The following blog post was authored by James M. McCabe and David P. Goodwin of Troutman Sanders, an international law firm with more than 650 lawyers practicing in 16 offices located throughout the United States and Asia.

The much-anticipated so-called federal contractor “blacklisting” rules and guidance (“Final Rule” and “Guidance”) were published in the federal register on August 25, 2016. The Final Rule becomes effective on October 25, 2016 and imposes four new legal obligations on covered federal contractors, which will be phased in over the next year (starting as early as October 25, 2016). It is important to also note that this is being phased in via Federal Acquisition Regulation (“FAR”) solicitation and contract provisions. This means that the Final Rule “becomes effective” by beginning to appear in new solicitations issued on or after October 25, 2016. This should not dampen a company’s concern and speed of progressing through the steps below and determining and pursuing compliance, but it is critical to understand and follow the specific path of obligation.

First, federal contractors will have to disclose “labor law decisions” both before and after contract award. The federal government will use these disclosures in making their “responsibility” determinations – the determination of whether the contractor is a responsible source to whom a contract may be awarded. Second, contractors must give a wage statement to employees containing for each workweek the number of hours worked, the number of overtime hours, rate of pay, and additions to and from gross pay, and total gross pay. Third, contractors must provide written notice to independent contractors informing them that they are independent contractors and not employees. Fourth, contractors can no longer enter into agreements with employees or independent contractors that require arbitration of claims under Title VII of the Civil Rights Act (includes discrimination and retaliation claims based on race, color, religion, sex and national origin) or sexual harassment claims.

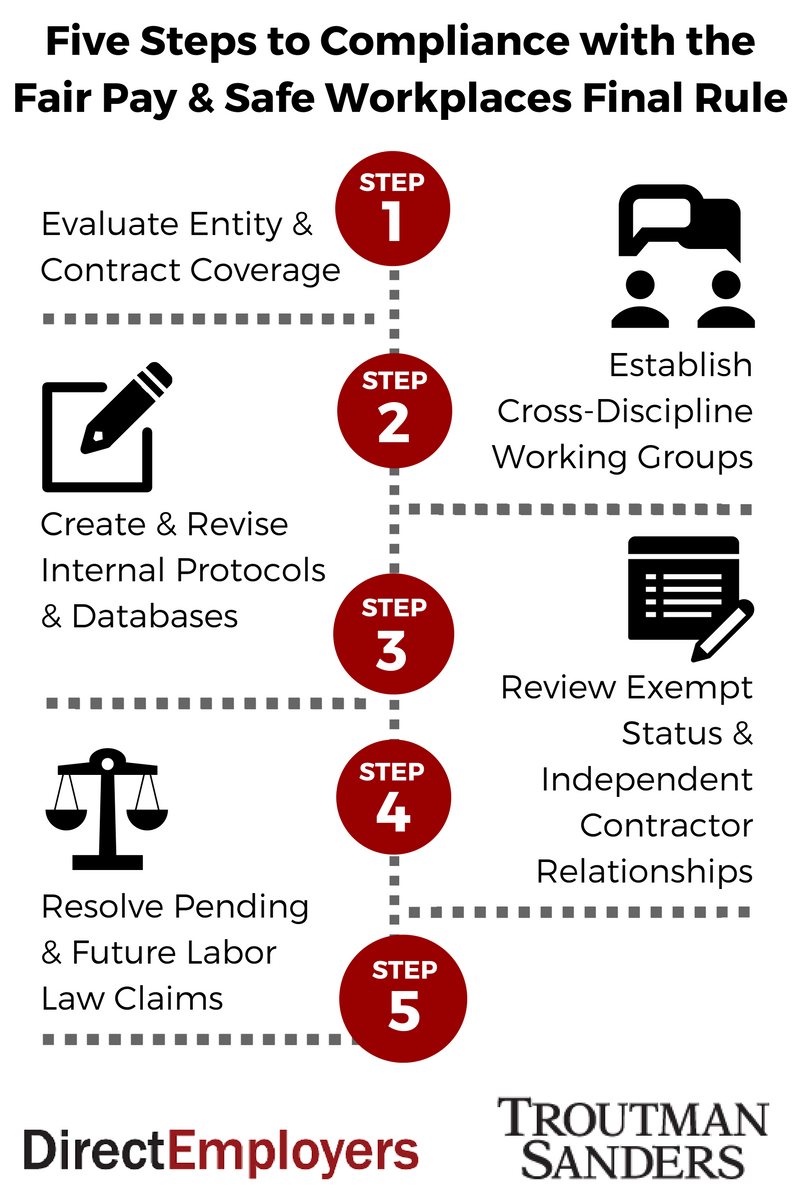

Federal contractors will need to become quick studies of the Final Rule and Guidance in order to begin developing procedures to ensure compliance as these requirements phase in over the next year. There are five steps that federal contractors should take now to come into compliance with the Final Rule.

