While OFCCP’s Final Rule (i.e. regulation) making discrimination based on “sexual orientation” (and “gender identity”) unlawful (what I will refer to below for brevity’s sake as the OFCCP’s LGBT[1] Rule”) include only three Affirmative Action requirements[2], the Rule’s non-discrimination law requirements are considerably more complex. This is especially true as applied to questions of benefit eligibility for same sex married couples. Here are the four different scenarios federal contractors and employers could confront. Your challenge is to determine which scenario applies to your company.

SUMMARY: One or more of three different legal obligations, discussed below, may entitle lawfully married same-sex couples to enjoy employment benefits (such as dependent/family medical or life insurance) from their employer (covered by Title VII of the 1964 Civil Rights Act) or from their employer which is also a federal contractor (covered by Executive Order 11246). Conversely, small closely held corporations which are faith-based may be immune to LGBT obligations. We first summarize these four scenarios below and thereafter go into greater depth as to each one.

-Scenario 1: federal law: Executive Order 11246 and/or Title VII may provide same sex couples a right to benefits–but read below in greater detail to see how messy (technical legal term) this conclusion is; and/or

-Scenario 2: state laws prohibiting sexual orientation discrimination and applicable to the employer may provide lawfully married same sex couples a right to dependent/family benefits—but read below to see what a “checkerboard” picture of legal obligation emerges; and/or

-Scenario 3: the employer’s own benefits policy and/or plan may provide by contract that an employee who is lawfully married to a same sex spouse enjoys a right to dependent and/or family benefits (see how the “Eligibility” section of your company’s policy or benefit/privileges plan is drafted: they are not all standardized; nor alike) EVEN IF the employer believes federal law does not prohibit sexual orientation discrimination and even if the at-issue employee works in one of the 28 states or 13 federal territories which do not make sexual orientation discrimination unlawful (and thus permit sexual orientation discrimination); and/or

Scenario 4: perhaps the employer/federal contractor agrees that federal and/or state sexual orientation non-discrimination law attaches to it, but the employer/contractor is nonetheless a small closely held corporation whose owners believe that same sex marriage violates their religious beliefs and that their religious beliefs immunize them from the dictates of sexual orientation non-discrimination requirements pursuant to either or both the Religious Freedom Restoration Act (“RFRA”), ala the US Supreme Court’s recent decision in Burwell v. Hobby Lobby, 573 U.S. __(2014), or perhaps even pursuant to the First Amendment’s Freedom of Religion Clause.

We now discuss each of these four scenarios in greater detail.

SCENARIO 1: The Easy Option: The employer could be (a) a covered federal contractor and (b) could conclude that OFCCP’s Final LGBT Rule is lawful. If so, Executive Order 11246 would obligate this federal contractor to supply the same benefits to lawfully married same sex couples which the contractor makes available to lawfully married opposite sex married couples because it believed itself obligated by law to do so. This is because (a) employer benefit plans, where offered, typically provide dependent/family benefits to employees who are lawfully “married”, AND (b) the effect of (i) the 30 states and two territories (Guam and the District of Columbia) which recognize same sex marriage by operation of state law[3] and (ii) the U.S. Supreme Court’s recent decision in Obergefell et al v. Hodges, Director, Ohio Department of Health, et al., 576 U.S. ___ (2015)[4] is that these state statutes and the U.S. Constitution now legally equate same sex marriage with opposite sex marriage. Accordingly, granting dependent/family benefits made available to employees lawfully married to opposite sex spouses while denying those same benefits to employees lawfully married to same sex spouses treats the employee married to a same sex spouse differently based solely on his/her “sexual orientation” (and, remember, that in this Scenario, this contractor believes that Executive Order 11246 and/or Title VII now outlaw sexual orientation discrimination).

NOTE: The U.S. Supreme Court’s decision in the Obergefell case is relevant to the same-sex benefit issue only in that the decision expanded from 32 to 65 the number of states and federal territories of the United States willing to issue marriage licenses to same sex couples. So, a lot more same sex marriages are now likely to occur in the United States. NOTE: there are 15 federal territories in “the United States”, including 7 which OFCCP’s Executive Order 11246 Rules cover within their definition of the term “United States.” NOTE: The OFCCP definition of the term “United States” includes: the District of Columbia, the Virgin Islands, the Commonwealth of Puerto Rico, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, and Wake Island.

