- Senate Confirmed Nomination of Jessica Looman to Head US DOL’s Wage and Hour Division

- US NLRB Unveiled Final, Union-Friendly Joint Employer Rule

- US DOL Inspector General’s Office Plans to Review Effectiveness of OFCCP Compliance Evaluations, FY 2024 Audit Workplan Revealed

- In Brief

- Looking Ahead: Upcoming Date Reminders

Wednesday, October 25, 2023: Senate Confirmed Nomination of Jessica Looman to Head US DOL’s Wage and Hour Division

Senator Sullivan Only Republican Voting in Favor

The evening before the confirmation vote, the Senate voted 51-47 to bring any debate on the nomination to a close. Senator Sullivan was also the sole Republican vote then. Democratic Senator Padilla and Republican Senator Scott did not vote.

How We Got Here

Ms. Looman has served as the principal Deputy Administrator since January 2021. President Biden first nominated Ms. Looman to head the WHD on July 28, 2022. (See our story on Ms. Looman’s initial nomination here.) The Senate failed to approve her nominations in the previous (117th) Congress which adjourned on January 3rd of this year as the 118th Congress was seated. Thereafter, President Biden re-nominated her in January. In March, the Senate Committee on Health, Education, Labor, and Pensions Committee reported favorably on Ms. Looman’s nomination (our story is here).

Thursday, October 26, 2023: US NLRB Unveiled Final, Union-Friendly Joint Employer Rule

New Standard Will Bring More Employees Under NLRA Coverage

Dissenting Member Kaplan Said New Rule “Misapprehends Common-Law Agency Principles”

Under the new standard, an entity may be considered a joint employer of another employer’s employees if the two “share or codetermine” ONLY one or more of the employees’ “essential terms and conditions of employment.” This expanded, employee-friendly standard will cover more entities, and thus, force more organizations to recognize workers as “employees.”

The Final Rule rescinds and replaces the NLRB’s previous Rule, published on February 26, 2020, that took effect on April 27, 2020. (See our stories on the previous Rule here and here.)

The effective date of the new rule is December 26, 2023. It will apply to NLRB cases filed on and after the effective date.

How Are “Essential Terms and Conditions of Employment” Defined?

Under the new rule, “essential terms and conditions of employment” are defined exclusively as: (1) wages, benefits, and other compensation; (2) hours of work and scheduling; (3) the assignment of duties to be performed; (4) the supervision of the performance of duties; (5) work rules and directions governing the manner, means, and methods of the performance of duties and the grounds for discipline; (6) the tenure of employment, including hiring and discharge; and (7) working conditions related to the safety and health of employees.

What is the Definition of “Share or Codetermine”?

The Final Rule defines “share or codetermine” to mean that an employer possesses “the authority to control (whether directly, indirectly, or both) or to exercise the power to control (whether directly, indirectly, or both) one or more of the employees’ essential terms and conditions of employment.”

NLRB Rule Separate from DOL Rule

In a “Fact Sheet” on its new Rule, the NLRB explained that:

“The Board’s final rule is completely separate from the [U.S. Department of Labor’s (“DOL”)] rule. The Board and DOL independently set joint-employer standards, consistent with their different governing statutes. The Board’s rule is thus grounded in the NLRA and longstanding common-law principles. By contrast, the DOL applies an economic-realities test to interpret “employer” for the purposes of the Federal Labor Standards Act. The Board does not use the economic-realities test.”

We discussed the DOL’s Wage and Hour Division’s Rule defining a joint employer to determine liability for wage-hour violations under the Fair Labor Standards Act in our story here.

How We Got Here

On September 7, 2022, the NLRB published its Notice of Proposed Rulemaking (“NPRM”). For more details on the NPRM, see our story here. After an extension, the period for initial comments and reply comments ended on December 21, 2022, with roughly 13,000 comments submitted. The Board details its response to those comments in the preamble to the Final Rule here.

The Spring 2023 Regulatory Agenda listed August 2023 as the target date for publication of this Final Rule. On October 2, 2023, the NLRB told a federal court in the District of Columbia that it planned to issue the Final Rule by the end of the month. (See our story here for more details). We discussed this litigation, the NPRM, and the convoluted recent history of the NLRB’s effort to issue a Joint Employer Rule in our story here.

