The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

Thursday, February 8, 2024: U.S. Supreme Court Unanimously Ruled “Retaliatory Intent” Not Required to Prove SOX Whistleblower Claim

SOX Burden More Plaintiff-Friendly Than Other Laws Prohibiting Employment Discrimination

What is SOX?

Employees who work for a publicly traded company or brokerage firm or for contractors, subcontractors, or agents of publicly traded companies have special whistleblower protections under Section 806 of the Corporate and Criminal Fraud Accountability Act of 2002 (18 U. S. C. §1514A), also known as Sarbanes-Oxley Act (“SOX”).

This statute, which Congress designed to protect consumers and bring greater transparency to financial systems on the heels of the sudden collapse after 158 years of business of Lehman Brothers, Inc. (the global securities trading powerhouse based in Manhattan) also protects employee whistleblowers who report violations of securities law or violations of commodities law. Specifically, SOX-protected activities include reporting alleged violations of the federal mail, wire, bank, or securities fraud statutes, any rule or regulation of the SEC, or any other provision of federal law relating to fraud against shareholders.

How Does SOX’s Evidentiary Framework Differ From Other Laws Barring Employment Discrimination?

On Thursday, SCOTUS ruled that employees seeking to establish a SOX claim must prove only that their protected activity “was a contributing factor in the unfavorable personnel action [at issue],” but they are not required to also show that the employer acted with “retaliatory intent.”

Once the employee proves that his or her protected action was a “contributing factor” to the employer’s at-issue adverse action (perhaps only 1% of the total calculus of the employer’s decision-making leading to the employer’s adverse action), the burden then shifts to the employer to demonstrate, by clear and convincing evidence, that the employer would have taken the same unfavorable personnel action in the absence of that behavior. Justice Sotomayor explained that:

“While many statutes dealing with employment discrimination apply a higher bar, requiring the plaintiff to show that his protected activity was a motivating or substantial factor in the adverse action, […] the incorporation of the contributing-factor standard in Sarbanes-Oxley reflects a judgment [by Congress] that [an employer’s personnel actions against employees should not be based on protected whistleblowing activities]—not even a little bit.” [citations omitted]

Thereby, Justice Sotomayor’s opinion distinguished the contributing factor requirement under SOX’s burden-shifting framework as a lesser burden than the “motivating factor” standard used in other contexts, such as the evidentiary framework for proving employment discrimination under Title VII.

Alito’s Concurring Opinion Emphasized That Intent Is Still a Required Element

The majority opinion was just over 13 pages. Justice Samuel Alito wrote a concurring opinion that was just over three pages, in which Justice Amy Coney Barrett joined. He wrote separately “to reiterate that [the Court’s] rejection of an ‘animus’ requirement does not read intent out of the statute. Rather, as the Court confirms, a plaintiff must still show intent to discriminate.” “[T]he plaintiff must show that a reason for the adverse decision was the employee’s protected conduct. The plaintiff need not prove that the protected conduct was the only reason or even that it was a principal reason for the adverse decision,” he wrote. Showing that it helped to cause or bring about that decision “is enough,” he added.

What Does This Mean for Employers?

In 2010, Congress amended SOX via the Dodd-Frank Wall Street Reform and Consumer Protection Act to provide potential employee whistleblowers the right to a jury trial, expand available remedies, and expressly prohibit the use of pre-dispute arbitration agreements for SOX claims. Given the exceptionally plaintiff-friendly nature of SOX, covered employers should ensure that their SOX compliance strategy includes robust provisions to adequately address potential whistleblower complaints and prevent retaliation. It will be particularly important regarding SOX-covered adverse employment actions for employers to be clear as to the factors which motivated the decision, and that proof exists that the adverse action decided upon did NOT involve ANY consideration of the employee’s SOX-protected right to complain.

