- USDOL ALJ Approved Consent Decree in Long-Running OFCCP Action Against Convergys

- U.S. Small Business Administration Will Take Over Certification of Veteran-Owned Small Businesses in January

- U.S. HHS Published a “Bulletin” Reminding HIPAA-Covered Entities & Business Associates of Limits to Use of Online Tracking Technologies

- In Another RFRA Case, the Eighth Circuit Barred, Nationwide, HHS/EEOC Enforcement of ACA Interpretations on Gender-Confirmation Surgery/Care

- U.S. NLRB Expanded Financial Remedies for Workers in Unfair Labor Practices Cases

- U.S. NLRB Modified the Appropriate Bargaining Unit Standard

- Washington State Finalizes Regulations Related to New Pay Transparency Law

- U.S. NLRB Reaffirmed Limits on Employers’ Questioning of Workers for ULP Investigations

- U.S. DOL & U.S. IRS Renewed Coordinated Enforcement Agreement

- U.S. GAO Found Special Operations Command May Not Have Needed Information to Assess Barriers to Women’s Careers

- U.S. GAO Interim Report Found Gender Pay Gap Varies by Education Levels, Race & Ethnicity

- NLRB Overturns Another Trump Era Rule, Reinstating Broader Access to Property for Contract Workers Staging Labor Protests

- In Brief

- Looking Ahead: Upcoming Date Reminders

Wednesday, November 16, 2022: USDOL ALJ Approved Consent Decree in Long-Running OFCCP Action Against Convergys

In July, Secretary Walsh Intervened to Order Contractor’s Compliance with Document Demands

In the underlying dispute, Convergys, a customer relationship management company headquartered in Cincinnati, Ohio, refused to provide the OFCCP copies of its affirmative action programs and several other supporting documents during a compliance review desk audit for several of its facilities. Convergys asserted that OFCCP lacked constitutionally sufficient cause for the audits and sought an order finding that OFCCP violated its Fourth Amendment right against unreasonable searches and seizures. In December 2014, OFCCP filed the first of multiple administrative lawsuits against Convergys to compel compliance with its demands. After years of litigation bouncing the case around among two different ALJs and the USDOL’s Administrative Review Board, Secretary Walsh intervened, issuing his July 1, 2022 order compelling Convergys to comply with OFCCP’s document demands.

According to the DOL’s Office of Administrative Law Judge’s (OALJ) docket listings, USDOL Solicitor’s Office filed the Consent Decree with the ALJ on October 26, 2022. Even though ALJ Annos’ order is dated November 16, it was not posted on the OALJ’s website until this past week. As of the WIR deadline, the Consent Decree itself was not posted on OFCCP’s FOIA Library website or on OFCCP’s Class Member Locator webpage.

Tuesday, November 29, 2022: U.S. Small Business Administration Will Take Over Certification of Veteran-Owned Small Businesses in January

How We Got Here

Previously, to be eligible for Department of Veterans Affairs (VA) contracts, VOSBs and SDVOSBs had to be “verified” (not “certified”) by the VA’s Center for Verification and Evaluation (CVE) pursuant to 38 U.S.C. 8127. There was no government-wide SDVOSB certification program. Companies seeking to be awarded SDVOSB sole source or set-aside contracts with federal agencies other than the VA only needed to self-certify their status as set forth in section 36 of the Small Business Act, 15 U.S.C. 657f.

The National Defense Authorization Act of 2021 (in Section 862) provided that the Department of Veterans Affairs Center for Verification and Evaluation (CVE), transfer its authority to the SBA, effective January 1, 2023. The Veteran Small Business Certification Program will be the SBA’s primary vehicle to certify VOSBs and SDVOSBs. These certifications are important to enable qualifying businesses to qualify for sole-source and set-aside federal contracts.

One-Year Extension

To smooth the transition, Administrator Guzman also announced that she intends to grant a one-time, one-year extension to current VOSBs the VA’s CVE has verified pursuant to the Vets First Verification Program as of the transfer date on January 1, 2023. The Administrator’s extension will therefore allow veterans an extra year to get recertified under the new SBA system. The extension will allow the SBA to process applications from new entrants into the program and grow the base of certified companies.

The SBA will certify those companies the VA CVE has verified before January 1, 2023, for the remainder of the firm’s eligibale verification period. New applicants the SBA certifies after January 1, 2023, will be certified for the standard three-year period.

