Sunday, October 1, 2023: OFCCP Discrimination Enforcement Statistics Hit New Lows

- only 29 discrimination law settlements known as “Conciliation Agreements” (“CAs”) worth a total through today (two weeks after the close of Fiscal Year 2023 on September 30) of only $9,779,529.79 in back pay by our calculations.

Note: OFCCP has yet to update its website database tracker of audit resolutions to report its FY 2023 enforcement data. See Notes at the end of this story.

- 15 Failure-To-Hire discrimination law violation settlements (OFCCP’s “bread and butter” discrimination claim) (52% of its total discrimination settlement agreements for FY 2023) worth $6,680,379.36 in backpay collections (68% of OFCCP’s backpay collections for FY 2023) for third-party beneficiaries to the government contractor’s contract with a federal Executive Branch agency

- 6 Compensation discrimination law violation settlements (21% of OFCCP’s discrimination CAs in FY 2023) worth $2,626,258.54 (27% of OFCCP’s back pay collections for FY 2023), although OFCCP would most likely count two more settlements, noted below, as “compensation” settlements but which do not involve the comparative pay of employees

- 1 contract violation settlement (OFCCP claims as a “compensation” violation involving an office cleaning company) worth $45,000 in back pay. Due to an internal payroll misunderstanding, the employer in error did not pay the wages it intended to pay but did so wholesale across an entire job classification without regard to race, sex, or any other protected status. OFCCP lacked jurisdiction (since the pay underpayment was not based on race, sex, color, or any protected status) but nonetheless insisted this was a “compensation” violation its audit had revealed. The contractor settled since it wanted to correct its pay error at any rate and to resolve OFCCP’s claim despite the agency’s lack of jurisdiction over the claim because the pay error was not based on a protected status

- 1 violation (worth $100,000 in backpay) for allegedly terminating an employee who inquired about the employer’s (Hospitality) pay practices (which OFCCP improperly characterizes as a “compensation” pay violation despite the fact that all compensation was properly paid)

- 4 disability (Section 503 claims) failure of reasonable accommodation settlements

- 1 Protected Veteran termination settlement worth $120,462.23 (SalesForce). Note: OFCCP lacks discrimination law authority pursuant to VEVRAA. (While OFCCP quietly altered its VEVRAA Rules in 2014 to rewrite them to state that VEVRAA prohibits discrimination based on a Protected Veteran’s status, the VEVRAA statute itself makes it only an “affirmative action” statute. Basic administrative law does not permit federal agencies to expand their Rules beyond Congress’ authorizing statute which the agencies are charged to faithfully implement, as written)

- 1 Protected Veteran termination settlement worth $13,455.18 (Sier Tek). Note: OFCCP lacks discrimination law authority pursuant to VEVRAA. (While OFCCP quietly altered its VEVRAA Rules in 2014 to rewrite them to state that VEVRAA prohibits discrimination based on a Protected Veteran’s status, VEVRAA makes it only an “affirmative action” statute. Basic administrative law does not permit federal agencies to expand their Rules beyond Congress’ authorizing statute which the agencies are charged to faithfully implement, as written)