Step 1: Evaluate Entity and Contract Coverage

Contractors should consider what entities will be subject to the Final Rule’s requirements and in what ways coverage can be limited or avoided. The Final Rule only applies to entities that enter into covered contracts, not parent, subsidiary or affiliate companies. In some cases, companies may wish to create separate entities devoted to government contracts in an effort to limit the burden of these new requirements going forward. However, the more separation that can be created between the entities, the better. While the commentary to the Final Rule expressly excludes parent companies, subsidiaries, or affiliates of covered contractors, in the past under other federal contractor laws and related regulations (e.g. Executive Order 11246), the DOL has taken the position that closely related companies can be considered a “single” entity for labor law purposes. The Final Rule and Guidance is silent on this issue.

In other cases, companies may devise ways to avoid entering into certain contracts that do not exceed the dollar threshold levels or involve only exempted contracts. For example, the Final Rule does not apply to subcontracts for commercially available off-the-shelf items (“COTS”). Those who in the past entered into prime contracts for COTS item contracts may now try to provide those same products through a prime contractor reseller in order to avoid these new obligations, since COTS subcontractors are not subject to the Final Rule. Taking that one step further, COTS item sellers may consider creating new reseller entities to limit the scope of the rule to that specific legal entity. Likewise, the Final Rule does not apply to contracts or subcontracts valued at $500,000 or less.

Step 2: Establish Cross-Discipline Working Groups

The impact of the Final Rules should be evaluated from several different perspectives in any organization. In the typical organization, human resource and labor and employment legal advisors are not always working hand in hand with the individuals who make bids for federal contracts, with payroll departments or with in-house legal or management teams overseeing litigation in various areas of federal employments law, such as OSHA. Input from representatives from all of these areas of the business will be important both for ensuring compliance with the new requirements and understanding and preparing for how these new obligations may impact day to day decisions, such as resolution of pending administrative investigations before and after a covered labor law decision has been triggered. At a minimum, a representative from the following groups should be part of this working group:

- Human Resources

- Legal Counsel with Expertise in the Final Rule

- Contract Management and Compliance

- Government Relations

- Payroll

- Health and Safety

- Risk Management

Step 3: Create and Revise Internal Protocols and Databases

The administrative burdens of the Final Rule are significant. For most contractors, the two most significant burdens will be revising payroll statements and creating protocols and databases for collecting and reporting labor law decisions. In nearly all cases, companies use electronic-based payroll systems that will need to be revamped to include the new wage statement information (unless the company is already providing one that is compliant in one of the approved states, which are (1) Alaska, (2) California, (3) Connecticut, (4) the District of Columbia, (5) Hawaii, (6) New York, and (7) Oregon). Likewise, companies will need to create confidential internal protocols for tracking labor law decisions and reporting them on an ongoing basis in the System for Award Management (“SAM”). While the phase-in period helps in this regard, contractors are already “behind” since the reporting obligation will reach back to October 25, 2015. Of course, the urgency of gathering and tracking this information depends in large part on the contractor’s anticipated government contracting pipeline. Here are the key dates to consider as you plan for implementation:

October 25, 2016

- Prohibition on pre-dispute arbitration agreement applies to any solicitations on or after October 25, 2016 and resulting contracts valued at over $1 million; commercial item and COTS item contracts and subcontracts are exempt.

- Labor law disclosure requirements apply to any solicitations on or after October 25, 2016 and resulting contracts valued at $50 million or more; COTS item subcontracts are exempt.

January 1, 2017

- Wage statement and independent contractor notice applies to any solicitations on or after January 1, 2017 and resulting contracts valued at more than $500,000; COTS item subcontracts are exempt.

April 25, 2017

- Labor law disclosure requirements apply to any solicitations on or after April 25, 2017 and resulting prime contracts valued at $500,000 or more.

October 25, 2017

- Labor law disclosure requirements apply to any solicitations on or after October 25, 2017 and resulting subcontracts valued at $500,000 or more; COTS item subcontracts are exempt.

