The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee J. Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

- US DOL Launching “Comprehensive Review” of Subminimum Wage Program, Assistant Secretary for ODEP Announced

- Federal Court Granted Motion to Pause Litigation Based on NLRB’s Plan to Issue Final Joint Employer Rule by October’s End

- U.S GAO Found Federal Agencies Deficient in Monitoring Federal Contractor E-Verify Compliance

- JOLTS Report – Job Openings Increased by 690k in August, Rate Increased to 5.8%

- FAR Council Issued Regulations to Enhance Whistleblower Protections for Federal Contractor Employees

- Economy Added 336k Jobs in September, Unemployment Rate Remained Steady at 3.8%

- California Governor Newsom Vetoed Bill That Would Have Explicitly Banned Caste Discrimination

- In Brief

- New Publications

- Looking Ahead: Upcoming Date Reminders

Thursday, September 28, 2023: US DOL Launching “Comprehensive Review” of Subminimum Wage Program, Assistant Secretary for ODEP Announced

Assistant Secretary Williams added:

“As part of this effort, we want to hear from all of you – and especially individuals with disabilities – about your experiences with the 14(c) program, and what changes are needed to expand equitable employment opportunities for people with disabilities. In the coming weeks[,] we will be engaging with key organizations, stakeholders, and impacted workers directly on these important issues.”

In April, Assistant Secretary Williams told the audience at DEAMcon23 that ODEP is “very much focused on advancing competitive integrated employment.” She continued:

“This is an issue where the President has been clear and very explicit that he wants to phase out [the] subminimum wage. We work very closely with our colleagues within the Department of Labor and our Wage and Hour Division but also with national and local providers all across the country to ensure that we’re providing support to help individuals transition from subminimum wage into competitive integrated employment.”

For more background on the Section 14(c) program, see our previous stories here, here, and here.

Monday, October 2, 2023: Federal Court Granted Motion to Pause Litigation Based on NLRB’s Plan to Issue Final Joint Employer Rule by October’s End

How We Got Here

On September 7, 2022, the NLRB published its Notice of Proposed Rulemaking (“NPRM”) regarding when one company qualifies as a “joint employer” with another company(ies) pursuant to the NLRA. After an extension, the period for initial comments and reply comments ended on December 21, 2022, with approximately 12,945 comments submitted. The Spring 2023 Regulatory Agenda listed August 2023 as the target date for publication of this Final Rule.

We discussed both the NPRM, the above-referenced litigation, and the convoluted recent history of the NLRB’s effort to issue a Joint Employer Rule in our story here.

Tuesday, October 3, 2023: U.S GAO Found Federal Agencies Deficient in Monitoring Federal Contractor E-Verify Compliance

More monitoring of federal contactor use of E-Verify coming: Be ready

The 58-page Report contained three key findings:

- The Federal Acquisition Regulation (“FAR”) requires agencies to include, with certain exceptions, a contract clause directing contractors to enroll in and use the program. The Departments of Defense (“DOD”), Homeland Security (“DHS”), and Health and Human Services (“HHS”) included the clause in 22 of the 24 contracts that the GAO reviewed. The GAO focused on these three agencies for its Report because they accounted for nearly two-thirds of the fiscal year 2021 contract awards that appeared subject to the E-Verify clause, the most recent data available at the time of the GAO’s review. The GAO reviewed fiscal years 2019–2021 contract data, assessed a nongeneralizable sample of 24 contracts, and analyzed data on contractor E-Verify enrollment.

- While the White House Office of Management and Budget (“OMB”) expects federal agencies to ensure that their contractors meet these requirements, not all agency officials knew of this expectation, according to the GAO. The OMB has not clearly communicated this expectation to agencies, the GAO concluded.

- USCIS, a component of DHS, administers E-Verify. The agency may terminate E-Verify accounts, including those of federal contractors, for misuse and non-use. From 2020 to March 2023, USCIS terminated almost 300 contractor accounts for misuse and more than 5,000 such accounts for non-use, but USCIS recently paused terminating accounts for non-use. Notably, USCIS does not have a process to refer federal contractors whose E-Verify accounts it has terminated to agency suspension and debarment officials. Consequently, these officials are not able to determine whether these federal contractors’ misuse or non-use of E-Verify merits further action. DHS officials said they plan to address this deficiency, but these plans are in the early stages.