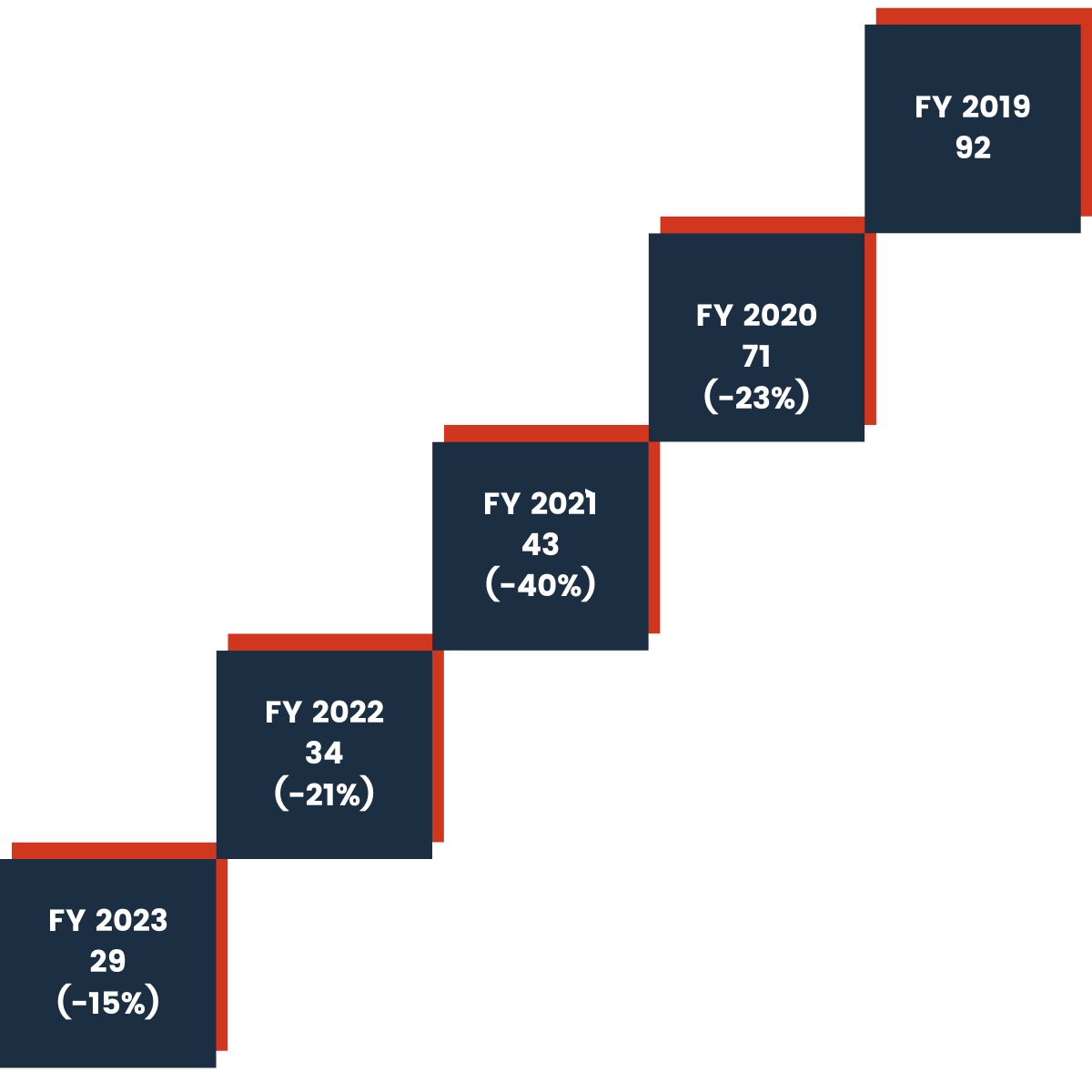

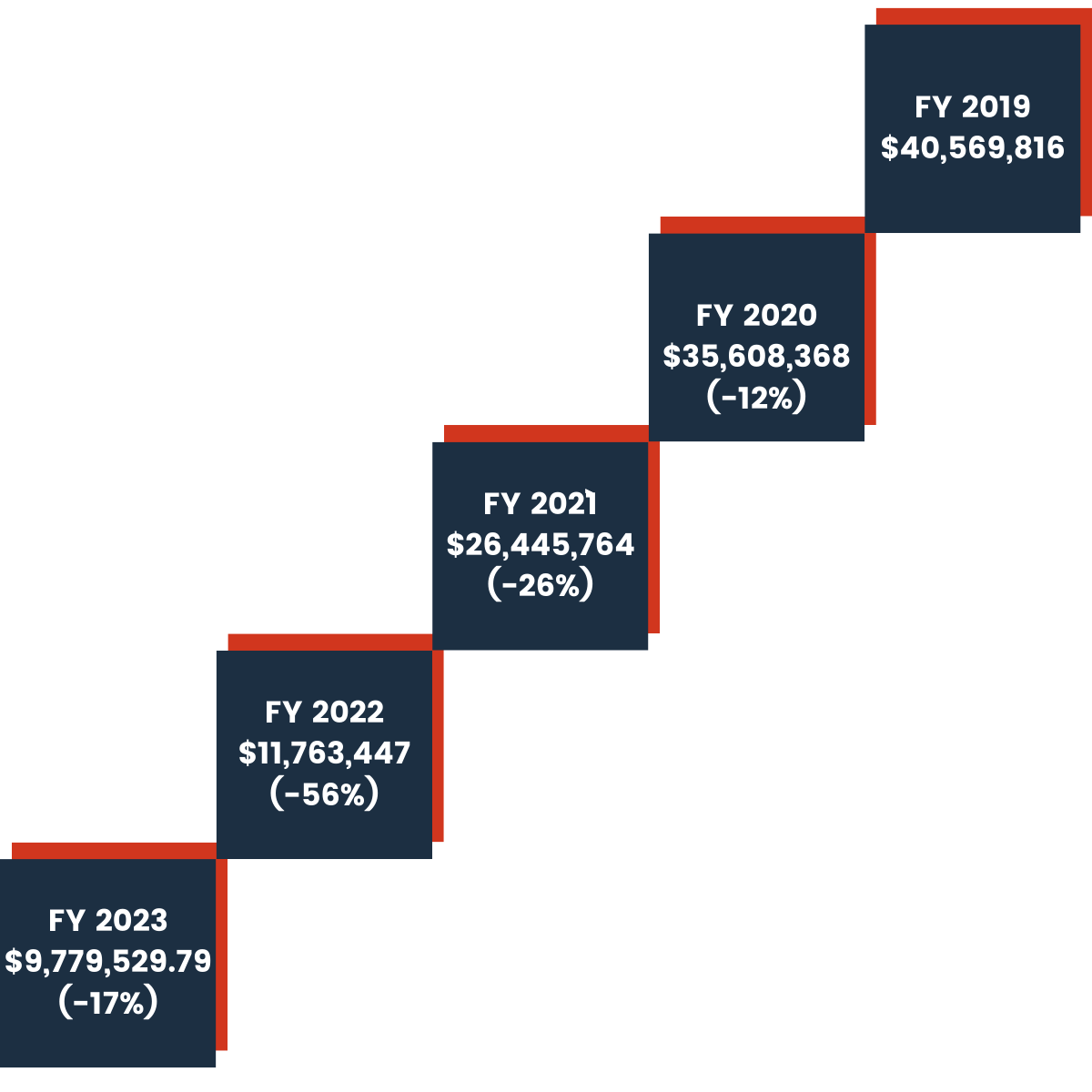

OFCCP continues to stair step down in both (1) the number of backpay resolutions and (2) the value of backpay collections, despite increasing budgets and employee headcount increases:

The Number of OFCCP Discrimination Settlements is Declining

The Value of Backpay Collections is Declining

OFCCP also continued its recent pattern of concluding most Conciliation Agreements in the first and last quarter of each Fiscal Year. The most likely time during the year to resolve difficult discrimination law claims with OFCCP continues, as has been true for the last several years, to be the end of Q4 (July, August & September) and the first two months of Q1 (October and November) of the immediately following Fiscal Year:

- Q1 FY 2023: 7 (many just narrowly missing being settled in the prior Fiscal Year)

- Q2 FY 2023: 4

- Q3 FY 2023: 5

- Q4 FY 2023: 13 (most in the last weeks of the FY)

Note 1: All OFCCP enforcement data for this report come (we use the word “data” in the plural) from OFCCP’s Website: OFCCP By The Numbers data and the OFCCP Library. OFCCP has not updated its OFCCP By The Numbers report for Q4 of FY 2023 (July, August & September). DE Week In Review staff has nonetheless been able to update, however, OFCCP’s discrimination settlements through today’s date to give our readers the benefit of the latest available data.

Note 2: OFCCP continually revises its enforcement data (often including prior year’s data, but typically not significantly “moving the needle”). Indeed, two weeks after the close of its FY 2023 on September 30, 2023, OFCCP last week reported four more discrimination Conciliation Agreements to bring its number of publicly reported CAs to 29 for the Fiscal Year. Accordingly, these data are susceptible to further change.

Unfair Labor Practices Charges, Union Petitions Rose in FY 2023, U.S. NLRB Reported

Unfair Labor Practices Charges Increased Over 10 Percent

Union Petitions Up 3 Percent

The Board did not note, however, that the U.S. non-farm labor market in the United States had grown 16% since January 1, 2016 (i.e., at a substantially higher percentage rate than the growth of NLRB cases).