Changes from the Proposed Rule

In the preamble to the Final Rule, the NLRB summarized the changes in the Final Rule compared to its NPRM. The Board notes that it “modified the proposed rule (1) to clarify the definition of ‘essential terms and conditions of employment,’ (2) to identify the types of control that are necessary to establish joint-employer status and the types that are irrelevant to the joint-employer inquiry, and (3) to describe the bargaining obligations of joint employers.”

Sole GOP Member’s Opposition

Democratic Board Members David Prouty and Gwynne Wilcox joined Chair Lauren McFerran in issuing the Final Rule. The Board’s lone Republican, Marvin Kaplan dissented. According to Kaplan:

“[T]he majority’s final rule effects an unprecedented and unwarranted expansion of the Board’s joint-employer doctrine. The majority misapprehends common-law agency principles in holding that those principles compel the Board to rescind its 2020 Rule […] and replace it with a joint-employer standard not seen anywhere else in the law. My colleagues dispense with any requirement that a company has actually exercised any control whatsoever (much less substantial control) over the essential terms and conditions of another company’s employees.”

Congressional Opposition & Support

The OMB classified this Final Rule as a major rule subject to Congressional review. Wasting no time, U.S. Senators Bill Cassidy, M.D. (R-LA), ranking member of the Senate Health, Education, Labor, and Pensions (“HELP”) Committee, and Joe Manchin (D-WV) announced on Thursday their plan to introduce a Congressional Review Act resolution to overturn the Final Rule. The Senators asserted that the Final Rule “forces liability on companies for another business’ employees even if they do not directly oversee them.”

Former HELP Committee Chair and current Senate Appropriations Committee Chair Patty Murray (D-WA) expressed a different view. She said the new standard “provide[s] guidance to make sure corporations don’t try to dodge” their “important responsibility” to collectively bargain with workers.

In her statement opposing the Final Rule, House Education and the Workforce Committee (“EWC”) Chair Virginia Foxx (R-NC) claimed that it “dissuades millions of businesses from working with one another.” The new standard also “muddies the water for businesses trying to abide by this administration’s mess of out-of-touch mandates,” according to Foxx.

The EWC Chair’s take was in stark contrast to that of EWC Ranking Member Bobby Scott (D-VA), who characterized the Final Rule as a measure that “makes clear that low-road employers can no longer hide behind intermediaries to evade their responsibilities to workers.”

Thursday, October 26, 2023: US DOL Inspector General’s Office Plans to Review Effectiveness of OFCCP Compliance Evaluations, FY 2024 Audit Workplan Revealed