The GAO made a total of eight recommendations (pages 33-34 of the Report): one for the DOD, one for HHS, two for DHS, two for OMB, and two for USCIS. Among the recommendations, GAO suggested that the OMB clarify agency responsibilities to monitor contractor compliance with the E-Verify clause and that DHS implement a process to refer contractors with terminated accounts to appropriate agency officials.

Tuesday, October 3, 2023: JOLTS Report – Job Openings Increased by 690k in August, Rate Increased to 5.8%

Signs of a buoyant economy…Not what the Federal Reserve wanted to hear

As the Federal Reserve Board tries to stifle again rising inflation by raising interest rates in an effort to dampen employment growth, it now finds itself in conflict with the Biden Administration’s legislative achievements to increase employment. The 2021 “Build Back Better Act,” supporting 2.3 million jobs per year for five years, and the “Bipartisan Infrastructure and Jobs Bill” pumping over a Trillion Dollars into jobs and materials this year and for the next several years, is this Administration’s plan to reduce the unemployment numbers in the U.S.

In August, job openings increased in professional and business services (+509,000), finance and insurance (+96,000), state and local government education (+76,000), nondurable goods manufacturing (+59,000), and the federal government (+31,000).

Hires, Total Separations, Quits & Other Separations Up, Layoffs/Discharges Down Slightly

The number of hires in August was 5,857,000 compared to the adjusted 5,822,000 number for July (+35,000). The rate held steady at 3.7 percent. The number of hires changed little in all industries.

Total separations were 5,676,000 for August, compared to 5,638,000 for July (+38,000). The rate held steady at 3.6 percent. Over the month, the number of total separations increased in accommodation and food services (+105,000) but decreased in information (-41,000) and the federal government (-8,000).

Within separations, quits in August were 3,638,000 up a bit from 3,619,000 in July (+19,000). The rate held steady at 2.3 percent. The number of quits increased in accommodation and food services (+88,000); finance and insurance (+28,000); state and local government, excluding education (+21,000); and arts, entertainment, and recreation (+18,000). The number of quits decreased in information services (-30,000).

Layoffs and discharges in August were 1,680,000, down a smidge from 1,681,000 in July (-1,000). The percentage rate remained steady at 1.1. The number of layoffs and discharges decreased in state and local government, excluding education (-39,000), but increased in state and local government education (+27,000).

The number of other separations was 357,000 in August, an increase from 338,000 in July (+19.000) The percentage rate remained steady at 0.2.

BLS posted interactive graphs here.

Three-Month Comparison Chart of Job Openings vs. Jobs Filled

Our below table reports the number of available jobs (as taken from the revised JOLTS reports) from the last four months of available data, as revised.

| Reports | May | June | July | August |

| JOLTS available jobs | 9,616,000 | 9,165,000 | 8,920,000 | 9,610,000 |

| Prior/mo. comparison | (704,000 < April*) | (451,000 < May) | (245,000 < June) | (690,000 > July) |

*April Job Openings were 10,320,000

Note: BLS is scheduled to release the JOLTS Report for September 2023 on Wednesday, November 1, 2023

Thursday, October 5, 2023: FAR Council Issued Regulations to Enhance Whistleblower Protections for Federal Contractor Employees

What Does this New Rule Provide?

The Final Rule makes permanent the protection for disclosing to specified entities information that the employee reasonably believes is:

(i) Evidence of gross mismanagement of a federal contract;

(ii) A gross waste of Federal funds;

(iii) An abuse of authority relating to a federal contract;

(iv) A substantial and specific danger to public health or safety; or

(v) A violation of law, rule, or regulation related to a federal contract (including the competition for or negotiation of a contract).

Retaliation is prohibited even if it is undertaken at the request of an executive branch official, unless the request takes the form of a non-discretionary directive and is within the authority of the executive branch official making the request.

Federal contractor employee disclosures are protected if made to the following entities:

- A Member of Congress or a representative of a committee of Congress.

- An Inspector General.

- The Government Accountability Office.

- A Federal employee responsible for contract oversight or management at the relevant agency.

- An authorized official of the Department of Justice or other law enforcement agency.

- A court or grand jury.

