- In Party-Line Vote, Federal Trade Commission Majority Approved Final Rule Preventing Most Worker Noncompete Agreements

- US DOL ODEP/EARN Announced Guidance on Workplace Disability Disclosures

- Measure to Compel ByteDance to Sell TikTok Included in Supplemental Appropriations Law

- OFCCP Added 16 FY 2024 Mega Construction Projects to Its Potential Audit Lists

- US DOL WHD Officially Published Its Overtime Final Rule

- In Brief

- Looking Ahead: Upcoming Date Reminders

The DEAMcon24 Day Three Recap is Live!

In addition to today’s OFCCP Week in Review, our authors have also published the final of three special edition blog posts to recap DirectEmployers 2024 Annual Meeting & Conference (DEAMcon24) which took place April 3rd-5th in New Orleans, Louisiana. Be sure to check out our Day Three Recap for important details from each session that took place during the conference!

Tuesday, April 23, 2024: In Party-Line Vote, Federal Trade Commission Majority Approved Final Rule Preventing Most Worker Noncompete Agreements

Rule Slated to Take Effect 120 Days From Official Publication Date [Currently Unknown]

Lawsuits Already Filed to Stop Implementation

In a special open meeting, the Commissioners voted 3-2 in favor of the Final Rule, which, once effective, will ban NCAs as an “unfair method of competition under Section 5 of the FTC Act [15 U.S. Code §45]. The Final Rule will take effect 120 days after its official publication in the Federal Register. As of our WIR deadline, an official publication date had not been set. The unofficial, 570-page pre-publication pdf version of the Final Rule Notice is here. The Preamble section of the Final Rule Notice ends, and the text of the finalized regulations begins, on pdf page 561.

Through the Final Rule, the FTC will amend its regulations to add a new section – Part 910 – to its regulations located at Title 16, Chapter I of the Code of Federal Regulations (“CFR”). Thus, the citation for these new regulations will be 16 CFR Part 910.

Justification for the Rule

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan (D) in a press statement posted immediately after the Commission’s meeting.

The FTC estimates that the Rule will lead to new business formation growing by 2.7 percent per year, resulting in more than 8,500 additional new businesses created each year. The agency also anticipates that the Rule will result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower healthcare costs by up to $194 billion over the next decade. In addition, the Rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years, according to the FTC.

Definitions (Part 1910.1)

The new regulation adopts the following definition of “noncompete clause”:

“A term or condition of employment that prohibits a worker from, penalizes a worker for, or functions to prevent a worker from:

(i) seeking or accepting work in the United States with a different person where such work would begin after the conclusion of the employment that includes the term or condition; or

(ii) operating a business in the United States after the conclusion of the employment that includes the term or condition.”

The final rule defines “worker” as “a natural person who works or who previously worked, whether paid or unpaid, without regard to the worker’s title or the worker’s status under any other State or Federal laws, including, but not limited to, whether the worker is an employee, independent contractor, extern, intern, volunteer, apprentice, or a sole proprietor who provides a service to a person.” The definition further states that the term “worker” includes a natural person who works for a franchisee or franchisor but does not include a franchisee in the context of a franchisee-franchisor relationship.”

Scope (Part 1910.2)

The Final Rule adopts a comprehensive ban on new NCAs with all workers, including senior executives. However, for existing NCAs, the Final Rule adopts a different approach for senior executives than for other workers. For senior executives, existing NCAs remain in force. Existing NCAs with workers other than senior executives would not be enforceable after the effective date. The Final Rule defines “senior executives” as workers earning more than $151,164 annually and who are in policy-making positions.

Exceptions (Part 1910.3)

The Rule does not apply to NCAs entered into by a person pursuant to a bona fide sale of a business entity. In addition, the final rule does not apply where a cause of action related to a noncompete accrued before the effective date.

Keep in mind that the Rule will only apply to entities over which the FTC has authority. This means that it does not cover banks, insurance companies, non-profits, transportation and communications common carriers, air carriers, and some other entities.

Impact on State Laws (Part 1910.4)

The Final Rule preempts state laws to the extent that they conflict with the FTC Rule.

Opponents of the Final Rule question whether the Commission has the authority under the FTC Act to issue it because, since NCAs are contracts, they have traditionally been the province of state, rather than federal, law.

Alternatives to NCAs

The FTC’s April 23rd press statement noted the Commission’s conclusion that employers have several alternatives to NCAs that still enable firms to protect their investments. According to the FTC:

“Trade secret laws and non-disclosure agreements [“NDAs”] both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.