Thursday, February 8, 2024: U.S. GAO Report on Military Spouse Employment Focused on Challenges of Part-Time Work

The GAO pointed out the following key takeaways from the 12-page Report:

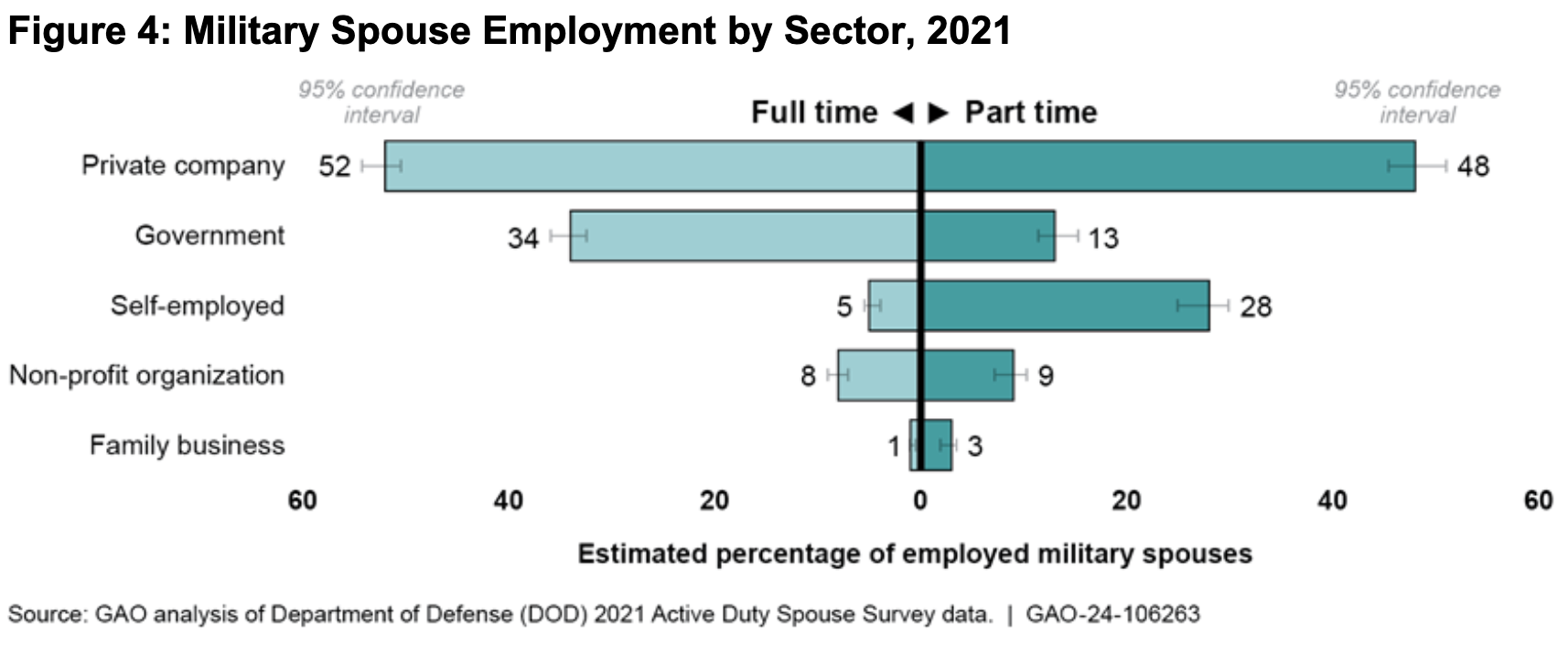

- In 2021, about a third of employed military spouses worked part-time based on the GAO’s estimates using data from the DOD’s most recent survey of military spouses. Overall, GAO estimated that there were about 540,000 civilian spouses of active-duty military service members. The vast majority – around 90 percent –were women. Moreover, the GAO estimated that about half of all military spouses (270,000) were employed in 2021. Of this group, about a third (88,000) worked part-time.

- Military spouses GAO interviewed who worked part-time reported various employment challenges, including being underpaid or overqualified for their job, working outside their career field, lacking opportunities for career advancement, and not earning retirement benefits. Although many other civilian workers may experience similar challenges, military spouses discussed how military life – including frequent moves – contributed to their employment challenges.

- In DOD’s 2021 survey, military spouses who worked part-time reported levels of satisfaction with military life that were similar to military spouses who worked full-time. However, DOD reported that, overall, military spouses’ satisfaction with military life has been decreasing since 2012.

Perspective from a DE Military Spouse

For additional insight, the WIR team reached out to Kim Lott, Community and State Outreach Administrator at DirectEmployers Association, a U.S. Navy Veteran, and a military spouse. Kim observed:

“It’s no secret in the military community, at least, that the military lifestyle – with its unique demands on the service member and family – creates challenges for spouses to obtain and maintain employment. This study does a great job of speaking to the contributing factors. The study doesn’t, however, examine the potential impact of frequent military moves and how that correlates to the likelihood of chronic and sustained underemployment, part-time employment (when full-time employment is desired and sought), gaps in work experience, shorter periods of employment, and acceptance of low-paying roles which offer little to no opportunity for advancement or retirement benefits.

