- Illinois and Tennessee Voters Went in Opposite Directions on Labor Law Ballot Measures

- U.S. EEOC Published Proposal to Eliminate Counting Employees to Determine Filing “Type” for EEO-1 Component 1 Data Collection

- With Coming New Independent Contractor Rules, U.S. GAO Reported That Many Companies Use Them

- U.S. Departments of Justice & Labor, Plus EEOC, Issued Joint Veterans’ Resources Document

- Looking Ahead: Upcoming Date Reminders

Tuesday, November 8, 2022: Illinois and Tennessee Voters Went in Opposite Directions on Labor Law Ballot Measures

Illinois likely to become the first state to constitutionally bar right-to-work laws

Illinois Measure

The Illinois ballot measure would add an amendment to the state’s constitution, providing:

“No law shall be passed that interferes with, negates, or diminishes the right of employees to organize and bargain collectively over their wages, hours, and other terms and conditions of employment and workplace safety.”

There are two routes by which the measure could ultimately pass: (1) it gets 60 percent of yes votes from people weighing in on the question; or (2) a majority of the overall number of people who voted in the election – including those who left the question blank – supported it.

As of the WIR deadline, with 95 percent of the vote in, it’s 58.1% – 41.9 in favor.

According to Ballotpedia and Reuters, “[a]t least three other states – New York, Missouri and Hawaii – have amended their constitutions to guarantee a right to organize and collectively bargain. But the Illinois proposal is the first of its kind to be approved by voters.” Moreover, the Illinois measure’s language barring right-to-work laws was not included in the state constitutions of Hawaii, Missouri, or New York. The Illinois amendment’s provisions guaranteeing a fundamental right to collective bargaining over wages, hours, and working conditions, and employees’ economic welfare and safety at work are also unique.

If the Illinois ballot measure is eventually successful, court challenges to the measure are likely. Among other issues, it appears federal law preemption would mean that the Illinois provision could only apply to state employees and those otherwise exempt from the National Labor Relations Act.

Tennessee Measure

The Tennessee measure will amend Article XI of the state’s constitution to provide:

“It is unlawful for any person, corporation, association, or this state or its political subdivisions to deny or attempt to deny employment to any person by reason of the person’s membership in, affiliation with, resignation from, or refusal to join or affiliate with any labor union or employee organization.”

Unofficial election results posted on the Tennessee Secretary of State website show the vote was 69.79% – 30.21% in favor.

Current State Right-to-Work Laws

As of 2022, the last vote on a right-to-work law was in 2018 in Missouri, according to Ballotpedia. There, voters defeated Proposition A, which repealed a right-to-work law passed by the state legislature. As of January 2021, 27 states had right-to-work laws. Of those 27 states, 18 had right-to-work statutes, and nine states had right-to-work constitutional amendments.

Thursday, November 10, 2022: U.S. EEOC Published Proposal to Eliminate Counting Employees to Determine Filing “Type” for EEO-1 Component 1 Data Collection

Proposed Changes Would “Streamline & Modernize” Data Collection, But Not Change the Demographic Data Collected

The EEOC’s Office of Enterprise Data and Analytics (OEDA) identified these proposed measures to make the filing process “more user-friendly and less burdensome,” according to the notice. The Commission is seeking Office of Management and Budget (OMB) approval of these measures to “streamline and modernize” how the EEOC collects current EEO-1 Survey Component 1 data. The proposed revisions to this Information Collection Requirement (ICR) would not change the types of demographic workforce data historically collected by the EEO-1 for Component 1 (i.e., employee data by job category and sex and race or ethnicity), the agency maintains.

The current approval for the EEO-1 Survey ICR expires on June 30, 2023. The EEOC requested approval for these changes as part of its routine request for a three-year clearance to continue the Component 1 ICR under the Paperwork Reduction Act. If implemented, these changes would apply to the 2022 EEO-1 Survey Component 1 data collection, the notice states. That data collection is tentatively scheduled to open in April 2023. The 2021 EEO-1 Component 1 data collection cycle opened on April 12, 2022 and ended on June 21, 2022.

Written comments on this notice must be submitted on or before January 9, 2023.

