and maintained affirmative action programs for each establishment or functional unit – https://www.dol.gov/newsroom/releases/ofccp/ofccp20230320

August 2023: U.S. NLRB’s target date for its Final Rule on Standard for Determining Joint-Employer Status (under the NLRA) (RIN: 3142-AA21)

August 2023: U.S. NLRB’s target date for its Final Election Protection Rule (RIN: 3142-AA22)

Friday, August 11, 2023: Deadline for Presenter Proposal Submissions for DEAMcon24 – https://deamcon.org/call-for-presenters/

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.