Additional Grace Period for Self-Certified SDVOSBs

Along with the recertification extension, the 2021 National Defense Authorization Act grants a one-year certification grace period until January 1, 2024 for self-certified SDVOSBs. During the grace period, businesses have up to one year to file an application for SDVOSB certification. In the meantime, self-certified SDVOSBs may continue to rely on their self-certification to compete for non-VA SDVOSB set-asides. Self-certified SDVOSBs that apply before the expiration of the one-year grace period will maintain eligibility until the SBA makes a final eligibility decision.

Beginning January 1, 2024, both VOSB and SDVOSB owners will need to be certified to compete for federal contract set-asides, unless an application from a self-certified firm is pending an SBA decision.

Thursday, December 1, 2022: U.S. HHS Published a “Bulletin” Reminding HIPAA-Covered Entities & Business Associates of Limits to Use of Online Tracking Technologies

A regulated entity’s failure to comply with the HIPAA Rules may result in a civil money penalty. “Bulletins” do not have the binding force and effect of law. Rather, they are a tool OCR uses to report its interpretation of statutes HHS enforces.

Tracking technologies are used to collect and analyze information about how users interact with the regulated entities’ websites or mobile applications (“apps”). HIPAA’s Rules apply when the information that regulated entities collect through tracking technologies or disclose to tracking technology vendors includes protected health information (PHI).

“Regulated entities are not permitted to use tracking technologies in a manner that would result in impermissible disclosures of PHI to tracking technology vendors or any other violations of the HIPAA Rules, the Bulletin warns.

This Bulletin contains a general overview of how the HIPAA Rules apply to regulated entities’ use of tracking technologies.

“… [B]ecause of the proliferation of tracking technologies collecting sensitive information, now more than ever, it is critical for regulated entities to ensure that they disclose PHI only as expressly permitted or required by the HIPAA Privacy Rule,” the Bulletin cautions.

Most Employers Not Covered by HIPAA

HIPAA generally does not apply to employee health information an employer maintains. Rather, HIPAA applies only to “covered entities” and specified “business associates” of covered entities. HHS has defined both terms at 45 CFR 160.103. “Covered entities” include (1) health plans, (2) healthcare clearinghouses, and (3) healthcare providers that electronically transmit certain health information. Tracking technology vendors are “business associates” if they create, receive, maintain, or transmit protected health information (PHI) on behalf of a regulated entity for a covered function or provide certain services to or for a regulated entity that involve the disclosure of PHI.

HIPPA does not apply to employers which do not fall within the above categories. Moreover, HIPPA does not apply to health information employers acquire in their roles as employers (i.e., employment records). However, note that covered entities are prohibited from disclosing protected health information to an employer – including human resources or management – without the employee’s authorization or as otherwise allowed by law.

Nevertheless, employers should keep in mind that they have some privacy obligations under the Americans With Disabilities Act and the Genetic Information Nondiscrimination Act.

Friday, December 9, 2022: In Another RFRA Case, the Eighth Circuit Barred, Nationwide, HHS/EEOC Enforcement of ACA Interpretations on Gender-Confirmation Surgery/Care

A coalition of entities affiliated with the Catholic Church challenged the implementation of Section 1557 of ACA. The coalition asserted that the U.S. Department of Health and Human Services’ (HHS’) and the Equal Employment Opportunity Commission’s (EEOC’s) interpretions of Section 1557 requiring coalition Members to perform and provide insurance coverage for gender-affirming care violated the RFRA. This decision is the latest in a series of federal court actions in which companies continue to test the boundaries of the U.S. Supreme Court’s ruling in Bostock v. Clayton County, 140 S. Ct. 1731 (2020).

In its 40-page opinion, the Eighth Circuit panel pared down the U.S. District Court’s Order imposing injunctive relief on the two federal agencies to the extent the lower Court’s Order recognized the standing of the Catholic Benefits Association (CBA) to represent unnamed Members. Rather, the appellate court ruled that the CBA lacked standing to sue on behalf of unnamed Members.

We previously reported, in late August 2022, that the U.S. Court of Appeals for the Fifth Circuit ruled in favor of a religious healthcare organization on similar RFRA claims. The Eighth Circuit relied heavily on that decision – Franciscan All., Inc. v. Becerra, 47 F.4th 368 (2022) – for its holdings.