The number of unfair labor practice (“ULP”) charges filed in FY 2023 increased 10 percent – from 17,988 charges in FY 2022 to 19,854 charges in FY 2023, continuing the increase (19 percent) from FY 2021 to FY 2022. In FY 2023, 2,594 union representation petitions were filed, which marked a 3 percent increase over FY 2022. “This uptick in filings builds on last fiscal year’s dramatic surge in representation-related activity and represents the highest number filed since FY 2015,” the Board pointed out. Specifically, in FY 2022, 2,510 union representation petitions were filed – a 53 percent increase from the 1,638 petitions filed in FY 2021.

However, the U.S. Department of Labor Bureau of Labor Statistics reported in January 2023 in USDL Report 23-0071 a downturn in the percentage of union employees in the 2022 U.S. workforce:

“The number of wage and salary workers belonging to unions, at 14.3 million in 2022, increased by 273,000, or 1.9 percent, from 2021. However, the total number of wage and salary workers grew by 5.3 million (mostly among nonunion workers), or 3.9 percent. This disproportionately large increase in the number of total wage and salary employment compared with the increase in the number of union members led to a decrease in the union membership rate. The 2022 unionization rate (10.1 percent) is the lowest on record. In 1983, the first year where comparable union data are available, the union membership rate was 20.1 percent and there were 17.7 million union workers.”

Employer Election Petitions Increased Following Cemex Ruling

As we reported in August, the Board majority’s recent ruling in Cemex Construction Materials Pacific, LLC announced a new framework to determine when employers must bargain with unions without a representation election. The Cemex ruling not only revived the Joy Silk doctrine, which had allowed unions to bypass an official NLRB election with only a card-check count serving instead as a “vote,” but went beyond Joy Silk by further removing one option for an employer to seek an election that Joy Silk had allowed. After the Board released the Cemex decision, employers filed 28 RM petitions (petitions for an election) with the agency’s field offices after being asked to voluntarily recognize employees’ unions. Under the Cemex framework, when a union requests recognition on the basis that a majority of employees in an appropriate bargaining unit have designated the union as their representative, an employer must either recognize and bargain with the union or promptly file an RM petition, the NLRB explained.

Budget Concerns Continue

Noting that this increase in activity in its field offices resulted in a corresponding increase in workload for the adjudicative side of the agency, the Board again bemoaned its budget woes. (See our related story from last November here.) The NLRB reported that it issued 246 decisions in contested cases during FY 2023, including more than a dozen significant precedent-setting cases, an uptick from 243 decisions in FY 2022.

The Board’s increased productivity also slightly lowered the median age of cases pending before it – from 108 days in FY 2022 to 106 days in FY 2023. Yet, similar to FY 2022, a significant jump in case intake overtook the NLRB’s case processing numbers. In FY 2023, the Board received 321 ULP and representation cases, up from 308 cases in FY 2022, driven by a 10 percent rise in representation cases brought before it. Consequently, even though the agency’s staffing levels remained static, it processed more cases than last fiscal year. The rise in case intake left 191 pending before the Board at the end of FY 2023, an increase from 145 in FY 2022.

In December 2022, Congress gave the NLRB a $25 million increase in budget dollars for FY 2023, ending a hiring moratorium, preventing furloughs, and allowing the NLRB to backfill some critical staff vacancies. However, the agency says it remains understaffed after almost a decade of flat funding. In the past two decades, staffing in field offices has shrunk by 50 percent. In its statement reporting the FY 2023 statistics, the Board advocated for President Biden’s proposed FY 2024 budget increase of $376 million. Its FY 2023 allocation was $299,224,000. (See our story on the President’s FY 2024 budget proposal here.)

In Brief

Tuesday, October 10, 2023: Almost 100,000 Public Comments Submitted on U.S. EEOC’s Proposed Regulations to Implement PWFA

Final Rule Deadline Looming: The PWFA statute took effect on June 27, 2023. The following day, the EEOC submitted its proposed regulations to implement the new statute to the White House Office of Management and Budget for review. On August 11, 2023, the Commission published its proposed regulations in the Federal Register for public review and comment. The statute provides that the EEOC must issue finalized regulations to implement it by December 29, 2023. For additional background, see our stories here, here, and here.