Component 1 Report Types

The EEO-1 Survey Component 1 data collection has various report types seeking the race/ethnicity and sex, and ethnic data for employees to be reported in nine Job categories with one divided into two parts for a total of ten reporting categories at various kinds of employer establishments. Currently, all multi-establishment companies must submit a “Type 2 Consolidated Report,” often called the “consolidated report.” The Type 2 Report must include data for all employees of the company (i.e., all employees at headquarters as well as all establishments) categorized by race/ethnicity, sex, and job category. Multi-establishment companies are also required to submit: (A) one “Type 3 Headquarters Report”; (B) a Type 4 Establishment Report for each establishment with 50 or more employees; and (C) a Type 8 Establishment Report for each establishment with fewer than 50 employees. All these reports must include employee data for each establishment categorized by race/ethnicity, sex, and job category.

Single-establishment companies are required to submit only one EEO-1 Component 1 Report, known as the “Type 1 Single-Establishment Report.” These reports must include data for all the company’s employees categorized by race/ethnicity, sex, and job category. For more information on the various EEO-1 Survey report types, see: https://www.eeocdata.org/pdfs/EEO-1_Fact_Sheet.pdf.

Proposed Changes Would Eliminate Counting Employees to Determine Filing Type

Under the proposed changes, a Multi-Establishment filer would no longer have to take the additional step of counting employees in each establishment to determine whether to file a Type 4 or Type 8 report. Multi-Establishment filers would still be required to submit a “Headquarters” Report (formerly referred to as a “Type 3” Report) and a “Consolidated Report” (formerly referred to as a “Type 2” Report). However, all individual “Consolidated Reports” for all Multi-Establishment filers would be auto-populated and auto-generated with data from their “Headquarters Report” and “Establishment-Level Report(s)” within the EEOC’s electronic, web-based EEO-1 Survey Component 1 Online Filing System.

There Are Two Implications for Federal Government Contractors Which OFCCP’s Executive Order 11246 EEO-1 Filing Requirements Cover

First, the change to the EEO-1 Form also changes the form for those employers which are federal Government contractors with 50-99 employees.

Background: OFCCP’s tradition has been to impose EEO-1 reporting obligations using an EEO-1 form OFCCP and the EEOC have jointly developed and for which they have jointly sought authority to use. While it is odd that OFCCP did not join with the EEOC in the EEOC’s request to OMB to approve an extension of the current Paperwork Reduction Act (“PRA”) authority to collect EEO-1 information, it nonetheless appears that the authorization the EEOC seeks will affect the EEO-1 form and only one such format will thereafter exist, if OMB approves it (as expected).

Then, OFCCP’s Rules at 41 CFR Section 60-1.7(a) require covered federal Government contractors/subcontractors to file the “jointly-developed” EEO-1 form. OFCCP’s Rule at 41 CFR Section 60-17(a)(ii) then further expands the EEO-1 filing requirement beyond those employers covered by the EEOC’s Rules issued pursuant to Title VII of the 1964 Civil Rights Act. Specifically, OFCCP’s EEO-1 filing Rule requires: (a) covered federal Government contractors/subcontractors to file the “jointly-developed” EEO-1 form, and (b) also drops the employee size threshold for filing from the EEOC’s 100-employee Rule to 50 employees if the employer is a covered federal Government contractor/subcontractor. Thus, OFCCP’s Rule brings covered federal Government contractors with 50-99 employees into the EEO-1 filing requirement.

Finally, OFCCP believes its Rule at 41 CFR Section 60-1.7 is all it needs to impose the requirement to compel covered federal Government contractors to file EEO-1s. OFCCP, therefore, does not participate in the EEOC’s request to OMB for permission to require the EEO-1 filings pursuant to the PRA. No contractor has yet challenged OFCCP’s reading of OFCCP’s Rules which the agency believes do not require it to seek PRA authority to continue collecting the EEO-1 form for those covered federal Government contractors employing fewer than 100 employees. Of course, this issue affects only those covered federal Government contractors with 50-99 employees as covered federal Government contractors with 100 or more employees are also “employers” subject to the EEOC’s EEO-1 filing requirement.

Second, OFCCP will have to either (a) change its OFCCP AAP Certification Portal filing protocols, or (b) maintain its current EEO-1 Rules that require multi-establishment federal contractors employing 50 or more employees (INCLUDING those employing 100 or more employees) to identify those establishments with fifty or fewer employees, or (c) change its now 40-year-old policy determination NOT to audit federal contractor establishments employing 49 or fewer employees. This is because OFCCP has historically consulted the EEO-1 filings, and recently the reports in its own AAP Certification Portal, to identify which contractor AAP establishments employ 49 or fewer employees. Then, OFCCP has historically excluded those establishments employing 49 or fewer employees from OFCCP’s audit lists. Without EEO-1 Reports segregating contractor establishments into those below 50 employees and those employing 50 or more employees, OFCCP will not know which federal contractor establishments employ 49 or fewer employees. As a result, OFCCP will inadvertently select for audit in coming audit selection cycles numerous federal contractor establishments employing 49 or fewer employees.