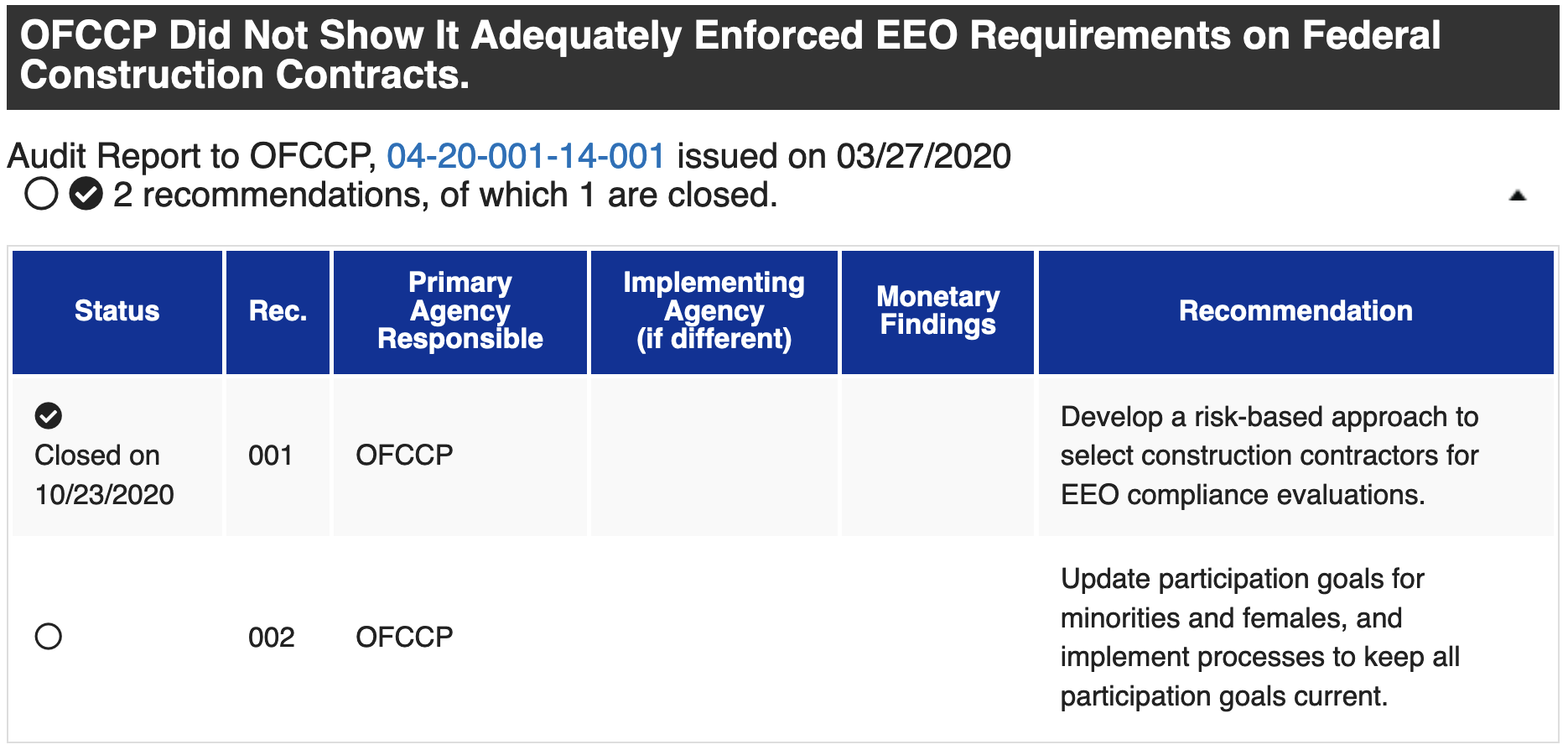

OFCCP Still Has Not Implemented Recommendations from 2020 OIG Audit Report to Update Its Construction Program Participation Goals for Minorities and Women

Who Are These Inspector Generals?

The OIG issues reports that make recommendations to the DOL to promote the effectiveness, efficiency, economy, and integrity of all DOL programs and operations, including those its contractors and grantees perform. It prepared this workplan to inform DOL agencies and Congress of audits and reviews that the OIG will complete or initiate in FY 2024. Notably, OFCCP still has not implemented one of two recommendations from the 2020 OIG Report on OFCCP Construction Audits.

Editor’s Note: The Offices of Inspector Generals throughout the federal Executive Branch were a creation of the Carter Administration in 1978. Presidential candidate Jimmy Carter ran on a platform, among other issues, of reigning in unnecessary and wasteful government spending and rendering the federal Executive Branch more efficient and effective. As Georgia’s Governor, he had reduced 300 departments within the state to 30 and streamlined services. When Carter arrived in Washington D.C., he was true to his campaign pledge and immediately set in motion many regulatory reforms, including management by objective principles and the OIGs to insure excellence, all still in place today.

OIG investigations are typically feared by the agencies which employ them. The Inspector Generals are charged to be independent within each agency and act as a chief ethics officer and senior manager, in effect. Their early tradition was that they were hostile to the agencies they reviewed and “pulled no punches” in what were often tough, candid and high-impact reports of management failures within the subcomponent agencies within a large Executive Branch department or agency. Upon arriving in Washington D.C. as President, Ronald Reagan, who succeeded Carter, decided to double-down on what Carter had started. President Reagan fired all 15 federal department Inspector Generals as being too soft on white collar crime in the federal government. White House Press Secretary Jim Brady thereafter reported President Reagan’s intention to appoint new IGs who would be “meaner than a junk yard dog.”

And that has been the tradition of the IGs to date: muckrakers with inside access. When John Fox was at OFCCP, even the whisper of a possible IG investigation of OFCCP would immediately send shudders down the spines of every agency manager since IGs did not investigate unless they already had proof of a serious problem. Each Administration’s IG is different in his/her independence from the agency and in the candor of their reports. Past IG Reports would typically cause “heads to roll.” We will potentially see in FY 2024 how candid and impactful the Biden OIG is as to OFCCP, if the audit indeed goes forward. See immediately below.

Mandatory Versus Discretionary Audits

The workplan presents the audits by each DOL agency and then further breaks them down into mandatory (those required by law or regulation) and discretionary audits. It does not include unanticipated work that will come from legislative mandates, congressional requests, DOL requests, or emerging programmatic issues. After the OIG commits resources to all mandatory audits, it uses its remaining funds for discretionary audits. The agency determines which discretionary audits to conduct based on risk and potential impact on DOL’s mission and goals. Also, the OIG uses its funds to perform audits in response to allegations of fraud, waste, and abuse which arise spontaneously from various sources.