The Commission also finds that instead of using noncompetes to lock in workers, employers that wish to retain employees can compete on the merits for the worker’s labor services by improving wages and working conditions.”

How We Got Here

In January 2023, the FTC published its proposed version of the Rule (see our story here). The public comment period for the proposal closed on April 19, 2023. While the Regulations.gov website shows approximately 21,112 comments submitted, the FTC reported that it received more than 26,000 comments. See also our related content here, here, here, and here.

The Fall 2023 Regulatory Agenda did not include a target date for the FTC’s Final Rule. Instead, it indicated that the FTC staff was, as of December 2023, still reviewing public comments and conducting a policy analysis.

Changes from Proposed Version

The final rule differs from the proposed rule in several respects, including:

- The rule does not ban existing noncompetes with senior executives;

- The rule simplifies the notice and compliance requirements for employers. The FTC eliminated a provision in the proposed rule that would have required employers to legally modify existing NCAs by formally rescinding them. Instead, under the Final Rule, employers will simply have to provide notice to workers bound to an existing noncompete agreement that the NCA will not be enforced against them in the future. To aid employers’ compliance with this requirement, the Commission has included model language in the Final Rule that employers can use to communicate with workers; and

- The rule expands the sale of business exception.

Model Notice Language

The following is the text of the Model Notice:

“A new rule enforced by the Federal Trade Commission makes it unlawful for us to enforce a noncompete clause. As of [DATE EMPLOYER CHOOSES BUT NO LATER THAN EFFECTIVE DATE OF THE FINAL RULE], [EMPLOYER NAME] will not enforce any noncompete clause against you. This means that as of [DATE EMPLOYER CHOOSES BUT NO LATER THAN EFFECTIVE DATE OF THE FINAL RULE]:

- You may seek or accept a job with any company or any person—even if they compete with [EMPLOYER NAME].

- You may run your own business—even if it competes with [EMPLOYER NAME].

- You may compete with [EMPLOYER NAME] following your employment with [EMPLOYER NAME].

The FTC’s new rule does not affect any other terms or conditions of your employment. For more information about the rule, visit ftc.gov/noncompetes. Complete and accurate translations of the notice in certain languages other than English, including Spanish, Chinese, Arabic, Vietnamese, Tagalog, and Korean, are available at ftc.gov/noncompetes.”

Landing Page & Other Resources

The FTC posted a landing page with a summary of the Final Rule and Model Notices in seven different languages. That page also contains links to other resources including:

- Business and Small Entity Compliance Guide;

- Estimated Increases in Total Annual and Average Worker Earnings by State;

- “Fact Sheet;” and

- Infographic.

FTC Meeting & Commissioner Statements

The FTC posted a video and transcript of Tuesday’s meeting. Following the meeting, Commissioners Rebecca Kelly Slaughter (D), Alvaro Bedoya (D), Melissa Holyoak (R), and Andrew N. Ferguson (R) each issued separate statements explaining their positions. Chair Lina M. Khan also indicated that she would issue a separate statement.

It was the first Commission meeting with its two new Republican Commissioners – Commissioner Holyoak, who was sworn in on March 25, 2024, and Commissioner Ferguson, who was sworn in on April 2, 2024.

The Democratic majority and the Republicans disagreed as to whether the Commission had the authority to issue the Rule under Sections 5 [15 U.S. Code §45] and 6(g) [15 U.S. Code §46] of the FTC Act. The Democrats said they had the authority under existing case precedent, but the Republicans argued that courts would rule differently today.

The Republicans also argued the Final Rule would trample on states’ rights, while the Democrats said NCAs reduce competition in the marketplace. They also disagreed on whether handling NCAs that reduce competition should be done via regulations or one-off adjudication/enforcement actions.

Business Groups Filed Lawsuits to Stop Implementation

Wasting no time, the same day as the FTC vote, the US Chamber of Commerce announced it would file a lawsuit to challenge the rules. The following day, the Chamber filed its complaint, on behalf of a coalition of business groups, in the U.S. District Court for the Eastern District of Texas, Tyler Division (Case No. 6:24-cv-00148).

Dallas, Texas-based Ryan, a global tax services and software provider, also announced its similar lawsuit filed in the U.S. District Court for the Northern District of Texas.