Tuesday, December 13, 2022: U.S. NLRB Expanded Financial Remedies for Workers in Unfair Labor Practices Cases

The Board’s traditional remedy for unlawful layoffs or terminations requires that employees be reinstated to their previous or substantially equivalent positions and be “made whole” for their loss of earnings and benefits, along with the search-for-work and interim employment expenses they incurred because of the employer’s prior unlawful conduct which initially led to the employee’s loss of employment.

In the new 3-2 decision, the NLRB majority ruled that employers must also compensate workers for all “direct or foreseeable pecuniary harm,” including credit card debt interest and out-of-pocket medical expenses.

What makes this holding unusual is that courts traditionally view unlawful terminations, including those violative of federal statutes, as essentially breach of contract cases. Recompense for “direct or foreseeable” pecuniary harm, rather, is typically a tort remedy. (”Torts” are a cause of action for negligence…for a violation of the usual standard of care the community expects in such circumstances: for example, running a red light, hitting cars and/or persons in an intersection and causing injury to people and/or property).

How We Got Here

In September 2021, we reported that the Biden Administration’s “NLRB General Counsel Issued a Memo Instructing Staff to Expand Financial Remedies in Enforcement Actions Under the NLRA, Including “Consequential” Damages.” For that report, we provided a breakdown of “consequential damages” and connected the dots to the Protecting the Right to Organize Act (PRO Act (H.R. 842)). Among other provisions, the PRO Act would impose additional potential financial penalties as a result of any ULP, such as civil penalties, liquidated damages, and the availability of punitive damages, consequential damages, and attorney’s fees payable in any civil action the Act would permit an employee to file should the NLRB decline to prosecute the employee’s claim.

The House of Representatives passed the PRO Act on March 9, 2021, by a 225-206 largely party-line vote, but the bill has been stalled in the Senate Health, Education, Labor, and Pensions Committee since March 11, 2021. “Consequential damages” refers to damages suffered indirectly, or only as a foreseeable and inevitable consequence of an event or incident.

A few months later, in November 2021, the NLRB unanimously agreed to issue a notice and invitation seeking input in the Thryv, Inc. case, which was then pending before the board. At the time, the Board sought input on whether it should expand its traditional make-whole remedy for discriminated employees to include monies lost for “consequential damages.” (See our story here.)

Because the PRO Act has not passed into law and will die when this 117th Congress adjourns on Wednesday, December 21, 2022 as currently scheduled, many employers the NLRB seeks to sock with damages demands to compensate “direct or foreseeable pecuniary harm” can be expected to challenge them as lacking a proper delegation of authority from the Congress to the NLRB.

NLRB Majority Abandoned the Term “Consequential Damages”

In an effort to help salvage this new form of compensation demand from the “lack of delegation of authority” attack that can be expected from employers, the Board majority decided to provide some separation from the failed PRO Act’s remedies by not using the PRO Act’s term “consequential damages.” To set up a Board argument that it was not adopting the failed PRO Act’s terminology authorizing the NLRB to pursue expanded authority, the Board wrote that “consequential damages” is “a term of art used to refer to a specific type of legal damages awarded in other areas of the law and fails to accurately describe the “make-whole remedial policy” provided for in the present ruling.”

Rather, the Board now asserts that it had this remedial power all along and in fact that power has been rooted in the National Labor Relations Act’s Section 10(c) mandate (presumably just discovered now after the last almost 90 years Section 10(c) remedies have been available) to “translat[e] into concreteness the purpose of safeguarding and encouraging the right of self-organization,” rather than common law tort [i.e. personal injury] or contract remedies, the majority explained.

Expanded Remedy Applicable to All New & Pending Cases

The Board majority also ruled that it will apply this expanded remedy in every case in which the NLRB’s standard remedy would include make-whole relief for employees. “We decline to treat today’s remedy as ‘extraordinary relief,’ to be issued only in the most egregious cases,” they wrote. Moreover, the Board will apply this remedy retroactively to all cases currently pending, the majority noted both in its decision and accompanying press release.

Dissenting Members Concerned Standard Will Infringe Employers Jury Trial Rights & Lead to Protracted Litigation

Fellow Democrats Gwynne A. Wilcox and David M. Prouty joined Board Chairman Lauren M. McFerran’s majority ruling. Republican Board Members Marvin E. Kaplan and John F. Ring dissented in part, objecting to the majority’s decision to adopt a “direct or foreseeable pecuniary harms” standard. In their view, “[t]his standard opens the door to awards of speculative damages that go beyond the Board’s remedial authority.” While they agreed with the majority that employees should be made whole for monetary losses that are a “direct” result of a ULP, they did not agree that all “foreseeable” losses indirectly caused by a ULP are compensable in an NLRB proceeding, regardless of how many steps removed those losses are from the ULP in the chain of causation.