Planned OFCCP Audit Categorized as Discretionary

Page 15 of the Audit Workplan revealed that the OIG plans to conduct an audit to “focus on the effectiveness of OFCCP’s enforcement of anti-discrimination and affirmative action obligations through compliance evaluations.” Because the OIG characterized this planned audit as discretionary, it is possible that the OIG may not conduct it in FY 2024, depending on the circumstances noted above.

Other Notable Planned FY 2024 Audits

Additional items of note in the Audit Workplan include:

- Occupational Safety and Health Administration (“OSHA”) Covid-19 Pandemic Program Results: On page 15 of the Audit Workplan the OIG states that its planned assessment will determine the actions OSHA has taken to address OSHA’s “lack of citations, incomplete information on infection rates at worksites, and insufficient evidence of hazard mitigation” during the Pandemic and “the efforts underway to ensure improved processes during future states of emergency.” The OIG categorized this planned audit as discretionary.

- Office of Labor-Management Standards (“OLMS”) Persuader Reporting: The Labor-Management Reporting and Disclosure Act of 1959 requires employers, labor relations consultants, and other entities to report certain expenses and agreements to the Department of Labor, such as those relating to activities to dissuade or persuade employees from exercising their rights to union representation or collective bargaining. In late July, OLMS updated the required form for this reporting, Form LM-10, effective August 28, 2023 (our story is here.) On page 16 of the Audit Workplan, the OIG explains that “[e]ven though these reports are legally required, there is evidence suggesting many employers and their consultants are not filing them.” As a result, OLMS requested the OIG review its efforts to enforce the Act’s requirements and improve employers’ and consultants’ reporting. The OIG categorized this planned audit as discretionary.

- IT Systems: On pages 16-17 of the Audit Workplan, the OIG discusses one mandatory and three discretionary planned audits involving IT systems, including modernization and disaster contingency and recovery plans. The one audit categorized as mandatory was for the Federal Information Security Management Act (FISMA). In performing its various missions, DOL collects and processes sensitive information through approximately 77 major information systems. This audit will focus on the status of the DOL Information Security Program in implementing an effective framework to secure DOL information systems.

- COVID-19 Impact on Jobs for Veterans State Grants (“JVSG”) Program: Page 21 of the Audit Workplan discusses the OIG’s plan to conduct an audit focusing on how the Pandemic impacted the [Veterans’ Employment and Training Service’s] JVSG program as well as the effectiveness of this program during a health crisis. The OIG categorized this planned audit as discretionary.

- Wage and Hour Division’s (“WHD”) Efforts to Fight Child Labor Violations: On pages 21-22 of the Audit Workplan, the OIG states it intends to conduct an audit to “focus on WHD’s efforts to curtail child labor law violations and determine the cause for rising child labor law violations.” The OIG categorized this planned audit as discretionary.

OFCCP Still Has Not Implemented 2020 OIG Audit Report Recommendation to Update Its Construction Program Participation Goals for Minorities & Women

The OIG considers its report recommendations resolved when the applicable agency management and the OIG agree on the required corrective actions. After the agreed-upon corrective actions have been completed, the recommendations are considered closed. The agency’s Recommendation Dashboard provides the status of OIG recommendations going back to FY 2011.

In early April 2020, we posted a Bonus Feature Blog discussing how a late March 2020 OIG report revealed that both the Obama and Trump Administration OFCCP construction audit programs “did not adequately enforce EEO requirements on federal construction contracts.” This report recommended a top-to-bottom overhaul of OFCCP’s construction contractor audit selection protocols and goals program.

Specifically, the OIG made two recommendations to the OFCCP stating that it should:

- “Develop a risk-based approach to select construction contractors for EEO compliance evaluations;” and

- “Update participation goals for minorities and females, and implement processes to keep all participation goals current.”

In other words, the OIG recommended that OFCCP start from scratch and build an entirely new audit selection system for construction contractors and that it update its construction availability goals for minorities and women to bring them up to date.

Our review of the OIG’s Recommendation Dashboard (by clicking on the “All” and “OFCCP” filters on the right side of the Dashboard) shows that the OIG considers only the first of these two recommendations as closed. Thus, OFCCP has yet to implement the OIG’s recommendation to update and keep its participation goals for minorities and women current.