Wednesday, April 24, 2024: US DOL ODEP/EARN Announced Guidance on Workplace Disability Disclosures

The guide covers why disability inclusion is important (page 1), why applicants and employees may choose to disclose their disability (pages 4-5); what factors can dissuade them from doing so (pages 5-6); and how employers play a vital role in creating a supportive, inclusive workplace culture that welcomes disclosure (pages 3-4).

It includes a discussion of the difference between Self-Identification and Disability Disclosure:

“It is important to understand the difference between disability disclosure and self-identification of disability. Disability disclosure is initiated by the applicant or employee. It happens when a person voluntarily shares information about their disability with their employer for personal reasons. Self-identification is initiated by the employer when they ask applicants and employees to voluntarily and confidentially self-identify as a person with a disability to provide data for affirmative action tracking and measuring effectiveness of organization-wide disability inclusion efforts. Outside of self-identification efforts, employers should be cautious when inquiring about disability of applicants and employees. The Americans with Disabilities Act (ADA) identifies several restrictions on employers when it comes to asking about disability. You can learn more about self-identification of disability in EARN’s National Industrial Liaison Group (NILG) Information Center: Self-Identification.”

Addressing what employers may ask an applicant or employee about their disability. The guide states:

“While employers can ask applicants and employees to voluntarily and confidentially self-identify for compliance or measurement purposes, they can only make limited inquiries about disability during the recruiting, hiring, and preemployment process. After an employer offers a job to a candidate, organizations can ask medical questions or require medical exams, but only if they do so for all individuals for that job type. After the employee starts work, an employer [may] ask medical questions or require medical exams only in support of an employee’s request for accommodation or if the employer has a legitimate belief that an employee would not be able to perform a job successfully or safely because of a medical condition or disability. These inquiries must be job-related and consistent with business necessity.”

The guide details how employers may encourage disclosure:

“To facilitate disclosure of disability, employers should create an environment of inclusion, acceptance, and belonging that allows every employee to choose to share information about themselves at work.

To create a more comfortable environment for disclosure, employers can:

- Demonstrate support for employees who choose to disclose. Some individuals have experienced disclosing a disability as the beginning of the end of their professional growth. Opportunities to advance become limited, work assignments are suddenly reduced, and eventually the employee is pushed out of the job. Avoid these consequences by addressing managers and coworkers’ internal bias and ableist ideals to help combat negative outcomes following disclosure.

- Promote positive relationships with managers and coworkers. Research shows that employees are 1.5 times more likely to disclose a disability to someone with whom they have a good relationship, such as a manager. Managers play a critical role in their employees’ day-to-day experiences; their relationships inform employees’ willingness to disclose a disability. When managers and employees show mutual respect, the decision to disclose becomes a little easier. Employers can also encourage positive relationships and foster an inclusive workplace culture by offering training about workplace disability inclusion to all employees.”

The document concludes with the following advice:

“Employers that encourage employees to disclose disabilities are asking them to trust their employer to honor their abilities, maintain confidentiality, and make employment decisions in good faith. To earn this trust, clearly communicate your organization’s commitment to workplace disability inclusion, implement a transparent and easy-to-understand reasonable accommodation policy, and provide organizational training for all employees on disability inclusion as a corporate value. Organizations should also encourage strong performance management and coaching relationships between managers and supervisors and their teams. Together, these efforts will encourage disability disclosure by helping to build a sense of trust, safety, and belonging for all employees.”

Wednesday, April 24, 2025: Measure to Compel ByteDance to Sell TikTok Included in Supplemental Appropriations Law

FAR Council’s Final Rule to Make Permanent Ban on TikTok for Federal Government Contractor Devices Expected Next Month

The new law, which President Biden signed on Wednesday gives ByteDance 270 days to sell TikTok. If it does not, TikTok would be prohibited from U.S. app stores and from internet hosting services that support it. The 270-day deadline means ByteDance would have to sell by January 19, 2025. However, the bill gives President Biden the power to extend the deadline another 90 days if he determines the company has made progress toward a sale. The measure also bans any entity from distributing, maintaining, or updating all “foreign adversary controlled” applications within the United States.

The House passed the package on Saturday, April 20, in four pieces with the TikTok ban included in H.R. 8038, which passed by a 360 to 58 vote. Late Tuesday night, the Senate passed all four pieces as one package, H.R. 815, with a 79 to 18 vote.

Multiple news sources reported that ByteDance plans to sue to stop the law’s enforcement.