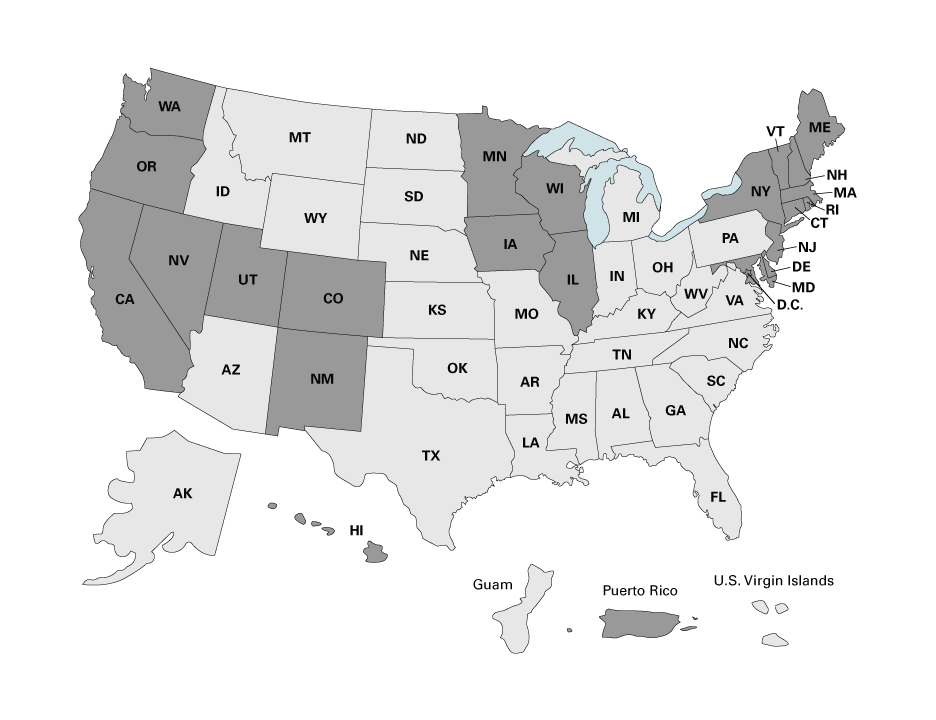

SCENARIO 2: The “Doubting Thomas” Checkerboard Option: If, however, the employer is (a) a federal contractor which (i) does NOT believe that the OFCCP Final LGBT Rule is lawful[5] and (ii) does not believe that Executive Order 11246 makes “sexual orientation” discrimination unlawful “sex discrimination”[6], or (b) is not a federal contractor AND does NOT believe that Title VII of the 1964 Civil Rights Act makes sexual orientation discrimination unlawful[7], this contractor/employer would nonetheless have to provide benefits to lawfully married same sex couples on the same basis it provides benefits to lawfully married opposite sex couples (if it does) if the covered employee works in one or more of the 22 states (Hawaii, Washington, Oregon, California, Nevada, Utah, Colorado, New Mexico, Minnesota, Iowa, Illinois, Wisconsin, New York, Maryland, New Jersey, Rhode Island, New Hampshire, Maine, Massachusetts, Connecticut, Delaware, and Vermont), the District of Columbia and Puerto Rico which currently have state anti-discrimination laws making sexual orientation discrimination unlawful in employment in the private sector (and which state laws presumably attach to and limit the discretion of the employer reading this blog).

It is not just federal law which governs employers. State law, too, can limit corporate discretion to act as the company pleases. In these 30 states, the District of Columbia and Puerto Rico, where it is unlawful to discriminate based on an employee’s sexual orientation, an employer would operate at its legal risk to deny dependent/family benefits to an employee lawfully married to a same sex spouse if the employer made those same benefits available to employees lawfully married to opposite sex spouses. Why? The reason for denial would be based on the sexual orientation of the employee married to a same sex spouse….a kind of discrimination these 30 states, the District of Columbia and Puerto Rico, currently make unlawful discrimination.

An employer operating nationwide AND which had made the policy decision to supply benefits to lawfully married same sex couples only in those 30 states, the District of Columbia and Puerto Rico, because the company did not believe federal law so required, but “state” law did, would find that a map of the states in which the company was required to supply benefits would look like a checkerboard.

States and Territories of the United States which make Sexual Orientation Discrimination Unlawful (as of 7/1/15)

In those states in which sexual orientation discrimination is lawful (and if one believed federal law did not make sexual orientation discrimination unlawful), the employer would be free to deny dependent/family benefits to an employee working in that state who was lawfully married to a same sex spouse EVEN THOUGH the employer nonetheless makes available those same benefits to an employee in that state lawfully married to an opposite sex spouse. This is because while the same sex spouses are lawfully married, there is no legal prohibition in this Scenario making unlawful the employer’s discrimination based on the sexual orientation of its employee married to a same sex spouse.