Emphasizing that foreseeability is a core concept of tort law, the dissenters asserted that the majority’s broadened standard could violate employers’ Seventh Amendment constitutional right to a jury trial. Further, the application of this expanded standard will “invite protracted litigation” which will delay “[c]ompliance with make-whole orders awarding monies to which employees are indisputably entitled,” the dissenters feared.

[Note: Member John F. Ring’s tenure on the Board expired on Friday, December 16.]

Wednesday, December 14, 2022: U.S. NLRB Modified the Appropriate Bargaining Unit Standard

The Board Returned to the Union-Friendly Obama-Era Rule

The Board offered no explanation for the differential quantum of proof it felt allowed a union to have to prove less than the respondent employer when the two joust over the appropriate size of any proposed bargaining unit.

How We Got Here

In December of last year, we reported that the NLRB issued a notice seeking feedback on whether it should reconsider its standard to determine if a petitioned-for bargaining unit is appropriate. This new 3-2 decision returns the Board to its prior test governing such determinations. The Board had set forth that prior test in the Obama Administration in Specialty Healthcare & Rehabilitation Center of Mobile, 357 NLRB 934 (2011). The Trump NLRB then overruled Specialty Healthcare in PCC Structurals, 365 NLRB No. 160 (2017), and in The Boeing Co., 368 NLRB No. 67 (2019).

Ordinarily, unions get the first “bite at the apple” to draw the footprint of a proposed bargaining unit when they petition the NLRB to hold an election among a group of employees who assertedly share a “community of interest.” Employers, however, may rebut the proposed makeup of the bargaining unit by countering that the union proposal leaves out employees who should belong in the unit and those who should not. Such circumstances tend to occur when a union petitions for an election among only a small segment of employees the union perceives to be “pro-union” within a factory or other large industrial establishment. Employers sometimes call these “micro-units” allowing only the pro-union employees of a larger affinity group of employees to unionize in an election the union will win by design.

NLRB Chair Said Ruling Allows Employees “Full Freedom of Association”

“The Board’s task in assessing the appropriateness of bargaining units is to ensure that workers enjoy—in the words of the National Labor Relations Act—‘full freedom of association,’” commented Chairman Lauren McFerran in a press release. “Returning to the Specialty Healthcare standard is consistent with this principle, ensuring that workers have the ability to organize in the unit of their choosing, so long as it is not arbitrary or irrational.”

Dissent Urged Application of Trump-Era “Traditional Test”

The Board majority consisted of Chairman Lauren M. McFerran and Members Gwynne A. Wilcox and David M. Prouty (all Democrats). Board Members Marvin E. Kaplan and John F. Ring (both Republicans) dissented arguing that the Board should use the Trump-era “traditional test” for unit determination. That test had three parts: (1) the proposed unit must share an internal community of interest; (2) the interests of those within the proposed unit and the shared and distinct interests of those excluded from that unit must be comparatively analyzed and weighed; and (3) consideration must be given to the NLRB’s decisions on appropriate units in the particular industry involved.

The restored Obama-era standard in Specialty Healthcare allows unions too much power over bargaining unit makeup, the dissenters wrote. “Under this framework, the question of whether the interests of excluded employees are truly distinct from those of employees in the proposed unit is at best a secondary consideration,” the dissenting members said. “[T]he similarity of excluded employees’ interests with those of included employees is simply disregarded unless the interests of included and excluded employees ‘overlap almost completely,’” they added.

Thursday, December 15, 2022: Washington State Finalizes Regulations Related to New Pay Transparency Law

As the effective date soon approaches, Washington’s Department of Labor & Industries issued final administrative guidelines on November 30th to assist employers to comply with the new requirements under the law. The Department had previously issued draft administrative guidance in August 2022 seeking comments from the general public. The new, final guidance provides some especially important clarifications for employers as to the salary transparency requirements:

- The guidance confirms that the salary transparency requirements in applicable job postings apply to all employers with 15 or more employees. A business is a covered “employer” under the law if it (a) engages in business in the state of Washington (in other words, the business does not have to have a physical location in the state of Washington), and (b) has at least 15 total employees regardless of where they are located (so long as at least one employee works in Washington state).