Anecdotally (and other studies have borne this out), we know that this adversely impacts employment and is a contributing factor to spouses settling for part-time positions when they truly desire and are qualified for full-time, salaried positions.

We also know from the study that the stress that this puts on the family has led to conversations about whether the service member should remain in the military. What we learn from this is that military spouse employment has a bearing on military readiness.

If we, as a society, want to maintain a strong volunteer force, we need to understand military spouses’ needs and create a culture and benefits structure that can meet them (i.e., flexibility, work-from-home options, childcare benefits, generous PTO to assist with permanent change of station moves, creation of employee resources groups which help foster community, ability to transfer professional licenses from state-to-state without barriers and delay).

It’s good for the health of the family unit, our country’s military readiness, and most importantly, for that military spouse, who desires to provide for their family, utilize their skills, contribute to their community and the larger society, and maintain financial independence outside of their military spouse. They deserve that opportunity and employers’ support.”

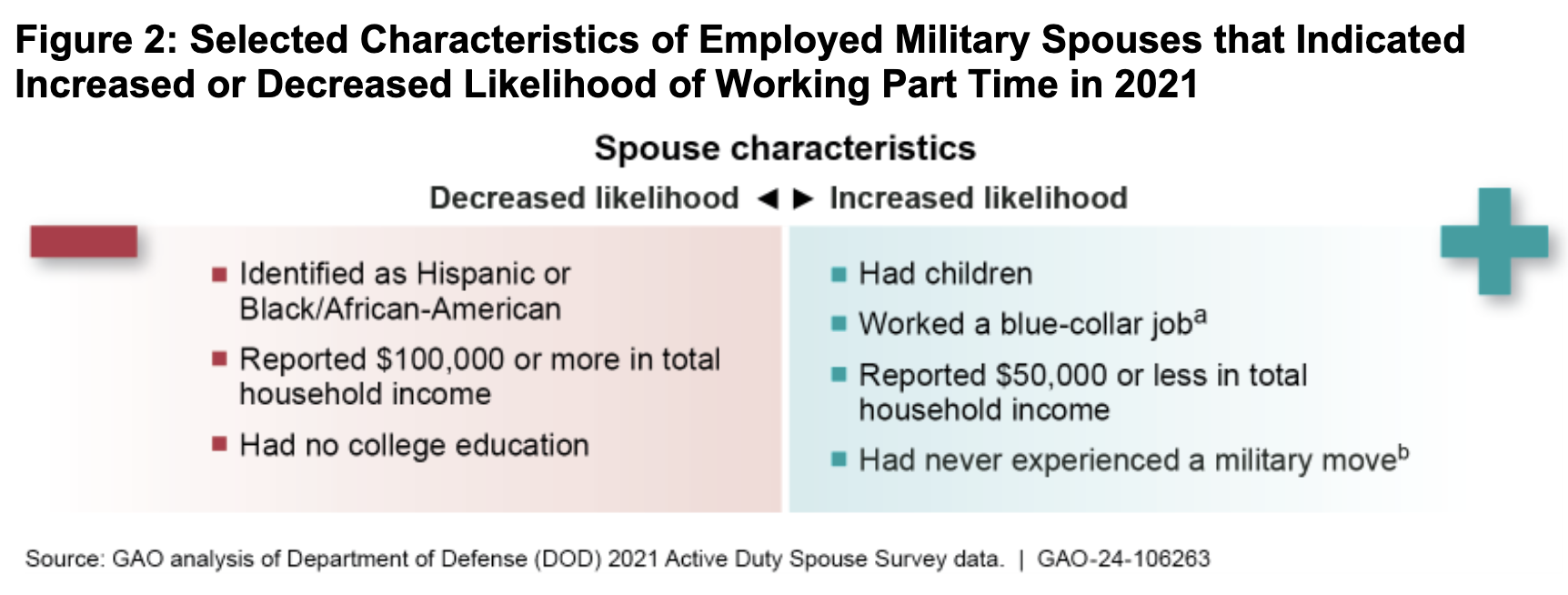

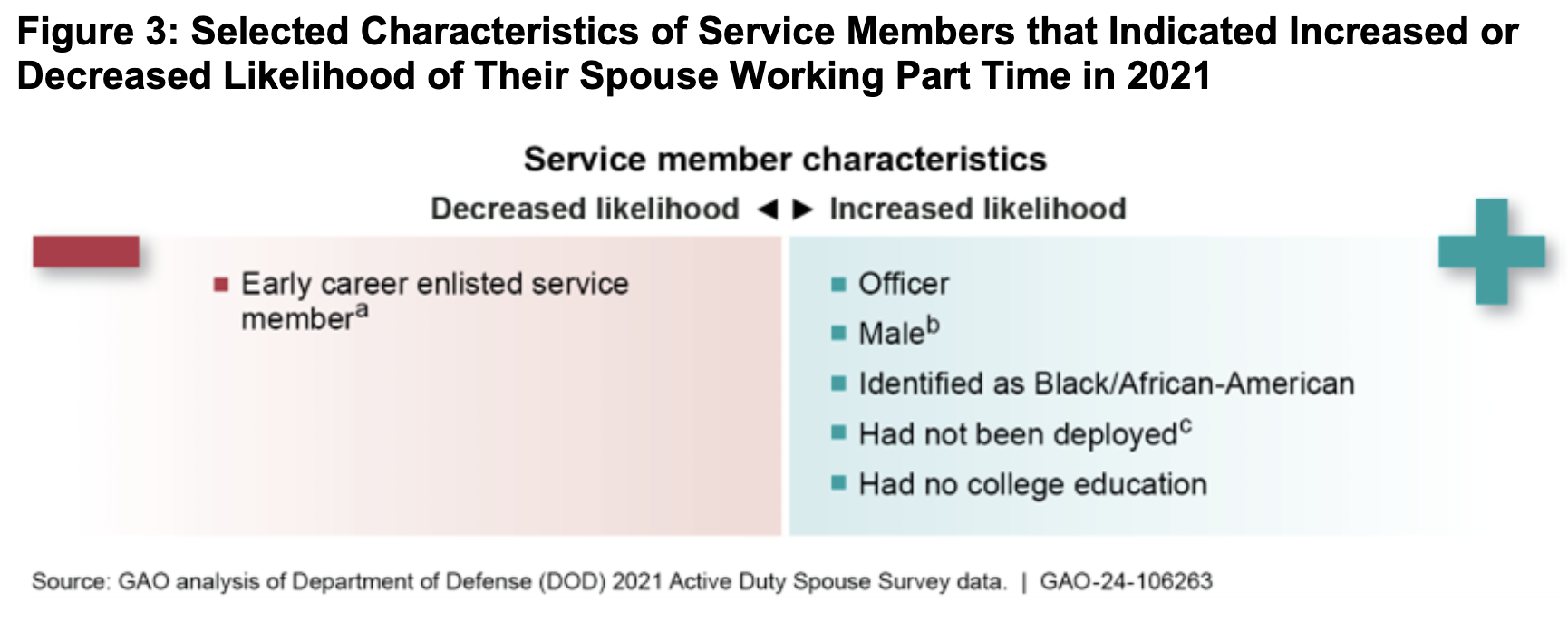

Furthering that discussion, pages 2-3 of the Report include the following charts showing how the demographic characteristics of service members and their spouses increased or decreased the likelihood of the spouse working part-time.

Friday, February 9, 2024: HIRE Vets Medallion Award Application Period Now Open

Application deadline is April 30, 2024

Employers of all sizes are eligible. The criteria for the 2024 award cycle are available here. Learn more and apply online at HIREVets.gov. Award recipients will receive a certificate and digital images of the medallion for use as part of their marketing and promotional activities.

A video of the 2023 HIRE Vets Medallion Awards Ceremony, held on November 8, 2023, is available here. You can search for those awardees using various filters on the table here. Click here for a map showing the locations of the awardees.

Looking Ahead:

Upcoming Date Reminders

There is one NEW item added to our calendar this week:

November 2023: EEOC’s (now overdue) target date for publication of an Interim Final Rule to Amend Procedural & Administrative Regulations to Include the PWFA (RIN: 3046-AB31)

November 2023: EEOC’s target date (now overdue) to publish its NPRM to amend its regulations on exemptions to certain recordkeeping and reporting requirements (RIN: 3046-AB28)

December 29, 2023: Statutory deadline (now overdue) for EEOC to finalize regulations to enforce the Pregnant Workers Fairness Act (RIN: 3046-AB30); EEOC submitted its Final Rule for OMB review on December 27, 2023

December 2023: U.S. OSHA’s current target date (now overdue) to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36)