This Scenario also raises the question whether the so-called “Place of Celebration” argument would prevail to require an employer which did not want to make available same sex benefits to nonetheless deliver those benefits to an employee in a state where sexual orientation discrimination is lawful. (The “Place of Celebration” argument was one crafted when only some states recognized same sex marriage. Same sex marriage advocates argued that an employee lawfully wed to a same sex spouse should enjoy the benefits of marriage even when working in a state which did not recognize same sex marriage: i.e. the employer had to honor the fact that the employee was lawfully married even though the employee thereafter went to work in a state which did not honor same sex marriage).

The short answer is that state law would not require an employer to provide same sex benefits if the state permitted sexual orientation discrimination (although look to see if the employer’s benefit plan might nonetheless provide benefits to same sex couples, by contract, to employees lawfully married to a same sex spouse as discussed more fully in the next Scenario). Even if the same sex couple were lawfully married, in the absence of federal or state law making discrimination based on sexual orientation unlawful (or an employer providing same sex benefits by contract), it does not matter that the couple is lawfully married. What matters is whether there is a federal or state law which makes unlawful sexual orientation discrimination of the type the employer has accomplished in this example (or a contract in which the employer voluntarily provides dependent/family benefits to an employee lawfully married to a same sex spouse).

SCENARIO 3: The “Least Common-Denominator Option”: A contrary policy determination to Option 2, above, is to follow the first rule of Human Resources– the KISS rule (“Keep it Simple Stupid!)–by adopting the “least common-denominator” (i.e. adopt nationwide the toughest requirement the employer will face …in that way the employer is never wrong and has a uniform policy which is easier to administer than to have several different policies addressing the same employment benefit or privilege). This policy determination allows a company to create uniform policies, rights and administration nationwide without the fear of misapplying the company’s policy in the “odd ball” state or states which require some special rule different from the other states in which the company has employees.

Mechanically, companies would create BY CONTRACT[8] with its employees such a uniform policy nationwide by creating the right to dependent/family benefits for employees lawfully wed to same sex spouses. As noted above, the employer would simply want to be careful to make that contract right at least as generous as the most onerous and demanding requirement of the federal and the 30 “state” sexual orientation non-discrimination laws the company determines are applicable to it.

Most Fortune 500 companies have reportedly drafted the eligibility portion of their written benefits and privileges[9] policies/plans to make benefits and privileges of employment available nationwide to lawfully married same sex couples.

NOTE: Once federal and/or state sexual orientation non-discrimination law(s) applies to a particular employee, his/her employer may NOT lawfully either reduce the benefit to the opposite sex couple or charge a differentially higher premium for the benefit to an opposite sex couple. Why not? Again, the employer would be taking this “adverse action” (reducing the benefit/charging same sex couples more for the same benefit than opposite sex couples pay) based solely on the employee’s sexual orientation. While these reduced benefit and premium pay options were once commonly used throughout the United States by companies which thought they were being “progressive” to voluntarily make available benefits to same sex couples which the employer previously made available only to opposite sex couples, the number of jurisdictions making sexual orientation discrimination unlawful is continually expanding and thus rendering these older “progressive” plans obsolete and indeed, unlawful.

Said another way, employers in states and territories which have passed into law sexual orientation non-discrimination laws (or if the employer believes federal law now outlaws sexual orientation discrimination), must equalize benefits in all jurisdictions outlawing sexual orientation discrimination (this is essentially nationwide if you believe that either Executive Order 11246 and/or Title VII are now properly and legally infused with sexual orientation non-discrimination law prohibitions) or else face a lawsuit seeking both an injunction (to stop the practice) and money damages to remedy the unlawful discrimination.

SCENARIO 4: This company might be one which is a small closely held “family company” whose owners may believe that federal law now prohibits sexual orientation discrimination and who may have employees in one or more states which make sexual orientation discrimination unlawful. But, these owners may nonetheless also believe that the company is exempt from the prohibitions of sexual orientation law because the owners hold religious beliefs which do not recognize same sex marriage. Presumably, too, this kind of employer would have a benefit plan which stated that it would render “eligible” for dependent/family benefits only those employees lawfully married to opposite sex spouses.