- A management official or other employee of the contractor or subcontractor who has the responsibility to investigate, discover, or address misconduct.

In addition, an employee who initiates or provides evidence of contractor or subcontractor misconduct in any judicial or administrative proceeding relating to waste, fraud, or abuse on a Federal contract shall be deemed to have made a disclosure.

The Final Rule also:

- requires contractors and subcontractors to inform their employees of the whistleblower protections through the inclusion of FAR clause 52.203–17 in acquisitions at or below the SAT.

- clarifies that FAR 31.205–47 prohibition on reimbursement for legal fees accrued in defense against reprisal claims applies to subcontractors, as well as contractors.

- makes permanent a four-year pilot program for the enhancement of contractor protection from reprisal for sharing covered information. This program does not apply to DoD, NASA, or the Coast Guard, which have a separate whistleblower program for contractor employees. Neither program applies to certain elements of the intelligence community.

How We Got Here

On December 26, 2018, the FAR Council agencies published its Notice of the Proposed Rulemaking (“NPRM”) to amend the Federal Acquisition Regulation (“FAR”) to implement a December 2016 statute (Pub. L. 114–261) that enhanced whistleblower protections for federal contractor employees, including employees of subcontractors. The comment period closed on February 25, 2019, with three public comments submitted.

Final Rule Unchanged from Proposed Version

The comments did not recommend changes to the Proposed Rule, the FAR Council reported. Rather, the commenters expressed concerns regarding the underlying intent of the December 2016 statute. Although the FAR Council recognized these concerns, it determined that the public comments were not within the scope of the Rule. Accordingly, the FAR Council made no substantive changes to the Final Rule as a result of the public comments.

Friday, October 6, 2023: Economy Added 336k Jobs in September, Unemployment Rate Remained Steady at 3.8%

While great news for the President, it was not what the Federal Reserve wanted

More interest rate hikes now feared

Recruiters were working hard! Total nonfarm payroll employment increased by 336,000 in September, and the unemployment rate held steady at 3.8 percent, the U.S. Bureau of Labor Statistics (”BLS”) stated in its September 2023 Employment Situation report. Job gains occurred in leisure and hospitality; government; health care; professional, scientific, and technical services; and social assistance.

Both the labor force participation rate, at 62.8 percent, and the employment-population ratio, at 60.4 percent, were unchanged from August to September.

The number of unemployed persons was 6,360,000 in September, up by only 5,000 from the 6,355,000 figure in August. The number of long-term unemployed (those jobless for 27 weeks or more) was 1,216,000 (19.1 percent of the total unemployed), which was down by 80,000 from August’s figure of 1,296,000 (20.3 percent of the total unemployed).

Major Worker Groups

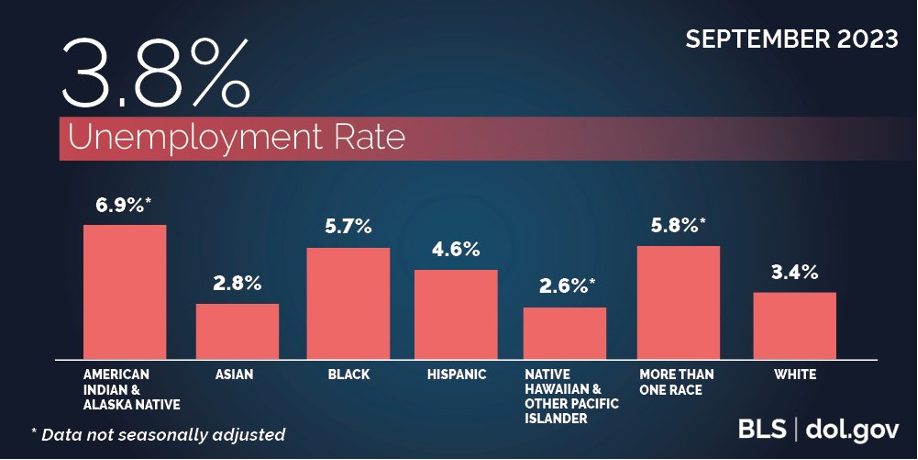

Among the major work groups, the unemployment rates for adult men (3.8 percent), adult women (3.1 percent), teenagers (11.6 percent), Whites (3.4 percent), Blacks (5.7 percent), Asians (2.8 percent), and Hispanics (4.6 percent) showed little or no change in September. However, the unemployment rate for Native Hawaiians or Other Pacific Islanders dropped to 2.6 percent in September compared to 5.7 percent in August. The rate for the Two or More Races category fell to 5.8 percent compared to 6.7 percent in August.