Readers may recall that last summer, we reported on the FAR Council’s Interim Rule banning TikTok on federal government contractor devices. We also have noted on our weekly calendar that May 2024 is the FAR Council’s target date for its Final Rule to Prohibit TikTok [or any successor application or service developed or provided by ByteDance Limited on Federal Government Contractor Devices.

Thursday, April 25, 2024: OFCCP Added 16 FY 2024 Mega Construction Projects to Its Potential Audit Lists

MCPs are large federal construction projects (currently) valued at $35 million or more. In March 2023, we reported that OFCCP had – once again – launched a “Mega Construction Project Program.” Under OFCCP’s latest Mega Construction Project Program, agency officials hope to connect with the General Contractor (“GC”) on MCPs BEFORE the work begins and before the GC’s subcontractors hire up for the job to make sure the subcontractors are aware of their non-discrimination duties by offering “compliance assistance” to the GC and its subcontractors. Such programs to intercede with Construction GCs before the GC hires its subcontractors for major federal construction jobs date back to the Carter Administration.

For the 16 newly designated FY 2024 Megaprojects, OFCCP partnered with the departments of Commerce, Energy, Interior, and Transportation, as well as with the Army Corps of Engineers, to apply neutral criteria in making the selections, OFCCP stated in a press release and an email sent to stakeholders.

Friday, April 26, 2024: US DOL WHD Officially Published Its Overtime Final Rule

Staggered Implementation Set to Begin on July 1, 2024

The WHD announced the Final Rule on Tuesday, following up with its official Federal Register publication on Friday. The last time the WHD updated the EAP exemption regulations was in 2019. The Final Rule does not make any changes to the existing standard job duties tests. If it is paired with an appropriate salary level requirement, the standard duties test can appropriately distinguish bona fide EAP employees from nonexempt workers, the WHD said.

The Preamble section of the 132-page Final Rule Notice ends, and the text of the finalized regulations begins here (page 32971 of the pdf version).

The WHD posted a landing page on the Rule, which includes:

- An explanatory video;

- Frequently Asked Questions;

- A comprehensive chart of all the earnings thresholds for EAP employees; and

- A Small Entity Compliance Guide.

What Are the Changes?

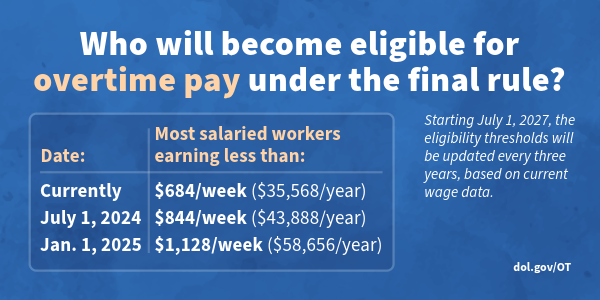

Starting July 1, 2024, most salaried workers who earn less than $844 per week will become eligible for overtime pay. On July 1, 2024, the standard salary level necessary for exemption – i.e., eligible for overtime pay – will increase from the current $35,568/year to $43,888/year. On January 1, 2025, it will increase to $58,656/year.

The HCE total annual compensation threshold will increase from the current $107,432 per year to $132,964 per year on July 1, 2024, and then increase to $151,164 per year on January 1, 2025.

Starting on July 1, 2027, both the standard threshold and the HCE threshold will be updated every three years based on current wage data.

How We Got Here

On September 8, 2023, the WHD published its NPRM in the Federal Register (see our stories here and here for details). The comment period closed on November 7, 2023, with almost 26,300 comments submitted, according to Regulations.gov. However, in the preamble to the Final Rule, the WHD states it received approximately 33,300 comments. The agency summarizes those comments in the preamble beginning here, and the WHD addresses specific issues raised by the comments, and its responses, beginning here. Throughout this lengthy section (running on pdf pages 32848 – 329710), the WHD identifies the changes it made between the proposed and final versions of the Rule. However, the WHD did not provide a summary section to succinctly catalog these changes.

The WHD submitted its Final Rule for Office of Management and Budget (“OMB”) review on March 1 (our story is here), and the OMB approved the Final Rule on April 10 (see our story here). With the Final Rule’s official publication, the WHD met its April 2024 target date set forth in the Fall 2023 Regulatory Agenda.