Whether the RFRA or the religious freedom protections of the First Amendment would immunize this kind of employer from supplying benefits to lawfully married same sex couples equal to those benefits the employer supplies to lawfully married opposite sex couples would be a true and closely watched legal “test” case. Indeed, such a case would enjoy a real chance to have the U.S. Supreme Court eventually hear it. This is because it would be a case the Justices would find interesting due to the clash of competing legal rights (especially since it would pit a Constitutional right (religious freedom) against a statutory right (sexual orientation non-discrimination). Indeed, the First Amendment case by itself would be a true and significant “test” case since the U.S. Supreme Court has never previously accorded corporations (as opposed to individuals) religious freedom protections under The First Amendment.

CONCLUSION: Figure out which of the above four Scenarios captures the state of affairs at your company and then write your employee benefit plan accordingly. My communications with clients thus far is that almost all of them fall squarely within Scenario # 3: they do not believe that federal law makes sexual orientation discrimination unlawful. Nonetheless, most companies now believe the right thing to do is to equalize benefits for lawfully married same sex couples and end the era in which the company supplied differential benefits depending upon the sexual orientation of the covered employee.

For its part, OFCCP believes all federal contractors must now equalize benefits for lawfully married same sex couples because it believes both that all same sex couples now have a right to be lawfully wed in all states and territories of the United States and that Executive Order 11246 outlaws sexual orientation discrimination as to all covered federal contractors. And, OFCCP is spoiling for a fight on this issue. It is primed and ready to litigate this issue. This issue could arise pursuant to either individual or class-type Complaint (from an employee or Applicant) or via a routinely scheduled OFCCP Compliance Evaluation. I am also quite sure OFCCP will soon make it a “checklist item” in audits to determine whether the federal contractor/subcontractor under audit has made its benefits and privileges available to lawfully wed same sex couples on the same terms the company makes them available (if it does) to those employees lawfully married to the opposite sex.

If you have any questions, please consult an employment lawyer for specific legal advice concerning your situation. Be careful out there…it is a little bit complex and certainly same sex marriage and benefits are issues which fill people with passion and quickly animate discussions around the water cooler and in the Boardroom!

John C. Fox

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

Reminder: If you have specific OFCCP compliance questions and/or concerns or wish to offer suggestions about future topics for future blog posts, please contact your membership representative at 866-268-6206 (for DirectEmployers Association Members), or email Candee Chambers at candee@directemployers.org with your ideas.

[1] “LGBT” is an informal shorthand reference to Lesbian, Gay, Bi-sexual & Transgender.

[2] These three Affirmative Action requirements are: (A) Include updated EEO clause in “new” or “modified”/“altered” subcontracts and purchase orders ensuring that applicants and employees are treated without regard to their sexual orientation and gender identity per 41 CFR § 60-1.4 (“Equal opportunity clause”); (B) Include updated EEO language in job solicitations and advertisements. 41 CFR § 60-1.4(a) (1) (2) & (7) and 41 CFR § 60-1.4(b) (1) (1) (2) & (7); and (C) Change all written references in AAPs and other writings describing Executive Order 11246’s prohibitions to include references to “gender identity” and “sexual orientation”, perhaps something like this: “Executive Order 11246, as amended, among other things, prohibits discrimination based on race, sex, gender identity, sexual orientation, religion, national origin and color.”

[3] While the legal landscape is complicated, in general it may be said that same sex marriage is legal throughout the following 30 states, the District of Columbia and Puerto Rico (and not for only a short period in history or in some but not all counties) by operation of state law: Alaska, Washington; Oregon, California, Idaho, Nevada, Montana, Colorado, Utah, Wyoming, New Mexico; Minnesota, Iowa, Oklahoma, Michigan, Illinois, Indiana, Maine, Vermont, New Hampshire, Massachusetts, Rhode Island, Connecticut, New Jersey, Pennsylvania, Maryland, West Virginia, North Carolina, South Carolina and Florida.

[4] Obergefell held that same sex couples have a constitutional right in all 50 states and in all federal territories to same sex marriage.

[5] Because the Congress has refused to amend Title VII of the 1964 Civil Rights Act to make sexual orientation discrimination unlawful pursuant to Title VII, and because the President must have authority from the Congress to act as to matters which the Constitution does not directly delegate to the President the power to act (as here), there is a powerful and compelling legal argument that OFCCP’s Final LGBT Rule is unlawful as a violation of the “Separation of Powers” doctrine of the U.S. Constitution. NOTE: the Congress has voted down legislation to amend Title VII and to order The President to amend Executive Order 11246 to make sexual orientation unlawful in 39 of the last 40 years and has not introduced such a bill in the 40th year referenced. Said another way, the President does not have the power to usurp the function of the Congress to make and pass federal laws.

