The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

The DE OFCCP Week in Review (WIR) is a simple, fast and direct summary of relevant happenings in the OFCCP regulatory environment, authored by experts John C. Fox, Candee Chambers and Cynthia L. Hackerott. In today’s edition, they discuss:

- US EEOC Published Proposal to Revise Federal Employee Complaint Process to Allow Document Transmittal Via Its Electronic Public Portal

- Another Recruit Rooster Takeover on the DE Talk Podcast: The Hidden Benefits of Remote Work

- It’s on the Way! OMB Paved the Way for US DOL to Publish Highly-Anticipated Independent Contractor Rule Proposal

- US NLRB Altered COVID-Related Rule to Allow Mail-In Ballots in Locations Where CDC Determines “High” Transmission Risk

- Senate Approved Gomez to head US DOL EBSA; Further Action on Pending Gilbride (EEOC Counsel) and Looman (WHD Head) Nominations Postponed Until After Midterm Elections

- President Biden Signed Continuing Resolutions Appropriations Bill Funding the Federal Government Through Mid-December

- The Air Went Out of OFCCP’s Tires in FY 2022 as Unlawful Discrimination Allegations Fall to New Lows

- In Brief

- Looking Ahead: Upcoming Date Reminders

Tuesday, September 27, 2022: US EEOC Published Proposal to Revise Federal Employee Complaint Process to Allow Document Transmittal Via Its Electronic Public Portal

The U.S. Equal Employment Opportunity Commission (EEOC) proposed amending its federal sector complaint processing regulations to explicitly authorize the Commission to transmit – as a standard practice – it’s hearing and appellate decisions and other documents to registered complainants through the EEOC Electronic Public Portal. [Background: The EEOC sits as a “judge” of employee Title VII complaints filed against the federal Executive agencies]. The proposed Rule would also require agencies to notify complainants that they may use the Public Portal to file hearing requests and appeals and communicate with the Commission.

The U.S. Equal Employment Opportunity Commission (EEOC) proposed amending its federal sector complaint processing regulations to explicitly authorize the Commission to transmit – as a standard practice – it’s hearing and appellate decisions and other documents to registered complainants through the EEOC Electronic Public Portal. [Background: The EEOC sits as a “judge” of employee Title VII complaints filed against the federal Executive agencies]. The proposed Rule would also require agencies to notify complainants that they may use the Public Portal to file hearing requests and appeals and communicate with the Commission.

How We Got Here

The EEOC has long recognized that it must proceed by formal Rulemaking to compel its regulated community to file documents electronically and in digital format. Compare the OFCCP’s approach to simply mandate electronic filings without the benefit of formal public Rulemaking. Under current EEOC regulations, agencies are generally required to submit complaint files and appeals to the EEOC’s Office of Federal Operations (OFO) in an acceptable digital format. Appellants are also encouraged to submit digital appeals and supporting documents to OFO. The Federal Sector EEO Portal (FedSEP), an electronic portal available only to Federal agencies, was developed after the current regulatory provisions were promulgated. Its use by agencies has resulted in ease of access and communication, increased efficiency, and the elimination of paper, according to the EEOC’s 3-page Notice of Proposed Rulemaking (NPRM).

Tuesday, September 27, 2022: Another Recruit Rooster Takeover on the DE Talk Podcast: The Hidden Benefits of Remote Work

This month, we have another Recruit Rooster takeover, where our flock will be sharing the hidden benefits of remote work – where the nation sits currently, why employees want to work remotely, why some companies are resisting, and considerations to take when looking to level up and change your workforce to follow the times. Listen to our DE Talk Podcast via any of the options below and subscribe to receive updates whenever a new podcast is available. Enjoy!