The BLS/DOL charts below illustrate the numbers by race and ethnicity (not seasonally adjusted):

Our table below compares the major worker groups’ numbers from the last three months of available data:

| The Employment Situation – September 2023 | ||||

|---|---|---|---|---|

| Unemployment Rate | July 2023 | August 2023 | September 2023 | Feb 2020 Pre-Pandemic |

| National (Seasonally adjusted) | 3.5% | 3.8% | 3.8% | 3.5% |

| White | 3.1% | 3.4% | 3.4% | 3.0% |

| Black | 5.8% | 5.3% | 5.7% | 6.0% |

| Asian | 2.3% | 3.1% | 2.8% | 2.5% |

| Hispanic (Seasonally adjusted) | 4.4% | 4.9% | 4.6% | 4.4% |

| Native Hawaiians & Other Pacific Islanders | 5.5% | 5.7% | 2.6% | 2.7% |

| Two or More Races (Not seasonally adjusted) | 6.3% | 6.7% | 5.8% | 6.1% |

| Men (20+) | 3.3% | 3.7% | 3.8% | 3.2% |

| Women (20+) (Seasonally adjusted) | 3.1% | 3.2% | 3.1% | 3.1% |

| Veteran (Not seasonally adjusted) | 2.9% | 3.6% | 3.5% | 3.7% |

| Individuals with Disabilities (Not seasonally adjusted) | 6.9% | 7.4% | 7.3% | 7.8% |

New Detailed Data Reporting on Hispanic or Latino Groups

For its August Jobs Report, the BLS began publishing monthly and quarterly labor force data for detailed Asian ethnic groups – Asian Indians, Chinese, Filipinos, Japanese, Koreans, Vietnamese, and Other Asians (see our story here). For its September Jobs Report, the BLS announced that it added monthly and quarterly labor force data for detailed Hispanic or Latino groups – Mexican, Puerto Rican, Cuban, Salvadoran, Other Central American (excludes Salvadoran), South American, Dominican, or Other Hispanic or Latino (excludes Dominican) – to its online database.

See Also:

- BLS has additional, interactive graphs available here.

- President Biden’s remarks

- Acting Secretary of Labor Julie Su’s statement

- White House Counsel of Economic Advisers’ blog

- USDOL video short illustrating the report

Saturday, October 7, 2023: California Governor Newsom Vetoed Bill That Would Have Explicitly Banned Caste Discrimination

“This bill would define ‘ancestry’ for purposes of the Fair Employment and Housing Act, the Unruh Act, and the Education Code to include ‘caste’ and other dimensions of ancestry.

In California, we believe everyone deserves to be treated with dignity and respect, no matter who they are, where they come from, who they love, or where they live. That is why California already prohibits discrimination based on sex, race, color, religion, ancestry, national origin, disability, gender identity, sexual orientation, and other characteristics, and state law specifies that these civil rights protections shall be liberally construed. Because discrimination based on caste is already prohibited under these existing categories, this bill is unnecessary.”

The California legislature sent the bill to the Governor on September 11, 2023. Had Newsom signed it, California would have become the first state in the United States to enact such an explicit ban.

Thus far, two U.S. municipalities have banned caste discrimination. On September 28, 2023, Fresno, California became the second U.S. city to ban caste discrimination after Seattle, Washington banned it on February 21, 2023.

What are Caste Systems?

Caste systems create rigid social hierarchies based on inherited status and often based on notions of purity and contamination. Custom, law, and/or religion may sanction these social barriers. Caste systems can not only impact social and economic opportunities but sometimes also result in abuse and violence between groups. According to a 2016 United Nations Report, they exist worldwide, affecting communities in Asia, Africa, the Middle East, the Pacific region, and also in various diaspora communities.

What Did the Bill Provide?