Step 4: Review Exempt Status and Independent Contractor Relationships

The obvious purpose of the wage statement and independent contractor notice is to attempt to bring some additional light to areas of employee misclassification and other wage and hour violations. Contractors who have not seriously evaluated the exempt status of their employees and other common wage and hour issues (e.g. improper deductions from pay) should consider reviewing areas of concern and making adjustments proactively, before the notices have to be sent out. Moreover, in reviewing the employment status of independent contractors, employers often find that there are ways to strengthen their position regarding employment status in various ways. Contractors should get ahead of these issues before the notices must be issued.

Step 5: Resolve Pending and Future Labor Law Claims

As contractors work through the nuts and bolts of coming into compliance with the Final Rule, they will also want to evaluate what impact, if any, these new obligations may have (or should have) on pending and future labor and employment law claims. The Final Rule requires covered contractors to provide information on covered labor law decisions over a three-year period. “Labor law decision” means an administrative merits determination, arbitral award or decision, or civil judgment, which resulted from a violation of one or more of the laws listed below:

(1) The Fair Labor Standards Act.

(2) The Occupational Safety and Health Act (OSHA) of 1970.

(3) The Migrant and Seasonal Agricultural Worker Protection Act.

(4) The National Labor Relations Act.

(5) 40 U.S.C. chapter 31, subchapter IV, formerly known as the Davis-Bacon Act.

(6) 41 U.S.C. chapter 67, formerly known as the Service Contract Act.

(7) E.O. 11246 of September 24, 1965 (Equal Employment Opportunity).

(8) Section 503 of the Rehabilitation Act of 1973.

(9) The Vietnam Era Veterans’ Readjustment Assistance Act of 1972 and the Vietnam Era Veterans’ Readjustment Assistance Act of 1974.

(10) The Family and Medical Leave Act.

(11) Title VII of the Civil Rights Act of 1964.

(12) The Americans with Disabilities Act of 1990.

(13) The Age Discrimination in Employment Act of 1967.

(14) E.O. 13658 of February 12, 2014 (Establishing a Minimum Wage for Contractors).

(15) Equivalent State laws as defined in the DOL Guidance.

Under item 15 above, the only equivalent state laws implemented in the Final Rule are OSHA-approved state plans, which can be found at www.osha.gov/dcsp/osp/approved_state_plans.html. All other states labor and employment laws have been excluded from the disclosure requirements until the DOL and the FAR Council provide further guidance.

Perhaps the most troubling aspect to employers of the Final Rule (aside from the tremendous paperwork and administrative burdens) is the broad nature of how “administrative merits determinations” has been defined. Such determinations include not only decisions from courts or administrative law judges, but many preliminary decisions of federal agencies that employers often vigorously contest. For example, administrative merits determinations that contractors must disclose include: NLRB complaints, OSHA citations, OFCCP show cause notices, EEOC reasonable cause determinations, and any complaint filed by or on behalf of an enforcement agency with a Federal or State court or an administrative law judge alleging that the contractor or subcontractor violated any provision of the covered labor laws. Employers and employer-advocates sharply criticized the inclusion of such preliminary findings by administrative agencies, which decisions are often highly politically motivated and eventually overturned by federal courts.

The labor law decision disclosures must be made even if the employer later settles the charges. However, if the agency’s determination is overturned at a later time, these decisions no longer have to be disclosed. Given these considerations, the Final Rule will likely encourage contractors to settle charges while investigations are ongoing but before an initial determination has been made in order to avoid the disclosure requirement. On the other hand, once the agency issues a covered decision, employers may be emboldened to contest the allegations rather than settle them.

For most contractors, the Final Rule will probably not have any immediate impact on how they make decisions in resolving labor and employment claims. These contractors will likely take a “wait and see” approach and evaluate how much contracting officers are using labor law disclosures in making their responsibility determinations (or at least wait to see who wins the presidential election). However, the sensitivity to this issue will likely depend on the importance of government contracting work to the overall business. For those whose bread and butter is in federal contracting, it will be very hard not to seriously consider the impact of disclosures when making settlement decisions concerning labor law claims, even in the short term.

Jim is a member of the Executive Committee and Board of Training Leaders International (TLI) (Minneapolis, Minnesota) and also serves as the Secretary of TLI.

Jim is a member of the Golf Committee at Druid Hills Golf Club.

David has the unique perspective of counseling commercial companies through the necessary aspects of growing and maintaining a successful government contracts division, with strong revenue streams from domestic and international government customers. His experience also extends to advising small, medium, and large government contractors on the full range of Government Contracts, Anti-Corruption, and Export Controls compliance issues—resulting in integrated programs that provide better compliance through business-wise implementation.

The U.S. Secretary of Commerce appointed David to serve on the District Export Council of Southern California—recognition that he is a leader in the international business community and a significant contributor to the increase of U.S. exports.