Apple • Spotify • Google • Stitcher • iHeartRadio • Stitcher • TuneIn • Overcast • Pocket Casts • Castro • Castbox • Podchaser • RSS Feed

…or your preferred Podcast provider

Wednesday, September 28, 2022: It’s on the Way! OMB Paved the Way for US DOL to Publish Highly-Anticipated Independent Contractor Rule Proposal

Clearing the way for imminent Federal Register publication, the White House Office of Management and Budget (OMB) has concluded its review of the U.S. Department of Labor’s Wage and Hour Division’s (WHD) July 5, 2022, request to publish a proposed Rule on Independent Contractor Status Under the Fair Labor Standards Act (FLSA). So far, there is no indication when the WHD will publish its proposal (RIN: 1235-AA43).

Clearing the way for imminent Federal Register publication, the White House Office of Management and Budget (OMB) has concluded its review of the U.S. Department of Labor’s Wage and Hour Division’s (WHD) July 5, 2022, request to publish a proposed Rule on Independent Contractor Status Under the Fair Labor Standards Act (FLSA). So far, there is no indication when the WHD will publish its proposal (RIN: 1235-AA43).

How We Got Here

We reported in March that a federal court in Texas shot down the Biden FLSA Independent Contractor Rule & reinstated the previous Trump Rule. On May 13, 2022, the Department filed a Notice of Appeal in that case. Nevertheless, the WHD has been working on a new proposed Rule for some time. While the Spring 2022 Regulatory agenda for WHD did not list the expected Independent Contractor Rule proposal, WHD Acting Administrator Jessica Looman wrote a June 3, 2022 blog stating that a new proposed Rule was in the works. The WHD also held two public forums on the topic in June.

Thursday, September 29, 2022: US NLRB Altered COVID-Related Rule to Allow Mail-In Ballots in Locations Where CDC Determines “High” Transmission Risk

The U.S. National Labor Relations Board (NLRB) issued a decision updating the considerations that guide Regional Directors to exercise their discretion to determine whether an election must be conducted by mail ballot, as opposed to an in-person manual-ballot election, due to COVID-19-related conditions. The new decision in Starbucks Corporation (Case No 19–RC–295849) modified one of the six factors in the Board’s 2020 decision in Aspirus Keweenaw (370 NLRB No. 45). It addressed an election held in a Starbucks coffee shop in Seattle.

The U.S. National Labor Relations Board (NLRB) issued a decision updating the considerations that guide Regional Directors to exercise their discretion to determine whether an election must be conducted by mail ballot, as opposed to an in-person manual-ballot election, due to COVID-19-related conditions. The new decision in Starbucks Corporation (Case No 19–RC–295849) modified one of the six factors in the Board’s 2020 decision in Aspirus Keweenaw (370 NLRB No. 45). It addressed an election held in a Starbucks coffee shop in Seattle.

How We Got Here

As we previously reported, on November 9, 2020, the Board issued its decision in Aspirus setting standards for the mail-in ballot process in light of COVID-19. At that time, the Board’s longstanding policy strongly favored in-person elections. However, since the onset of the COVID-19 pandemic, the Board permitted mail-ballot elections under an “extraordinary circumstances” exception to the policy, based on six considerations.

Under Aspirus, the six factors included the following.

- The Agency office tasked with conducting the election is operating under “mandatory telework” status.

- Either the 14-day trend in the number of new confirmed cases of COVID-19 in the county where the facility is located is increasing, or the 14-day testing positivity rate in the county where the facility is located is 5% or higher.

- The proposed manual election site cannot be established in a way that avoids violating mandatory state or local health orders relating to maximum gathering size.

- The employer fails or refuses to commit to abide by GC Memo 20-10, Suggested Manual Election Protocols.

- There is a current COVID-19 outbreak at the facility, or the employer refuses to disclose and certify its current status.

- Other similarly compelling circumstances.

Second Factor Changed

The Starbucks decision changed factor 2 to now allow Regional Directors the discretion to order a mail-ballot election in communities in which the Centers for Disease Control (CDC) has determined that the risk of COVID-19 transmission in a particular community is “high,” based on the CDC’s county-based community level tracker. The NLRB did not change the remaining five factors of Aspirus.

The Board decided to apply this latest Starbucks decision prospectively only. That means the mail-ballot election conducted in this case and other previously ordered mail-ballot elections were not disturbed. Accordingly, the Region will now proceed to open and count the election ballots at issue in the case, which have been held pending this decision.