The bill that Newsom vetoed would have amended “California’s Fair Employment and Housing Act” and two other laws that prohibit discrimination based on sex, race, color, religion, ancestry, national origin, disability, medical condition, genetic information, marital status, sexual orientation, citizenship, primary language, or immigration status. It would have added “caste” to the statute’s definition of “ancestry.”

The legislation would have defined “caste” as “an individual’s perceived position in a system of social stratification on the basis of inherited status.” The bill stated that a system of social stratification based on inherited status “may be characterized by factors that may include, but are not limited to, inability or restricted ability to alter inherited status; socially enforced restrictions on marriage, private and public segregation, and discrimination; and social exclusion on the basis of perceived status.”

Controversy Over the Measure

Opponents of the measure – including the Hindu American Foundation and the Coalition of Hindus of North America – argued that the legislation would stigmatize and target South Asians and Hindus because caste systems have historically been most closely associated with these groups. On October 3, two Republican California state senators – Brian W. Jones (San Diego) and Shannon Grove (Bakersfield) – sent a letter to Governor Newsom urging him to veto the bill. They argued that it would “not only target and racially profile South Asian Californians, but will put other California residents and businesses at risk and jeopardize our state’s innovative edge.”

Proponents of the bill – including Equity Labs, the Californians for Caste Equity Coalition, and the International Commission for Dalit Rights (“ICDR”) (the Dalits in South Asia are a historically marginalized caste) – argued that those from caste-oppressed backgrounds face bullying, harassment, bias, wage theft, sexual harassment, housing discrimination, and hate crimes. The bill’s primary sponsor, Democratic State Senator Aisha Wahab (Fremont), said it was necessary because “[c]aste systems are a social hierarchy that limit human potential, crush spirits, and cause intergenerational trauma spanning centuries.”

Advocacy Group Previously Urged EEOC & DOJ to Interpret Existing U.S. Law as Prohibiting Caste Discrimination

In 2021, the ICDR, on behalf of itself and other groups, sent “policy memorandums” to the U.S. Equal Employment Opportunity Commission and the U.S. Department of Justice arguing that Title VII of the Civil Rights Act of 1964 should be read as prohibiting caste-based discrimination. According to the ICDR, the U.S. Supreme Court’s reasoning in its 2020 decision in Bostock v. Clayton County [140 S. Ct. 1731] ruling applies not only to sex discrimination in employment, but also to other areas of federal law where discrimination is prohibited. Therefore, the ICDR asserted that Title VII covers caste discrimination because it “involves not only discrimination based on descent, but also race and national origin.”

Accordingly, the ICDR urged the EEOC to incorporate this interpretation into “relevant EEOC non-discriminatory guidelines and other EEOC materials.” The advocacy group also requested that the Civil Rights Division of the Justice Department provide “applicable guidance” to the EEOC incorporating this interpretation.

In Brief

Thursday, September 28, 2023: U.S. Office of Personnel Management Expanded Access to Federal Jobs for Military Spouses

Public comments on this Interim Final Rule are due by November 27, 2023, and may be submitted here.

Does your private company or institution have special hiring eligibility rules for Military spouses?

Friday, October 6, 2023: OFCCP Added Twelve FY 2023 Mega Construction Projects to Its Potential Audit Lists

OFCCP added a list of twelve Fiscal Year (“FY”) 2024 Mega Construction Project (“MCP”) Designees to its Scheduling List Resources webpage. In March, we reported that OFCCP had – once again – launched a “Mega Construction Project Program.” Under OFCCP’s latest Mega Construction Project Program, agency officials hope to connect with the General Contractor (“GC”) on MCPs BEFORE the work begins and before the GC’s subcontractors hire up for the job to make sure the subcontractors are aware of their non-discrimination duties by offering “compliance assistance” to the GC and its subcontractors. Such programs to intercede with Construction GCs before the GC hires its subcontractors for major federal construction jobs date back to the Carter Administration.

MCPs are large federal construction projects (currently) valued at $35 million or more. OFCCP’s newly posted list identifies twelve initial MCPs located in twelve different states for its FY 2024 program. In March of this year, OFCCP revealed a list of twelve FY 2023 Mega Construction Project (“MCP”) Designees (see our story here). OFCCP is thus now identifying construction contract targets from 24 different Mega Construction Projects.