- Covered employers must include the following information in a job posting when that posting includes qualifications for desired applicants of a specific position (in other words, job ads that do not include qualification requirements do not need to contain pay transparency [examples are provided in the guideline]):

- a wage scale or salary range that the employer reasonably and genuinely expects the range of compensation to be for the job (from lowest rate to highest rate; for commission-based positions, this can be the commission rate range);

- a general description of all benefits an employer must report for federal tax purposes, including health care, retirement, and paid time off that is more generous than statutorily required; and

- a general description of other compensation, such as discretionary bonuses, commissions, profit sharing, and stock options that are in addition to the position’s salary or wage range. A covered employer may use a hyperlink or web address to lead applicants to descriptions of benefits and other compensation information.

- Covered employers must provide the pay transparency information for postings for remote work that a Washington state-based employee can perform. Like the Colorado pay transparency law, the new Washington state regulations purport to prohibit employers from avoiding the pay transparency requirement by stating in the posting for remote work that the employer will not consider Washington state applicants.

- Whether the State of Washington, or any state, can export its legal requirements extra-territorially and cast them into other states across the United States, is an open legal question. However, it is highly unlikely. [For example, let us assume Colorado attempted to trump Texas law, and Texas attempted to trump Washington law, and Florida attempted to trump Colorado and Washington law, etc. You can see the quickly developing cacophony of different rule sets that would bring anarchy to business relations for companies operating across states lines as they tried in vain to determine which rule applies and which conflicting laws to disobey?]

- Exceptions to the pay transparency law include situations in which the employer is using a printed hard copy posting that is made and distributed entirely outside the state of Washington. Additionally, employers do not need to disclose pay transparency information for jobs a worker will perform entirely outside of Washington state, even if the posting reaches applicants who would fill the position as a Washington-based employee. This exception applies to jobs tied to physical worksites located entirely outside of Washington state (for example, a posting for a job at a facility just across the border in Idaho, even though people from Washington may get the job and commute to the Idaho location).

Failure to comply with the law can result in actual or civil damages, civil penalties, and recompense to the aggrieved party for costs, attorney’s fees, and other equitable relief for bringing suit. DE Members interested to learn more about state transparency laws may go to DE Connect to access the PowerPoints and extensive spreadsheets summarizing the state transparency laws Jay Wang, Esq. of Fox, Wang & Morgan P.C. prepared for these three webinars DE recently conducted discussing all three different types of state transparency laws.

Thursday, December 15, 2022: U.S. NLRB Reaffirmed Limits on Employers’ Questioning of Workers for ULP Investigations

How We Got Here

In Johnnie’s Poultry Co, 146 NLRB 770 (1964), enf. denied 344 F.2d 617 (8th Cir. 1965), the Board set down procedural safeguards employers must follow when interviewing employees to prepare the company’s defense to a ULP charge. Those safeguards are: (1) the employer must communicate to the employee the purpose of the questioning, assure the employee that no reprisal will take place, and obtain the employee’s participation on a voluntary basis; (2) the questioning must occur in a context free from employer hostility to union organization and must not itself be coercive in nature; and (3) the questions must not exceed the necessities of the legitimate purpose by prying into other union matters, eliciting information concerning an employee’s subjective state of mind, or otherwise interfering with the statutory rights of employees.

We reported in March 2021 that the Board voted 3-1, to invite briefs addressing whether the NLRB should adhere to or overrule Johnnie’s Poultry.

Majority Asserted Standard Properly Balances Employer Interest & Employee Rights

In Thursday’s Sunbelt Rentals decision, the Board majority concluded that the safeguards adopted in Johnnie’s Poultry properly balanced employers’ legitimate needs to defend against ULP charges with protecting employee rights under the NLRA.

“Because of the strong possibility of coercion in an employer interview about unfair labor practice issues, employees need protection,” NLRB Chairman Lauren M. McFerran stated in a press release. “This familiar, bright-line test is easy for employers to comply with and brings certainty to the administration of the Act.”

Per the usual, Democrat Board Members Gwynne A. Wilcox and David M. Prouty joined Chairman McFerran in the majority ruling.

Dissent Advocated Rebuttable Presumption Standard

Republican Board Members Marvin E. Kaplan and John F. Ring dissented. First, they explained that any employer questioning which fails to observe all the applicable safeguards without exception is unlawful per se under the Johnnie’s Poultry standard. Several federal circuit courts of appeals have rejected this per se standard, however, and have denied enforcement of those decisions applying it, including the Eighth Circuit Court of Appeals in the Johnnie’s Poultry case itself. Those courts concluded that the NLRB lacked the statutory authority to hold that noncompliance with Board-created safeguards or standards is a per se violation of the NLRA when those standards go beyond the prohibitions established.