Thursday, September 29, 2022: Senate Approved Gomez to head US DOL EBSA; Further Action on Pending Gilbride (EEOC Counsel) and Looman (WHD Head) Nominations Postponed Until After Midterm Elections

Upon reconsideration, the U.S. Senate confirmed, by a 49-36 vote, President Biden’s nomination of Lisa M. Gomez to be an Assistant Secretary of Labor for the Employee Benefits Security Administration (EBSA). The EBSA regulates private-sector retirement and health plans. In June, the Senate voted along party lines – 49-51 – to block her confirmation. Due to the absence of Vice President Kamala Harris, Senate Majority Leader Charles Schumer (D-NY) changed his vote to “no” for procedural reasons and motioned the chamber to allow a vote again so Gomez could be reconsidered before the full Senate at a later date with VP Harris in attendance.

Upon reconsideration, the U.S. Senate confirmed, by a 49-36 vote, President Biden’s nomination of Lisa M. Gomez to be an Assistant Secretary of Labor for the Employee Benefits Security Administration (EBSA). The EBSA regulates private-sector retirement and health plans. In June, the Senate voted along party lines – 49-51 – to block her confirmation. Due to the absence of Vice President Kamala Harris, Senate Majority Leader Charles Schumer (D-NY) changed his vote to “no” for procedural reasons and motioned the chamber to allow a vote again so Gomez could be reconsidered before the full Senate at a later date with VP Harris in attendance.

Senate Majority Leader Charles Schumer (D-NY) said Thursday, after the Senate confirmed Gomez, that the chamber would not return for a roll-call vote until November 14. The midterm elections are the week before that, on November 8.

The Senate’s Health, Education, Labor, and Pensions (HELP) Committee calendar originally slated September 21 for its executive meeting to vote on the nominations of Karla Gilbride for EEOC General Counsel and Jessica Looman to head the US Department of Labor‘s Wage and Hour Division. That meeting was moved to September 28 and then again to September 29. However, as of the WIR deadline, there was no indication that any vote took place yet on these nominations. Therefore, it appears that the Committee has postponed the vote on the Gilbride and Looman nominations until after the midterm elections. As of our WIR deadline, the HELP Committee’s calendar did not show any rescheduled date(s) for these votes.

Friday, September 30, 2022: President Biden Signed Continuing Resolutions Appropriations Bill Funding the Federal Government Through Mid-December

The President signed into law H.R. 6833 (as amended by the Senate), the “Continuing Appropriations and Ukraine Supplemental Appropriations Act, 2023,” which provides fiscal year (FY) 2023 appropriations to federal agencies through December 16, 2022, for continuing projects and activities. This stop-gap legislation, known as a “Continuing Resolution”, will keep the government open past the November mid-term elections and allow both chambers extra time to resolve contentious details to arrive at a broader FY 2023 budget deal.

The President signed into law H.R. 6833 (as amended by the Senate), the “Continuing Appropriations and Ukraine Supplemental Appropriations Act, 2023,” which provides fiscal year (FY) 2023 appropriations to federal agencies through December 16, 2022, for continuing projects and activities. This stop-gap legislation, known as a “Continuing Resolution”, will keep the government open past the November mid-term elections and allow both chambers extra time to resolve contentious details to arrive at a broader FY 2023 budget deal.

The effect of a Continuing Resolution (CR) is that it authorizes budget to the federal agencies to continue operating but at the same level of budget the Congress gave each agency for the just concluded Fiscal Year and not at the usually higher level of the proposed budget for the new Fiscal Year now in progress.

Earlier on Friday, ten Republicans joined all House Democrats in passing this CR measure by a vote of 230-201. On Thursday, the Senate approved the bill by a 72-25 vote.

The House Appropriations Committee posted online a one-page summary of the legislation. The law also provides relief to communities recovering from natural disasters and includes supplemental appropriations to respond to the situation in Ukraine.