In Brief

Wednesday, April 24, 2025: House Education & Workforce Committee Announced Acting Secretary Su Scheduled to Testify at May 1 Hearing

Thursday, April 25, 2024: Coalition of Seventeen GOP States’ Attorney Generals Sued to Stop EEOC’s PWFA Regs

The AGs assert that the regulations’ inclusion of abortion-related workplace accommodations is unconstitutional and violates the Administrative Procedure Act (“APA”). Specifically, their APA claims center on their arguments that the regulations contravene the PWFA itself and are arbitrary and capricious. As to the Constitutional claims, they assert that the regulations run afoul of Federalism, State Sovereignty, and the First Amendment. On top of all that, they claim that the EEOC’s independent commission structure violates the Separation of Powers provision in Article II of the U.S. Constitution.

Looking Ahead:

Upcoming Date Reminders

We have added two NEW items to our calendar this week:

November 2023: EEOC’s target date (now overdue) to publish its NPRM to amend its regulations on exemptions to certain recordkeeping and reporting requirements (RIN: 3046-AB28)

December 2023: U.S. OSHA’s current target date (now overdue) to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36); On February 9, 2024, OSHA submitted its Final Rule to OMB for review and approval

March 11, 2024: Previous effective date of NLRB’s Final Rule on Standard for Determining Joint-Employer Status under the NLRA (per U.S. District Judge’s order previous February 26, 2024, effective date extended); On March 8, 2024, a U.S. District Judge vacated this Final Rule – stay tuned for further developments

March 2024: EEOC’s (now overdue) target date for proposal to amend its regulations regarding the electronic posting of the “Know Your Rights” Poster (RIN: 3046-AB29)

March 2024: U.S. NLRB’s (now overdue) target date for its Final Election Protection Rule (RIN: 3142-AA22)

April 29, 2024: Responses due (TODAY!) to OMB’s Request for Information on the responsible procurement of artificial intelligence in government

April 30, 2024: Deadline (TOMORROW!) to apply for 2024 HIRE Vets Medallion Award – https://www.hirevets.gov/

April 30, 2024: Opening Date for 2023 EEO-1 Survey Component 1 Data Collection

May 13, 2024: Deadline for comments on US DOL’s Request for Information seeking public input on whether to revise the list of Schedule A job classifications that do not require permanent labor certifications to include occupations in Science, Technology, Engineering & Mathematics (“STEM”) & other non-STEM occupations; previous February 20, 2024 deadline extended

May 15, 2024 (11:00 – 5:30 EST): US DOL WHD online seminar on prevailing wage requirements for federally-funded construction projects; register here

May 2024: FAR Council’s target date for its Final Rule to Prohibit TikTok [or any successor application or service developed or provided by ByteDance Limited] on Federal Government Contractor Devices (RIN: 9000-AO58); the Interim Rule is here

June 4, 2024: Deadline for 2023 EEO-1 Survey Component 1 Data Collection

June 6, 2024 (11:00 – 11:45 am CDT): OFCCP webinar for federal contractors on its pre-complaint inquiry process for workers

June 18, 2024: EEOC’s Final Rule to Implement the Pregnant Workers Fairness Act takes effect

July 1, 2024: OFCCP’s asserted “deadline” for covered federal Supply and Service contractors & subcontractors to certify, via OFCCP’s online Contractor Portal, that they have developed & maintained Affirmative Action Programs for each establishment or functional unit

NEW July 1, 2024: First effective date for US DOL WHD’s Final Rule on Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees (Overtime Rule); the standard salary level necessary for exemption – i.e., eligible for overtime pay – will increase from $35,568/year to $43,888/year and the highly compensated employee threshold will increase from the current $107,432/year to $132,964/year.

August 29, 2024 (11:00 – 5:30 EST): US DOL WHD online seminar on prevailing wage requirements for federally-funded construction projects; register here

September 2024: OFCCP’s current target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

September 2024: OFCCP’s current target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

September 2024: EEOC’s anticipated date for amending its FOIA procedures to add fees for electronic disclosure of records (RIN: 3046-AB20).

September 2024: U.S. DOL WHD’s target date to publish an NPRM on “Employment of Workers With Disabilities Under Special Certificates” (Subminimum Wage Rule) (RIN: 1235-AA14)

NEW January 1, 2025: Second effective date for US DOL WHD’s Final Rule on Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees (Overtime Rule); the standard salary level necessary for exemption – i.e., eligible for overtime pay – will increase from $43,888/year to $58,656/year and the highly compensated employee threshold will increase from $132,964/year to $151,164/year.

May 21 – May 23, 2025: DEAMcon25 in Scottsdale, Arizona

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.