Kaplan and Ring argued that the Board should instead adopt a “rebuttable presumption” standard. Under that standard, unlawful coercion would be rebuttably presumed when an employer fails to comply with the Johnnie’s Poultry safeguards. The employer would then have the burden to rebut the presumption by showing that its questioning was not coercive under the totality of the circumstances.

“This standard respects judicial guidance about the limits of the Board’s authority, preserves all the benefits of Johnnie’s Poultry, and at the same time ensures that proper consideration is given to evidence that questioning was not coercive even though not all the Johnnie’s Poultry safeguards were observed,” the dissenting Republican Board Members wrote.

Thursday, December 15, 2022: U.S. DOL & U.S. IRS Renewed Coordinated Enforcement Agreement

Agreement Allows the U.S. DOL to “Drop a Dime” on Employers that Have Misclassified Workers as “Independent Contractors” instead of “Employees”

The two agencies first entered into an MOU in 2021 to enable them to use their resources to promote employer compliance with obligations to pay employees and related employment taxes. Since that time, the WHD and IRS have shared information when an investigation discovered that an employer had misclassified employees, the press release noted.

What Does This Mean for Employers?

The new provisions of this updated MOU will add to the costs of misclassification because the IRS will now be better positioned to: (1) seek payroll taxes and late payment penalties; and (2) seek financial penalties for the employer’s failure to withhold income taxes the employee owes. Furthermore, the WHD and IRS collaboration could lead further to employer misclassification costs because the employer stands potentially secondarily liable for the employee’s income taxes (the substantive taxes) if the employer did not withhold and the former independent contractor (now recharacterized after-the-fact as an “employee”) did not pay his/her taxes and cannot/will not.

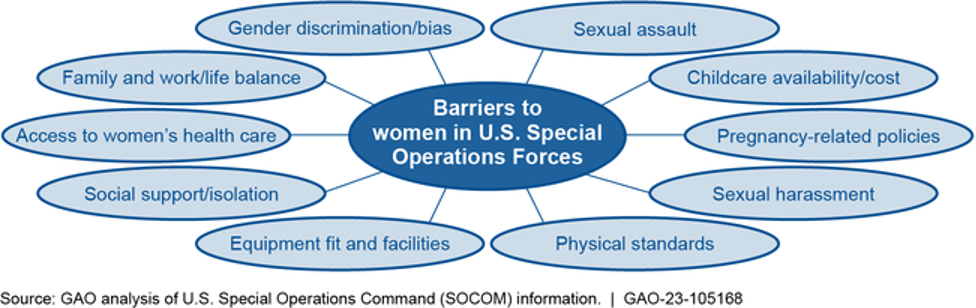

Thursday, December 15, 2022: U.S. GAO Found Special Operations Command May Not Have Needed Information to Assess Barriers to Women’s Careers

Policy Inconsistencies Between Defense Department & Various Military Services Also A Concern

How GAO Got Here

Unidentified “Congressional Requesters” commissioned the 169-page Report, asking GAO to review the incidence of gender discrimination, sexual harassment, and sexual assault, as well as the Department of Defense’s (DOD) efforts to assess potential barriers that may affect women’s careers in U.S. Special Operations Forces (SOF). Women make up less than 10 percent of SOCOM service members, compared with about 19 percent of DOD-wide service members. For the Report, the GAO reviewed policies; interviewed DOD, SOCOM, and service officials; interviewed officials at five SOF headquarters installations; and interviewed 51 women currently or formerly serving in SOF.

Comprehensive Evaluation of Barriers Lacking, Collaborative Process Needed

SOCOM has taken some steps to identify and address barriers, such as gender discrimination and pregnancy-related policies, which may affect women’s careers in U.S. Special Operations Forces.

SOCOM-Identified Barriers to Women Serving in U.S. Special Operations Forces

However, the DOD has yet to complete a comprehensive evaluation of barriers to women or develop a plan of action for addressing identified barriers, the GAO observed. In addition, per a 2016 DOD requirement, SOCOM and the military departments are supposed to conduct annual assessments on the full integration of women into previously closed positions. But the DOD has not communicated which office has oversight responsibility for the assessments and their intended use is unclear, the GAO found. Without taking action to address these issues, DOD and Congress may be limited in their efforts to understand and address barriers to women in SOF, the GAO said.