The new measure was originally supposed to contain provisions to speed up the permitting process for some major energy projects. After Senate Republican leaders and some Senate Democrats came out against the provision on Tuesday, Democratic leadership agreed to drop the provision to ensure the CR could pass.

Senator Joe Manchin, D-WV, who authored the permitting changes, stated just before a scheduled preliminary vote Tuesday evening that he did not want to put his permitting reforms up for a vote just to see them fail.

See also, John Fox’s Bonus Blog from April 4: OFCCP FY 2023 Budget Request Seeks A Lot Of Money And Lays Out A Very Comprehensive And Ambitious Internal Rebuilding Program

Friday, September 30, 2022: The Air Went Out of OFCCP’s Tires in FY 2022 as Unlawful Discrimination Allegations Fall to New Lows

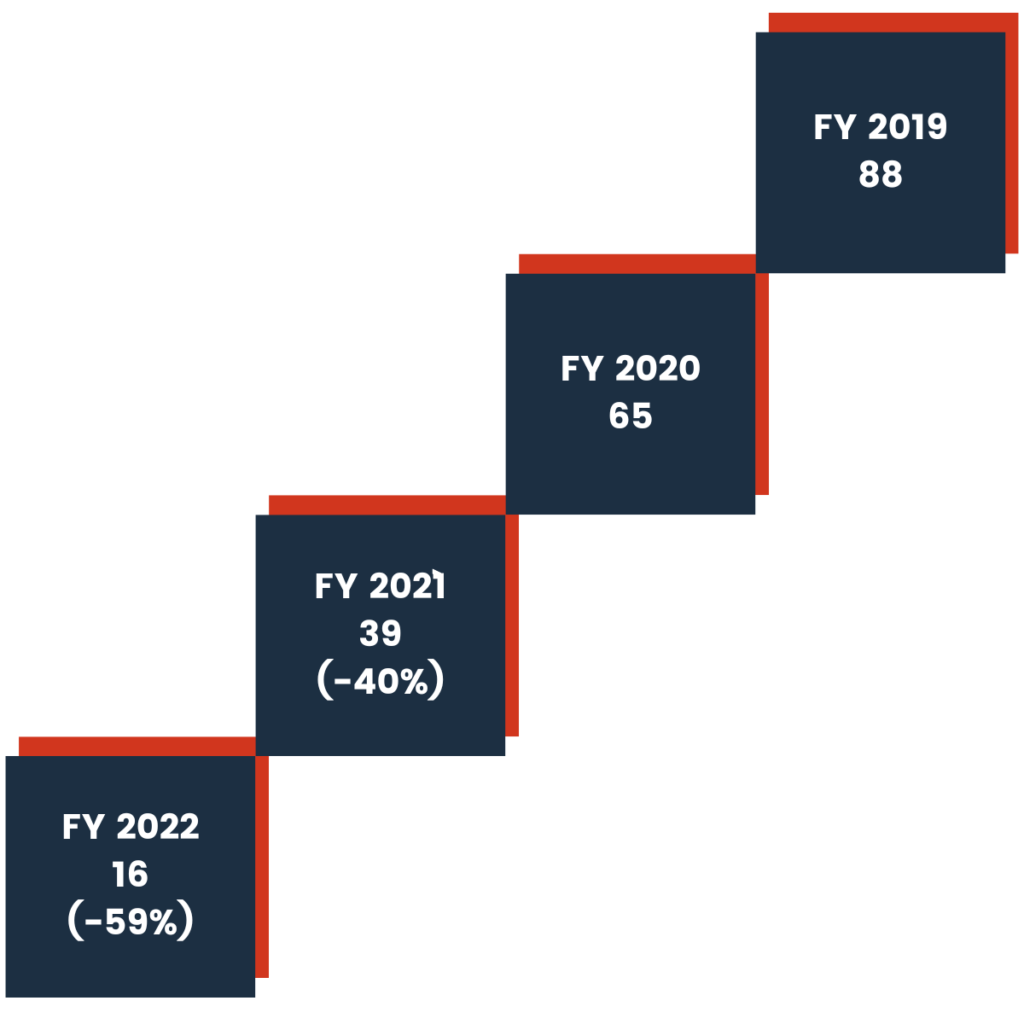

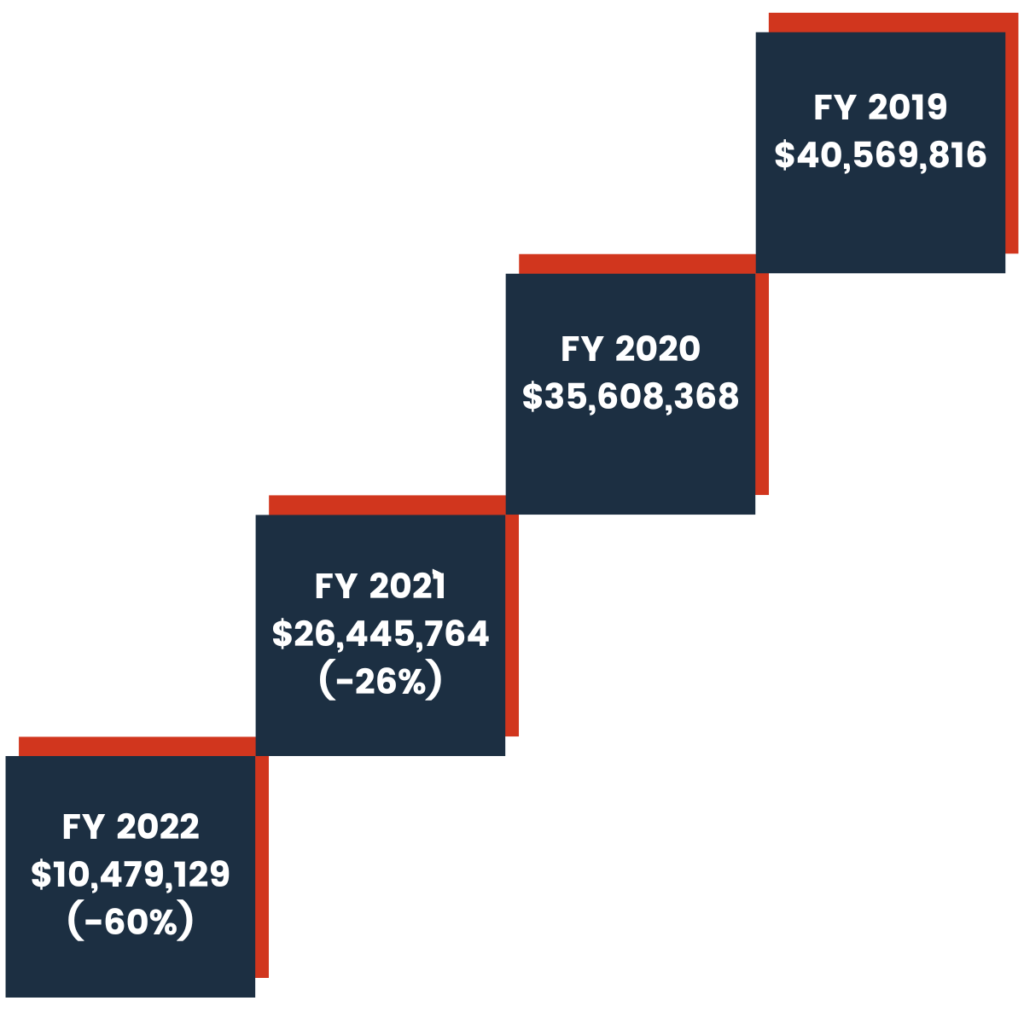

It has been a steady stair-step down for OFCCP since the Trump OFCCP: in the just concluded FY 2022 (the first full year of the Biden OFCCP – President Biden took office on January 20, 2021, with the 2nd quarter of FY 2021 in full swing), OFCCP has reported it signed only 16 Conciliation Agreements (“CAs”) in the last twelve months (between October 1, 2021 and September 30, 2022), with covered federal Government contractors alleging unlawful discrimination. That is down 75% from the last full year of the Trump Administration in FY 2020 in which OFCCP signed 65 Conciliation Agreements alleging unlawful discrimination and down over 80% from the 88 Conciliation agreements alleging unlawful discrimination the Trump OFCCP signed in FY 2019.