OMB Previously Separated Control Numbers for Components 1 and 2

The latest Federal Register notice references two earlier notices from September 12, 2019, and March 23, 2020. As we reported (here and here), in those previous notices, the EEOC sought OMB’s approval to remove and separate the OMB control numbers for Component 1 from OMB control number 3046-0007 and assign it a new control number. At that time, the Commission did not ask OMB to renew Component 2 under OMB control number 3046–0007. The OMB approved the EEOC’s request on June 12, 2020, and assigned Component 1 the OMB control number 3046-0049.

Why Do OMB Control Numbers Matter?

A federal agency generally cannot conduct or sponsor a collection of information extending to more than nine members of the public, and the public is not required to respond to an information collection unless the OMB approves it and displays a currently valid OMB Control Number. In addition, a federal agency may not typically prosecute a member of the public for failing to comply with a collection of information that does not display a valid OMB Control Number, even if the agency has the authority and approval to undertake the collection.

[Note: The portion of the report that the EEOC refers to as “Component 1” requires covered private sector employers to provide workforce profiles by race, ethnicity, sex, and job category. As explained above, the Type 2 Consolidated Report is one of the various Component 1 report types. The Type 2 Consolidated Report for Component 1 is not to be confused with the “Component 2” pay data reporting. The EEOC (not OFCCP) added Component 2 for one filing cycle – which collected aggregate data on pay ranges and hours worked – for a limited run during the reporting years 2017-2018. (For recent developments on Component 2, go here and here.)]

Burden Estimates

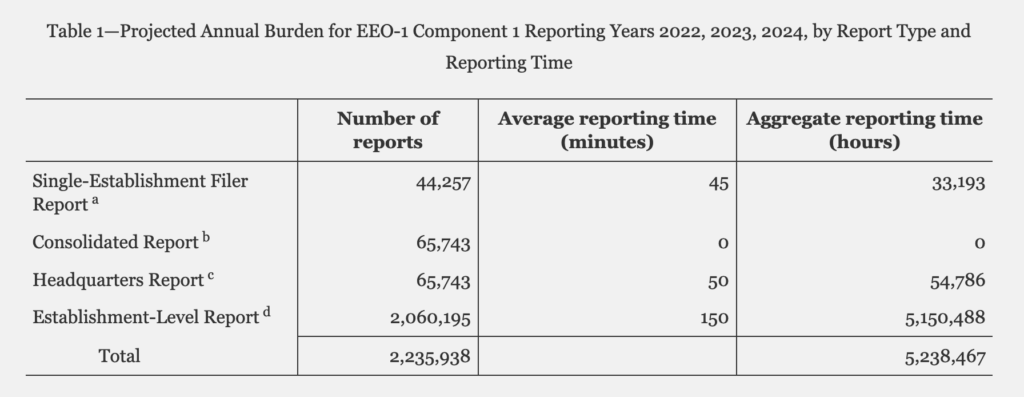

The EEOC spent considerable space in its six-page notice covering burden estimates. Based on data trends over the last three EEO-1 Component 1 data collection reporting years (i.e., 2019, 2020, 2021), as well as ongoing updates by the EEOC to the EEO-1 Component 1 frame (i.e., filer roster or master list), the Commission believes the total number of filers submitting at least one report may increase to 110,000. The agency estimated 2,235,938 reports per annual collection. The Commission also estimated, per annual collection: 5,238,467 reporting hours; $272,275,151.80 respondent burden hour cost; and $4,113,388.55 federal cost.

The notice included the following table to outline the number of reports, the average reporting time by report type, and the aggregate number of hours estimated to submit these reports.

Thursday, November 10, 2022: With Coming New Independent Contractor Rules, U.S. GAO Reported That Many Companies Use Them