While SOCOM has started to address its data access limitations, the DOD has not established a collaborative process to ensure SOCOM has access to data maintained in various Office of the Secretary of Defense and military service databases, the GAO found. Without such a process to facilitate SOCOM’s access to needed data, SOCOM leadership will not be positioned to identify trends or address urgent concerns, the GAO pointed out.

GAO Also Found Policy Inconsistencies

The DOD policies on gender discrimination, sexual harassment, and sexual assault are applicable department-wide, the GAO explained. The various military services, not SOCOM, are responsible for administering service-specific policies on these types of incidents. While SOCOM service members conduct missions in a multi-service environment, some of the services’ policies related to incidents of gender discrimination and sexual harassment occurring in joint environments are not aligned with DOD policies. Specifically, DOD policies state, in joint environments, discrimination and harassment complaints should be processed through the complainant’s service. However, Army, Marine Corps, and Air Force policies all assign this responsibility to the alleged offender’s service. Without the military services revising their policies for joint environments to help ensure alignment with DOD policies, such cases may be processed inconsistently across DOD, the GAO pointed out.

Recommendations

To address these issues, the GAO made eight recommendations, with which the DOD concurred. The recommendations include that: (1) the military services revise their policies for incidents in joint environments to align with DOD policy; (2) DOD establish a collaborative process for SOCOM to access data; (3) DOD clarify oversight and use of the annual assessments; and (4) DOD complete a comprehensive analysis of barriers to women in SOF. The GAO also made specific recommendations to the Department of Army, Department of Navy, and Department of Air Force. More details on all eight recommendations are here.

Thursday, December 15, 2022: U.S. GAO Interim Report Found Gender Pay Gap Varies by Education Levels, Race & Ethnicity

GAO Plans to Issue More Detailed Report in Spring 2023

“This report is descriptive, and it neither confirms nor refutes the presence of discriminatory practices,” the GAO cautioned. Moreover, it examined overall pay gaps, rather than comparisons of the same jobs. The Report examined: (1) the representation of women, and the difference in pay between women and men in the overall workforce; and (2) how pay differences between women and men in the overall workforce vary based on race and ethnicity and level of education.

Highlights of the 14-page Report’s findings include that, in 2021:

- Women made up an estimated 44 percent of the overall workforce, but an estimated 41 percent of managers.

- Women earned an estimated 82 cents for every dollar that men earned (an overall pay gap of 18 cents on the dollar).

- Compared to the overall pay gap, the gender pay gap was greater for full-time female managers, who earned an estimated 77 cents for every dollar earned by full-time male managers (a pay gap of 23 cents on the dollar).

- The gender pay gap was also greater for women in certain sectors. For example, among workers who were self-employed in their own incorporated business, women earned an estimated 69 cents for every dollar earned by men (a pay gap of 31 cents on the dollar). In private, for-profit companies, women earned an estimated 78 cents for every dollar earned by men (a pay gap of 22 cents on the dollar). In government agencies and non-profit organizations, women earned an estimated 85 cents for every dollar earned by men (a pay gap of 15 cents on the dollar).

- Compared to pay for White men, the pay gap was greater for women in most historically underserved racial and ethnic groups than for White women. For example, for every dollar earned by White men, Hispanic or Latina women earned an estimated 58 cents (a pay gap of 42 cents on the dollar), and Black or African American women earned an estimated 63 cents (a pay gap of 37 cents on the dollar), while White women earned an estimated 79 cents (a pay gap of 21 cents on the dollar).

- The gender pay gap also varied by level of education. For example, among workers—including both full-time and part-time workers—with less than a high school diploma, women earned an estimated 66 cents for every dollar earned by men (a pay gap of 34 cents on the dollar). Among workers with a bachelor’s degree, women earned an estimated 70 cents for every dollar earned by men (a pay gap of 30 cents on the dollar).

More Detailed Report on the Way Next Spring

Congresswomen Carolyn B. Maloney (D-NY) and Debbie Dingell (D-MI) requested the report. Representative Maloney is currently the Chair of the House Committee on Oversight and Reform. Noting that this was an interim report, the GAO stated it plans to issue a more detailed report in spring 2023.