It has been a steady stair-step down for OFCCP since the Trump OFCCP: in the just concluded FY 2022 (the first full year of the Biden OFCCP – President Biden took office on January 20, 2021, with the 2nd quarter of FY 2021 in full swing), OFCCP has reported it signed only 16 Conciliation Agreements (“CAs”) in the last twelve months (between October 1, 2021 and September 30, 2022), with covered federal Government contractors alleging unlawful discrimination. That is down 75% from the last full year of the Trump Administration in FY 2020 in which OFCCP signed 65 Conciliation Agreements alleging unlawful discrimination and down over 80% from the 88 Conciliation agreements alleging unlawful discrimination the Trump OFCCP signed in FY 2019.

A newly developed trend also continued to change the historic look of the data being reported. That change first began to emerge in earnest in the last several years as more individual complaint settlements began to appear in the discrimination settlement data. This has occurred because the Trump OFCCP fundamentally changed the OFCCP’s Memorandum of Understanding with the EEOC to allow OFCCP, for the first time, to keep in its investigation inventory all individual Complaints (the EEOC calls them Charges) arising under Title VII and the Americans with Disabilities Act. We wrote about that change here. As a result, OFCCP is now being flooded with individual Complaints and is remedying more of those than ever before. Those individual settlements are now showing up in dribs and drabs in OFCCP’s enforcement statistics. Indeed, while still relatively small in number at OFCCP compared to the 60,000 plus such claims the EEOC intakes every year, these individual Complaints are accounting for more and more of the number of OFCCP settlement transactions, while accounting for relatively insignificant dollar value settlements relative to OFCCP’s typical class claim settlements.

This Year’s 16 Discrimination Settlements: Of the sixteen CAs OFCCP has reported signing during the just closed FY 2022 (FY 2022 ended Friday, September 30, 2022), “Failure to Hire” claims again led the number of discrimination claims settled (as it has for over four decades) with 10 of the 16 (~62%) reporting discrimination in various forms of hiring claims, although no testing claims. This is also a new low percentage of “Failure-to-Hire” claims relative to other OFCCP discrimination claims settlements. Historically, OFCCPs F-T-H claims have averaged over 90%of OFCCP’s alleged discrimination settlements.

“Compensation” discrimination claims came in second place in terms of the number of claims OFCCP alleged at 4 of the 16 (25%), but two of these settlements were not “compensation” claim violations, in fact. The first of these four was actually not a Compensation claim at all, but rather was a sex discrimination claim that the contractor assigned women to lower-paying jobs. The remedy was to have the contractor pay back pay to the women in the amount of the value of the higher-paying job. So, compensation was the remedy, not the claim of unlawful discrimination.

The second of these four CAs OFCCP classified as “compensation” claims is actually a claim involving the termination of an employee for allegedly disclosing and discussing the pay of others. The $6,250 of back pay paid was make-whole money to gap the employee’s time before finding alternative employment. OFCCP’s mistake in classifying this and the prior claim as “compensation” discrimination was to confuse the payment of back-pay as a claim for compensation discrimination. If every backpay resolution were a “compensation claim,” all OFCCP discrimination settlements would be “compensation” resolutions. The type of claim is dictated not by the employer’s payment of backpay, but rather by the type of employment transaction identified as having caused the alleged unlawful discrimination (failure-to-hire; demotion; involuntary termination; etc.).

The remaining two true “compensation” cases were statistical cases claiming the contractor paid women less than men for work in jobs allegedly similar (a class-based equal pay claim). NOTE: OFCCP lacks Equal Pay authority. Moreover, OFCCP identified no policies or practices allegedly causing the at-issue pay differentials (as opposed to mere statistical imbalance). It is thus highly doubtful either of these claims were even proper discrimination claims made unlawful by Title VII.