In Brief

Wednesday, October 25, 2023: Senate HELP Committee Advanced Nomination of Current EEOC Chair Burrows for 3rd Commissioner Term

Wednesday, October 25, 2023: Senate HELP Subcommittee Scheduled Hearing on “AI and the Workforce” for October 31

Looking Ahead:

Upcoming Date Reminders

There are three NEW items added to our calendar this week:

June 2023: U.S. DOL WHD’s current target date (now overdue) to publish its Final Rule on Nondisplacement of Qualified Workers Under Service Contracts (RIN: 1235-AA42)

June 2023: U.S. OSHA’s current target date (now overdue) to publish its Final Rule on Occupational Exposure to COVID-19 in Healthcare Settings (RIN: 1218-AD36)

August 2023: U.S. DOL WHD’s (now overdue) target date for its Final Rule on Employee or Independent Contractor Classification Under the Fair Labor Standards Act (RIN: 1235-AA43)

August 2023: U.S. NLRB’s (now overdue) target date for its Final Election Protection Rule (RIN: 3142-AA22)

August 2023: U.S. DOL’s OASAM’s (now overdue) target date to publish Proposed Rule on “Revision of the Regulations Implementing Section 188 of the Workforce Innovation and Opportunity Act (WIOA) to Clarify Nondiscrimination and Equal Opportunity Requirements and Obligations Related to Sex” (RIN: 1291-AA44)

October 31, 2023: Opening Date for EEO-1 Survey Component 1 Data Collection

November 1, 2023: Public comments due on U.S. EEOC’s proposal to update its “Enforcement Guidance on Harassment in the Workplace.”

NEW November 1, 2023 (5:30 pm – 7:00 pm ET): US DOL ODEP’s second “stakeholder engagement session” on Section 14(c) subminimum wage program; for more information, see our story here.

November 6, 2023: Effective Date of FAR Council’s Final Rule to enhance whistleblower protections for federal contractor employees

November 7, 2023: Comments due on U.S. DOL WHD’s proposal to revise its FLSA regulations on the exemptions from minimum wage and overtime pay requirements for executive, administrative, & professional employees

November 13, 2023: Deadline for comments on OSHA’s union-friendly proposal to revise its Worker Walkaround Representative Designation Process (previous October 30 deadline extended)

NEW November 15, 2023 (5:30 pm – 7:00 pm ET): US DOL ODEP’s third “stakeholder engagement session” on Section 14(c) subminimum wage program; for more information, see our story here.

November 20, 2023: Deadline for comments on the Census Bureau’s Proposal to Test Questions on Sexual Orientation & Gender Identity for the American Community Survey

November 27, 2023: Comments due on the U.S. Office of Personnel Management’s Interim Final Rule to extend the eligibility date for noncompetitive appointment of military spouses married to a member of the armed forces on active duty through December 31, 2028

December 5, 2023: Submission deadline for EEO-1 Survey Component 1 Data Collection

December 26, 2023: NLRB’s Direct Final Rule revising its procedures governing representation elections takes effect

NEW December 26, 2023: Effective date of NLRB’s Final Rule on Standard for Determining Joint-Employer Status (under the NLRA)

December 29, 2023: Statutory deadline for EEOC to finalize regulations to enforce the Pregnant Workers Fairness Act

December 2023: OFCCP’s current target date for its Notice of Proposed Rulemaking to “Modernize” Supply & Service Contractor Regulations (RIN: 1250-AA13)

December 2023: OFCCP’s current target date for its Final Rule on “Technical Amendments” to Update Jurisdictional Thresholds & Remove Gender Assumptive Pronouns (RIN: 1250-AA16)

January 1, 2024: U.S. DOL OSHA’s Final Rule Requiring Covered High-Hazard Industry Employers to Electronically Submit Injury & Illness Records Takes Effect

April 3 – April 5, 2024: DEAMcon24 New Orleans

January 1, 2024: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.90 per hour, and the minimum cash wage for tipped employees increases to $9.05 per hour (See our story here detailing exceptions)

January 1, 2024: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $17.20 per hour, and this minimum wage rate will apply to non-tipped and tipped employees alike (See our story here detailing exceptions)

June 2024: OFCCP’s current target date for its Notice of Proposed Rulemaking to Require Reporting of Subcontractors (RIN: 1250-AA15)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 18668693326 and confirm your subscription. Provider message and data rates may apply.