For the 12 newly designated FY 2024 Megaprojects, OFCCP partnered with the Department of Transportation, Department of Energy, General Services Administration, and Environmental Protection Agency, the U.S. Department of Labor stated in a press release and an email that OFCCP sent to stakeholders. OFCCP reports it applied a set of neutral criteria to designate Megaprojects from a wider pool of eligible projects.

New Publications

Monday, October 5, 2023: Blog post by US DOL’s Office of Disability Employment Policy Chief of Staff Anupa Iyer Geevarghese on “National Disability Employment Awareness Month 2023: Advancing Access and Equity”

Looking Ahead:

Upcoming Date Reminders

There are four NEW items added to our calendar this week:

June 2023: U.S. DOL WHD’s current target date (now overdue) to publish its Final Rule on Nondisplacement of Qualified Workers Under Service Contracts (RIN: 1235-AA42)

June 2023: U.S. OSHA’s current target date (now overdue) to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36)

August 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act (RIN: 1235-AA43)

August 2023: U.S. NLRB’s (now overdue) target date for its Final Rule on Standard for Determining Joint-Employer Status (under the NLRA) (RIN: 3142-AA21)

August 2023: U.S. NLRB’s (now overdue) target date for its Final Election Protection Rule (RIN: 3142-AA22)

August 2023: U.S. DOL’s OASAM’s (now overdue) target date to publish Proposed Rule on “Revision of the Regulations Implementing Section 188 of the Workforce Innovation and Opportunity Act (WIOA) to Clarify Nondiscrimination and Equal Opportunity Requirements and Obligations Related to Sex” (RIN: 1291-AA44)

October 2, 2023: Deadline for comments on DHS/ICE’s proposed pilot procedure program & information collection for non-E-Verify participants as to remote I-9 Form document inspections

October 10, 2023: Comments due on EEOC’s Proposed Regulations to Implement the Pregnant Workers Fairness Act

October 10, 2023: Comments due on the EEOC’s proposal to extend – without change – its ADEA/OWBPA third-party waiver & disclosure requirements

October 23, 2023: US DOL’s WHD Final Rule updating Davis-Bacon & Related Acts regulations takes effect

October 30, 2023: Deadline for comments on OSHA’s union-friendly proposal to revise its Worker Walkaround Representative Designation Process

October 31, 2023: Opening Date for EEO-1 Survey Component 1 Data Collection

November 1, 2023: Public comments due on U.S. EEOC’s proposal to update its “Enforcement Guidance on Harassment in the Workplace.”

NEW November 6, 2023: Effective Date of FAR Council’s Final Rule to enhance whistleblower protections for federal contractor employees

November 7, 2023: Comments due on U.S. DOL WHD’s proposal to revise its FLSA regulations on the exemptions from minimum wage and overtime pay requirements for executive, administrative, & professional employees

November 20, 2023: Deadline for comments on the Census Bureau’s Proposal to Test Questions on Sexual Orientation & Gender Identity for the American Community Survey

NEW November 27, 2023: Comments due on the U.S. Office of Personnel Management’s Interim Final Rule to extend the eligibility date for noncompetitive appointment of military spouses married to a member of the armed forces on active duty through December 31, 2028

December 5, 2023: Submission deadline for EEO-1 Survey Component 1 Data Collection

December 26, 2023: NLRB’s Direct Final Rule revising its procedures governing representation elections takes effect

December 29, 2023: Statutory deadline for EEOC regulations to enforce the Pregnant Workers Fairness Act

December 2023: OFCCP’s current target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

December 2023: OFCCP’s current target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

January 1, 2024: U.S. DOL OSHA’s Final Rule Requiring Covered High-Hazard Industry Employers to Electronically Submit Injury & Illness Records Takes Effect

NEW January 1, 2024: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.90 per hour, and the minimum cash wage for tipped employees increases to $9.05 per hour (See our story here detailing exceptions)

NEW January 1, 2024: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $17.20 per hour, and this minimum wage rate will apply to non-tipped and tipped employees alike (See our story here detailing exceptions)

April 3 – April 5, 2024: DEAMcon24 New Orleans

June 2024: OFCCP’s current target date for its Notice of Proposed Rulemaking to Require Reporting of Subcontractors (RIN: 1250-AA15)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.