Note: The dollar value of all Failure to Hire claims settled came to $5,154,997.79. This is a much smaller dollar value than OFCCP usually harvests for Failure to Hire claims and reflects another trend emerging at the Biden OFCCP: the shift away from Failure to Hire claims and the dogged pursuit of compensation discrimination claims. OFCCP believes compensation discrimination is widespread, even though OFCCP’s investigations have shown, like this year, for over 40 years (through seven different political administrations of the OFCCP) that there is no widespread unlawful compensation discrimination in the United States based on a legally protected status.

Note: Once the two CAs which were not in fact “compensation” claims are removed from OFCCP’s compensation ledger, the number of OFCCP resolutions of “compensation” discrimination claims shrinks to two (2) for FY 2022 and the value of OFCCP’s compensation recoveries properly shrinks to $4,100,000.

One of the two remaining CAs resolved both a claim that the contractor terminated an employee because of his sexual orientation rather than merely disciplining him for misconduct (as OFCCP claimed should have occurred), and in another situation discriminated against an employee because of his disability.

The last of the 16 CAs is an odd one in that it claimed the contractor discriminated against an employee by allegedly improperly denying her a promotion based on her protected status as a woman and as a Protected Veteran. Since this was an intentional discrimination allegation, it is first unlikely that the contractor discriminated against this employee both because she was a woman and a Protected Veteran. Second, OFCCP does not have non-discrimination authority under that portion of VEVRAA it enforces (38 USC Section 4212). Rather, 38 USC Section 4212 imposes only “affirmative action” compliance” obligations. (Yes, we know that OFCCP has quietly converted its VEVRAA Rules (beginning in 2000 and finally completed that unauthorized transition in 2014) to make discrimination based on Protected Veteran status unlawful. However, a basic tenet of federal administrative laws is that federal agency Rules must faithfully implement the Congressional statutory mandate. As a result, federal agencies may neither enlarge nor shrink that delegation of authority from Congress. So, federal agency Rules, like OFCCP’s modern VEVRAA Rules, different from and larger than the statute the Rules are designed to implement are simply unenforceable. Because OFCCP’s conciliation demand was less than $7,000, it appears the contractor just “wrote the check” rather than spending more money to defend against OFCCP’s unusual allegations.

OFCCP collected a total of $10,479,129.81 in backpay settlements for FY 2022. This collection represents another large stair-step down in OFCCP’s recent backpay collections. This represents a 74% decline in backpay collections since OFCCP’s FY 2019 collection and a 70% decline in backpay collections since OFCCP’s FY 2020 collection.

Special Note: We have not reported here the “affirmative action” compliance violations the agency resolved in FY 2022 since OFCCP has not yet reported those data. (It typically takes OFCCP about 30-60 days to report these data and then correct them). We previously reported here on July 25, 2022, as to all OFCCP audits and CAs through the end of OFCCP’s Third Quarter (which ended June 30, 2022). At this writing, it appears that OFCCP has signed a total of 90 CAs in the past 12 months with declining production through the year even as the COVID-19 pandemic lifted:

| First Quarter | 44 CAs |

| Second Quarter | 26 CAs |

| Third Quarter | 14 CAs |

| Fourth Quarter | 6 CAs |

| Total | 90 CAs during FY 2022 |

In Brief

Tuesday, September 27, 2022: OFCCP Published Formal Notice of Previously Announced Extension to the Contractor Deadline to Object to the EEO-1 Component 1 (Type 2=Consolidated) Data FOIA Disclosure

OFCCP posted a formal Notice in the Federal Register of its deadline extension – to October 19, 2022 – for contractors to submit objections regarding a reporter’s Freedom of Information Act (FOIA) request for EEO-1 consolidated Component 1 Survey data. As we previously reported, the agency earlier stated – in a note posted on the portal landing page and via an email announcement – that it extended the deadline for “multiple reasons,” including numerous federal contractor requests for extension. Also, “since the publication of the original notice, some federal contractors have raised questions regarding their efforts to verify whether they are included in the universe of Covered Contractors during the requested timeframe,” OFCCP reported. To address this issue, OFCCP will email contractors that the agency believes are covered by this FOIA request (and for what years), using the email address provided by contractors that have registered in OFCCP’s Contractor Portal and the email addresses provided as a contact for the EEO-1 Survey.