Monday, October 16, 2023: OSHA Extended Comment Deadline on Union-Friendly Proposal to Revise Rule Regarding Employee Representatives for Safety Inspections

Deadline Extended by Two Weeks

OSHA extended the previous public comment deadline of October 30 to November 13, 2023. You may submit comments here or here.

New Publications

Friday, October 13, 2023: US DOL’s Office of Disability Employment Policy (“ODEP”) updated its National Disability Employment Awareness Month (“NDEAM”) website to add ideas on how employers and employees may celebrate. See also, ODEP’s 31 Days of NDEAM.

Looking Ahead:

Upcoming Date Reminders

There are two NEW items added to our calendar this week:

June 2023: U.S. DOL WHD’s current target date (now overdue) to publish its Final Rule on Nondisplacement of Qualified Workers Under Service Contracts (RIN: 1235-AA42)

June 2023: U.S. OSHA’s current target date (now overdue) to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36)

August 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act (RIN: 1235-AA43)

August 2023: U.S. NLRB’s (now overdue) target date for its Final Rule on Standard for Determining Joint-Employer Status (under the NLRA) (RIN: 3142-AA21)

August 2023: U.S. NLRB’s (now overdue) target date for its Final Election Protection Rule (RIN: 3142-AA22)

August 2023: U.S. DOL’s OASAM’s (now overdue) target date to publish Proposed Rule on “Revision of the Regulations Implementing Section 188 of the Workforce Innovation and Opportunity Act (WIOA) to Clarify Nondiscrimination and Equal Opportunity Requirements and Obligations Related to Sex” (RIN: 1291-AA44)

October 23, 2023: US DOL’s WHD Final Rule updating Davis-Bacon & Related Acts regulations takes effect

NEW October 26, 2023 (2:00 pm – 3:00 pm ET): DE Masterclass Employment Law Roundtable | Compliance to Recruitment – PART II

October 31, 2023: Opening Date for EEO-1 Survey Component 1 Data Collection

November 1, 2023: Public comments due on U.S. EEOC’s proposal to update its “Enforcement Guidance on Harassment in the Workplace.”

November 6, 2023: Effective Date of FAR Council’s Final Rule to enhance whistleblower protections for federal contractor employees

November 7, 2023: Comments due on U.S. DOL WHD’s proposal to revise its FLSA regulations on the exemptions from minimum wage and overtime pay requirements for executive, administrative, & professional employees

NEW November 13, 2023: Deadline for comments on OSHA’s union-friendly proposal to revise its Worker Walkaround Representative Designation Process (previous October 30 deadline extended)

November 20, 2023: Deadline for comments on the Census Bureau’s Proposal to Test Questions on Sexual Orientation & Gender Identity for the American Community Survey

November 27, 2023: Comments due on the U.S. Office of Personnel Management’s Interim Final Rule to extend the eligibility date for noncompetitive appointment of military spouses married to a member of the armed forces on active duty through December 31, 2028

December 5, 2023: Submission deadline for EEO-1 Survey Component 1 Data Collection

December 26, 2023: NLRB’s Direct Final Rule revising its procedures governing representation elections takes effect

December 29, 2023: Statutory deadline for EEOC to finalize regulations to enforce the Pregnant Workers Fairness Act

December 2023: OFCCP’s current target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

December 2023: OFCCP’s current target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

January 1, 2024: U.S. DOL OSHA’s Final Rule Requiring Covered High-Hazard Industry Employers to Electronically Submit Injury & Illness Records Takes Effect

April 3 – April 5, 2024: DEAMcon24 New Orleans

January 1, 2024: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.90 per hour, and the minimum cash wage for tipped employees increases to $9.05 per hour (See our story here detailing exceptions)

January 1, 2024: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $17.20 per hour, and this minimum wage rate will apply to non-tipped and tipped employees alike (See our story here detailing exceptions)

June 2024: OFCCP’s current target date for its Notice of Proposed Rulemaking to Require Reporting of Subcontractors (RIN: 1250-AA15)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.