Friday, December 16, 2022: NLRB Overturns Another Trump Era Rule, Reinstating Broader Access to Property for Contract Workers Staging Labor Protests

This time, the NLRB issued a 3-2 decision reinstating the prior NLRB rule allowing off-duty employees of an onsite contractor who regularly work on an employer’s property to engage in onsite labor protests unless it “significantly interferes with the use of the property or where exclusion is justified by another legitimate business reason.” The Trump NLRB had altered the rule to allow property owners to bar contract workers from labor protests on the property unless they worked regularly and exclusively on the property, and the protestors did not have a “reasonable, non-trespassory alternative” to communicate their message. As a result of the decision on Friday, the NLRB found that the Bexar County Performing Arts Center Foundation violated the NLRA by stopping contract musicians from distributing leaflets outside of the facility.

The decision on Friday re-adopts the rule from the NLRB’s decision in New York, New York Hotel & Casino, 356 NLRB 907 (2011). That decision, which addressed situations where a property owner sought to exclude off-duty employees of a contractor from non-working areas open to the public, weighted the respective interests between property owners and workers advocating for unionization. In balancing between the two, the NLRB in 2011 found that communications directed toward the public or customers was entitled to the same protections as communications aimed at fellow workers. As such, providing workers access to property grounds provided the necessary protection for advancing protected speech.

In its decision, the NLRB stressed the importance of such protection and noted the importance of employees seeing and interacting with each other where they provide their labor. The property site where work is performed is “well suited to discuss working conditions.” As such, the re-adopted rule was a proper accommodation between the right of those who are not strangers or outsiders to the property to engage in labor activities, and the property owner’s private property rights.

With the re-implementation of the prior rule, employers must once again provide property access for union-organizing activities. Employers should now update their plans used under New York, New York to determine what legitimate business reason exists to limit such activities as necessary.

In Brief

Tuesday, December 13, 2022: President Biden Signed Respect for Marriage Act

The RFMA ensures federal recognition of state-sanctioned same-sex & interracial marriages in the event the U.S. Supreme Court overturns its current precedent on U.S. Constitutional protections. It would also require states to recognize same-sex and interracial marriages from other states via provisions that prohibit the denial of full faith and credit or any right or claim relating to out-of-state marriages on the basis of sex, race, ethnicity, or national origin. We detailed the provisions of the RFMA – including what the law does and does not do – in last week’s edition of the WIR.

Looking Ahead:

Upcoming Date Reminders

Wednesday, December 21, 2022 [this week!]: Deadline to submit reply comments in response to initial comments on NLRB’s NPRM to Determine Joint Employer Status (previous November 21 deadline extended) – https://www.regulations.gov/docket/NLRB-2022-0001

Sunday, January 1, 2023: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.15 per hour, and the minimum cash wage for tipped employees increases to $8.50 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20905/minimum-wage-for-federal-contracts-covered-by-executive-order-13658-notice-of-rate-change-in-effect

Sunday, January 1, 2023: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $16.20 per hour, and the minimum cash wage for tipped employees increases to $13.75 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20906/minimum-wage-for-federal-contracts-covered-by-executive-order-14026-notice-of-rate-change-in-effect

Monday, January 9, 2023: Comments due on US EEOC proposal to eliminate counting employees to determine filing “type” for EEO-1 Survey Component 1 – https://www.regulations.gov/document/EEOC-2022-0005-0001

Tuesday, January 17, 2023: Comments due on OFCCP’s Proposed Changes to Disability Self-Identification Form to Update Preferred Language for Specific Disabilities – https://www.regulations.gov/commenton/OFCCP-2022-0003-0004

Friday, January 20, 2023: Deadline to submit comments on OFCCP’s Proposed Changes to Its Supply & Service Contractor ICRs, Including Use of Portal to Submit Revised Scheduling Letter & Revised Itemized Listing Responses – https://www.regulations.gov/commenton/OFCCP-2022-0004-0001

Thursday, February 2, 2022: Deadline to submit initial comments on NLRB’s proposed changes to NLRA regulations (previous January 3 deadline extended) – https://www.regulations.gov/commenton/NLRB-2022-0002-0001

Thursday, February 16, 2022: Deadline to submit reply comments in response to initial comments on NLRB’s proposed changes to NLRA regulations (previous January 17 deadline extended) – https://www.regulations.gov/commenton/NLRB-2022-0002-0001

Wednesday, April 12 – Friday, April 14, 2023: DEAMcon23 Chicago (Registrations open now; Agenda now available here!)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.