The information sector had the highest proportion of contract workers

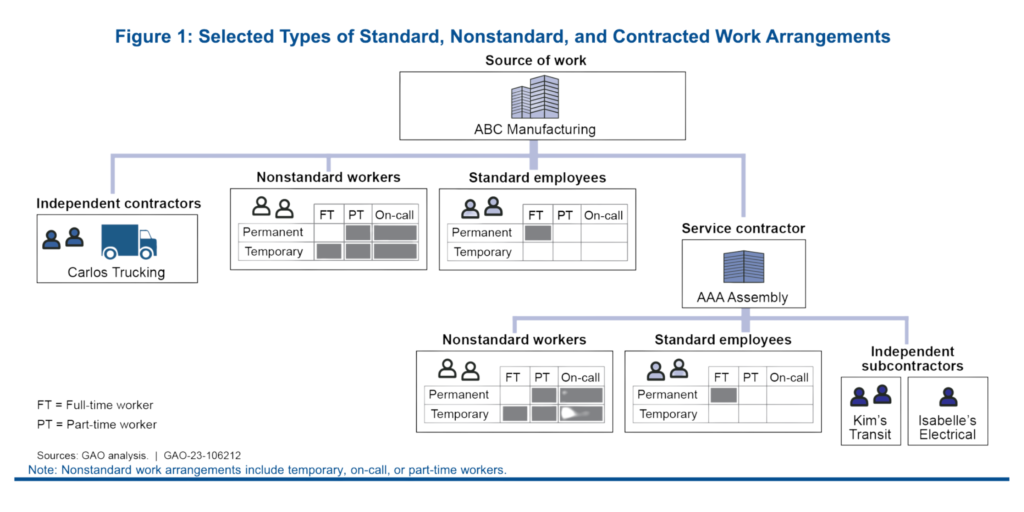

The GAO Report further found that about 89 percent of a generalizable sample of 2021 Form 10-Ks reported using contractors of some type. (10-K reports are one of the nation’s fundamental financial reports containing detailed data all publicly traded companies must annually file with the Securities and Exchange Commission (SEC)).

The GAO used the following two sources to learn more about the size and scope of this workforce:

- The 2020 ABS (“Annual Business Survey”) submissions of 300,000 companies. This is the Survey that reported that approximately one-third of respondent companies reported that they used “contractors, subcontractors, independent contractors, or outside consultants.” Fifty percent reported using part-time workers. (The U.S. Census Bureau and the National Center for Science and Engineering Statistics within the National Science Foundation conduct the ABS.) The information sector had the highest proportion of companies reporting the use of contract workers (57 percent). However, statistics reported on these types of workers in the survey cannot be “generalized” (i.e., extrapolated) to all U.S. companies, the GAO cautioned.

- A generalizable sample of 80 annual reports (2021 Form 10-Ks) that public companies listed in the S&P 500 submitted to the SEC. There, an estimated 89 percent of the companies mentioned using contractors of some type, including independent contractors or firms. Sixty-five percent used contractors for services, such as for IT support, human resources, or maintenance. The companies also cited factors that could increase labor costs. A small percentage mentioned workplace safety, wages, and access to benefits, among other topics, expressly for nonstandard or contracted workers. Moreover, the GAO estimated that 9 percent of the 10-K reports mentioned nonstandard or contracted workers in any discussion about work conditions (such as access to benefits, flexible work arrangements, or access to training and professional development activities). In addition, the GAO estimated that 15 percent expressly mentioned these workers in any discussion of wages and workforce costs or of health and safety (such as workplace injuries).

The information the GAO gathered for its 33-page Report was not a comprehensive inventory of companies’ public disclosures on nonstandard and contracted work arrangements, the agency emphasized. The GAO’s review does not measure companies’ actual practices, it added.

The GAO Report included the following table to illustrate some of the types of work arrangements it found in the data it reviewed:

Why GAO Did This Study

Why GAO Did This Study

Senators Sherrod Brown (D-OH) and Mark Warner (D-VA) commissioned the Report. The GAO provided a draft copy to the Census Bureau and SEC for review and comment, and the SEC provided technical comments.

Policymakers and other stakeholders want to know how many workers are in such arrangements and their reported effects on workplace safety, wages, and access to benefits, among other issues, the GAO noted. They seek this information, in part, because some of these workers may not have access to certain workplace protections or benefits, and information on these types of work arrangements can assist in determining whether government policies support full employment (given federal policy goals of maximizing employment), the GAO pointed out.

“Furthermore, investors are increasingly asking public companies to disclose information on environmental, social, and governance factors, including those related to human capital and labor conditions,” the GAO stated, citing one of its reports from earlier this year.

The Bigger Picture

Last month, we reported that the U.S. Department of Labor’s Wage and Hour Division formally proposed a six-part test to determine independent contractor status under the Fair Labor Standards Act. In that story, we also noted that the Federal Trade Commission (FTC) issued a 17-page “Policy Statement on Enforcement Related to Gig Work.” Furthermore, we reported in July that the National Labor Relations Board and FTC signed a Memorandum of Understanding (MOU) to focus on “Anticompetitive and Unfair Labor Practices.” That MOU pinpoints areas of mutual interest, including labor market developments relating to the gig economy such as employer misclassification of workers and algorithmic decision-making; one-sided and restrictive contract provisions, such as non-compete and nondisclosure provisions; the extent and impact of labor market concentration; and collective bargaining.