[6] Because it is both the law of Executive Order 11246 and OFCCP’s policy for the substantive law of Executive Order 11246 to follow the substantive law of Title VII, there is a compelling argument that the Executive Order’s prohibition on “sex discrimination” does not make ”sexual orientation” discrimination unlawful. OFCCP’s position, of course, is two-fold: (1) The Executive Order since 1967 has ALWAYS outlawed sexual orientation discrimination and (2) the EEOC’s recent (July 16, 2015) decision in Complainant v, Foxx, Secretary of the Department of Transportation that an unnamed FAA employee could pursue a legal claim against the U.S. Secretary of Transportation pursuant to Title VII for alleged unlawful sexual orientation discrimination] definitively interprets Title VII to make sexual orientation discrimination unlawful. However, the EEOC’s administrative Foxx decision is contrary to a long line of federal court cases decisions going back 30 years holding that Title VII does not make sexual orientation discrimination unlawful. This is indeed the VERY reason that substantial segments of the Congress have felt the need to pass a statute they have named, in recent years, ENDA (Employment Non-Discrimination Act). As noted above, such reform efforts have failed in Democrat and Republican controlled Congresses and have failed all Congresses convened over the past 40 years in a row. OFCCP’s sudden discovery of sexual orientation discrimination prohibitions President Johnson allegedly originally embedded in the Executive Order in 1967 is, of course, highly suspect and is the subject of great derision in the legal community, even among those who believe fervently in LGBT rights.

[7] The EEOC’s July 16, 2015 administrative decision in in Complainant v, Foxx, Secretary of the Department of Transportation discussed above in the prior footnote, is also highly suspect for the reasons noted in the prior footnote. Most legal pundits view the EEOC’s decision in the Foxx case to be a misguided and aberrant, albeit well-intentioned, effort to legislate a result most of society in the United States wants, but which the Congress has steadfastly refused to deliver. Most legal pundits do not believe the Foxx decision to be a serious legal case decision to which many, if any, federal courts will give deference.

[8] In general, employers may create contracts with their employees in one of two ways: (a) via “express” oral or written contracts with their employees by exchanging promises and supporting those promises with “consideration” (i.e. something of value, although that value could be so little as to be a mere “peppercorn”). Please review, however, applicable state laws to determine how precisely to establish or avoid express contracts pursuant to your local state law(s), or (b) via “implied contracts”. In most states, employee handbooks and benefit and privileges plans the employer publishes to employees operate as oral or written “implied contracts” expressing the “reasonable expectations of the parties” entering into the at-issue employment contract. The terms of the employee handbook or benefit plan or policy, for example, are implied—as a matter of law– into the employment contract terms and conditions of the employee’s employment contract as though written there. Again, however, please consult an employment attorney concerning the contract formation laws of the state(s) of interest to your company.

[9] Title VII of the 1964 Civil Rights Act makes it unlawful to discriminate against covered employees in the “terms and conditions” of employment, benefits of employment and as to “privileges of employment”. See the applicable portion of Section 703 of Title VII codified as 42 USC Section 2000e-2 (a)(1). A “privilege” of employment is technically different from a “benefit” of employment because the employee may elect to enjoy the employer’s proffered benefit, but need not do so. For example, many companies allow senior managers the “privilege” of electing to purchase more life insurance or more enhanced Long Term Disability insurance at the employee’s own cost. Another example would be the privilege many part-time employees have to purchase health insurance coverage at their cost but at the company’s lower-cost group insured premium rate. Executive Order 11246 is very poorly drafted in this regard and is not nearly so detailed or specific in its description of prohibited practices made unlawful as is the language of Title VII. Nonetheless, while it is very messy (technical legal term”) language which is disheartening for careful wordsmiths to read, my feeling is that Section 202 (1) of Executive Order 11246 is drafted sufficiently broadly to make unlawful discrimination actionable as to even “privileges of employment”:

“The contractor will not discriminate against any employee or applicant for employment because of race, color, religion, sex, sexual orientation, gender identity, or national origin. The contractor will take affirmative action to ensure that applicants are employed, and that employees are treated during employment, without regard to their race, color, religion, sex, sexual orientation, gender identity, or national origin. Such action shall include, but not be limited to the following: employment, upgrading, demotion, or transfer; recruitment or recruitment advertising; layoff or termination; rates of pay or other forms of compensation; and selection for training, including apprenticeship.”