January 15, 2024: Statutory deadline for EEOC’s (now overdue) publication of its Final Rule on the “2024 Adjustment of the Penalty for Violation of EEOC’s Notice Posting Requirement” (RIN: 3046-AB26)

February 12, 2024: Comment deadline for OFCCP’s request to renew OMB approval of its online Supply & Service Contractor Portal interface, including new requirement for contractors to provide UEI numbers for the parent company and its establishments

February 12, 2024: Effective date for US DOL WHD Final Rule on “Nondisplacement of Qualified Workers Under Service Contracts”

February 15, 2024 (12:00 pm – 01:00 pm ET): DE Masterclass Employment Law Roundtable | Who is an Independent Contractor, Part II

February 20, 2024: Deadline for comments on US DOL’s Request for Information seeking public input on whether to revise the list of Schedule A job classifications that do not require permanent labor certifications to include occupations in Science, Technology, Engineering & Mathematics (“STEM”) & other non-STEM occupations.

February 26, 2024: Effective date of NLRB’s Final Rule on Standard for Determining Joint-Employer Status under the NLRA (previous December 26, 2023, effective date extended)

February 27, 2024 (11:00 – 5:30 EST): US DOL WHD online seminar on prevailing wage requirements for federally-funded construction projects; register here

March 1, 2024: Expiration date for Continuing Resolution to fund the Departments of Transportation, Housing & Urban Development, Energy, Veterans Affairs, and Agriculture at current levels

March 8, 2024: Expiration date for Continuing Resolution to fund certain government agencies – including the US DOL/OFCCP, the EEOC, and the NLRB – at current levels

March 11, 2024: Effective date for US DOL WHD’s Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act

March 18, 2024: Comments due on US DOL ETA’s proposal to Modernize its Registered Apprenticeship Regulations

March 19, 2024: Comment deadline for US DOL VETS request to extend – without change – the Information Collection Requirement for its HIRE Vets Medallion Program

March 2024: EEOC’s target date for proposal to amend its regulations regarding the electronic posting of the “Know Your Rights” Poster (RIN: 3046-AB29)

March 2024: U.S. NLRB’s target date for its Final Election Protection Rule (RIN: 3142-AA22)

April 1, 2024: Comments due on FAR Council’s Proposed Rule on “Pay Equity and Transparency in Federal Contracting”

April 3 – April 5, 2024: DEAMcon24 New Orleans – The DEAMcon24 Program is now live!

April 2024: U.S. DOL WHD’s current target date for its Final Rule on Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees (Overtime Rule) (RIN: 1235-AA39)

May 15, 2024 (11:00 – 5:30 EST): US DOL WHD online seminar on prevailing wage requirements for federally-funded construction projects; register here

NEW May 2024: FAR Council’s target date for its Final Rule to Prohibit TikTok [or any successor application or service developed or provided by ByteDance Limited] on Federal Government Contractor Devices (RIN: 9000-AO58); the Interim Rule is here

August 29, 2024 (11:00 – 5:30 EST): US DOL WHD online seminar on prevailing wage requirements for federally-funded construction projects; register here

September 2024: OFCCP’s current target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

September 2024: OFCCP’s current target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

September 2024: EEOC’s anticipated date for amending its FOIA procedures to add fees for electronic disclosure of records (RIN: 3046-AB20).

September 2024: U.S. DOL WHD’s target date to publish an NPRM on “Employment of Workers With Disabilities Under Special Certificates” (Subminimum Wage Rule) (RIN: 1235-AA14)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.

“It’s no secret in the military community, at least, that the military lifestyle – with its unique demands on the service member and family – creates challenges for spouses to obtain and maintain employment. This study does a great job of speaking to the contributing factors. The study doesn’t, however, examine the potential impact of frequent military moves and how that correlates to the likelihood of chronic and sustained underemployment, part-time employment (when full-time employment is desired and sought), gaps in work experience, shorter periods of employment, and acceptance of low-paying roles which offer little to no opportunity for advancement or retirement benefits.

“It’s no secret in the military community, at least, that the military lifestyle – with its unique demands on the service member and family – creates challenges for spouses to obtain and maintain employment. This study does a great job of speaking to the contributing factors. The study doesn’t, however, examine the potential impact of frequent military moves and how that correlates to the likelihood of chronic and sustained underemployment, part-time employment (when full-time employment is desired and sought), gaps in work experience, shorter periods of employment, and acceptance of low-paying roles which offer little to no opportunity for advancement or retirement benefits.