Thursday, November 10, 2022: U.S. Departments of Justice & Labor, Plus EEOC, Issued Joint Veterans’ Resources Document

The two federal laws that prohibit discrimination in employment based on service member or veteran status are the Uniformed Services Employment and Reemployment Rights Act (USERRA) and the Vietnam Era Veterans’ Readjustment Assistance Act of 1974 (VEVRAA). VETS provides a side-by-side comparison of the two statutes here.

Although the EEOC does not have enforcement authority for VEVRAA and USERRA, the document details how the laws enforced by the EEOC, particularly the Americans with Disabilities Act (ADA), might pertain to servicemembers and veterans based on other protected characteristics. The Commission’s new webpage on EEOC Efforts for Veterans with Disabilities details the relevance for disabled veterans of the employment discrimination and accommodation provisions in the ADA. EEOC Chair Charlotte A. Burrows also posted a Veterans Day message on the EEOC’s website, touting the agency’s efforts to support the enforcement of laws that protect veterans.

In addition, OFCCP added a webpage for veterans’ resources.

See also, our related story from last December: USDOL and USDOJ Renew MOU To Ensure Military Service Members’ Employment Rights

Looking Ahead:

Upcoming Date Reminders

Thursday, November 17, 2022: (1:00 PM Eastern Time): OFCCP Webinar – “FAAP Directive 2013-01, Revision 3”

Thursday, November 17, 2022: (2:00 pm – 3:00 pm ET): DE Legal Roundtable Masterclass Creating the Proper Footprint and Architecture for Your AAPs

Friday, November 25, 2022: US DOL Final Rule rescinding Industry-Recognized Apprenticeship Programs and shifting department resources to Registered Apprenticeship Programs takes effect – http://www.federalregister.gov/d/2022-20560

Wednesday, November 30, 2022: (2:00 – 3:00 PM Eastern Time): DE Webinar – “Who Has the Right to Talk? Discussing the Laws Promoting Employee Rights to Pay Transparency”

Monday, December 5, 2022: Comments due on USDOL WHD’s request to extend unchanged paid sick leave recordkeeping requirements for federal contractors – https://www.regulations.gov

Monday, December 5, 2022: Comments due on Draft FY 2022-2026 Strategic Plan – https://www.regulations.gov/document/EEOC-2022-0004-0001

Wednesday, December 7, 2022: Deadline to submit initial comments on NLRB’s proposed Rule to Determine Joint Employer Status (previous November 7 deadline extended) – https://www.regulations.gov/docket/NLRB-2022-0001

Tuesday, December 13, 2022: Comments due on USDOL WHD proposed rule on “Employee or Independent Contractor Classification Under the Fair Labor Standards Act” (previous November 28 deadline extended) – https://www.regulations.gov/docket/WHD-2022-0003

Wednesday, December 21, 2022: Deadline to submit reply comments in response to initial comments on NLRB’s NPRM to Determine Joint Employer Status (previous November 21 deadline extended) – https://www.regulations.gov/docket/NLRB-2022-0001

Sunday, January 1, 2023: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.15 per hour, and the minimum cash wage for tipped employees increases to $8.50 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20905/minimum-wage-for-federal-contracts-covered-by-executive-order-13658-notice-of-rate-change-in-effect

Sunday, January 1, 2023: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $16.20 per hour, and the minimum cash wage for tipped employees increases to $13.75 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20906/minimum-wage-for-federal-contracts-covered-by-executive-order-14026-notice-of-rate-change-in-effect

Tuesday, January 3, 2023: Deadline to submit initial comments on NLRB’s proposed changes to NLRA regulations – https://www.regulations.gov/commenton/NLRB-2022-0002-0001

Monday, January 9, 2023: Deadline to submit comments on US EEOC proposal to eliminate counting employees to determine filing “type” for EEO-1 Survey Component 1 – https://www.regulations.gov/document/EEOC-2022-0005-0001

Tuesday, January 17, 2023: Deadline to submit reply comments in response to initial comments on NLRB’s proposed changes to NLRA regulations – https://www.regulations.gov/commenton/NLRB-2022-0002-0001

Wednesday, April 12 – Friday, April 14, 2023: DEAMcon23 Chicago (Registrations open now; Agenda coming soon!)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.

Why GAO Did This Study

Why GAO Did This Study