OFCCP posted a formal Notice in the Federal Register of its deadline extension – to October 19, 2022 – for contractors to submit objections regarding a reporter’s Freedom of Information Act (FOIA) request for EEO-1 consolidated Component 1 Survey data. As we previously reported, the agency earlier stated – in a note posted on the portal landing page and via an email announcement – that it extended the deadline for “multiple reasons,” including numerous federal contractor requests for extension. Also, “since the publication of the original notice, some federal contractors have raised questions regarding their efforts to verify whether they are included in the universe of Covered Contractors during the requested timeframe,” OFCCP reported. To address this issue, OFCCP will email contractors that the agency believes are covered by this FOIA request (and for what years), using the email address provided by contractors that have registered in OFCCP’s Contractor Portal and the email addresses provided as a contact for the EEO-1 Survey.

The above information was repeated in the latest Federal Register notice, along with five separate, minor corrections to OFCCP’s initial August 19th Federal Register Notice regarding its online portal for contractors to submit objections.

Thursday, September 29, 2022: USDOL/ODEP Announced NDEAM Employer Chat on Workplace Mental Health and Well-Being

The U.S. Department of Labor (USDOL) Secretary Marty Walsh and Assistant Secretary of Labor for Disability Employment Policy Taryn Williams will host an employer discussion on workplace mental health and well-being on Thursday, October 13, 2022. The discussion will be streamed online from 10:00 – 11:15 a.m. ET (CART captioning and ASL interpreters will be available.) Secretary Walsh and Assistant Secretary Williams will be joined by corporate, disability advocacy, and labor employers recognized for their innovative approaches to fostering supportive, mental health-friendly workplaces.

The U.S. Department of Labor (USDOL) Secretary Marty Walsh and Assistant Secretary of Labor for Disability Employment Policy Taryn Williams will host an employer discussion on workplace mental health and well-being on Thursday, October 13, 2022. The discussion will be streamed online from 10:00 – 11:15 a.m. ET (CART captioning and ASL interpreters will be available.) Secretary Walsh and Assistant Secretary Williams will be joined by corporate, disability advocacy, and labor employers recognized for their innovative approaches to fostering supportive, mental health-friendly workplaces.

As we reported earlier this year, USDOL chose “Disability: Part of the Equity Equation” as the theme for October’s National Disability Employment Awareness Month (NDEAM) 2022. This discussion is offered in honor of NDEAM. Registration for the free event is available here.

Thursday, September 29, 2022: US EEOC Released New Data on EEO-1 and Other Survey Collections Plus New Discrimination Charge Visualizations by State

The U.S. Equal Employment Opportunity Commission added new data on its website that includes the 2019 and 2020 EEO-1 Component 1 data for private employers with 100 or more employees and federal contractors with 50 or more employees, 2020 EEO-3 data for referral local unions, 2021 EEO-4 data for state and local governments, and 2020 EEO-5 data for public elementary and secondary schools. In addition, the Commission moved previously static data tables for earlier years to EEOC Explore, which the agency touts as “a more dynamic platform.” This platform allows for improved access and customized data results. It will, for the first time, allow users to access a charge visualization tool that provides a new way to look at aggregated data about charges of discrimination filed with the EEOC from fiscal years 1997-2021. The EEOC will continue to add new data to EEOC Explore as the data becomes available.

The U.S. Equal Employment Opportunity Commission added new data on its website that includes the 2019 and 2020 EEO-1 Component 1 data for private employers with 100 or more employees and federal contractors with 50 or more employees, 2020 EEO-3 data for referral local unions, 2021 EEO-4 data for state and local governments, and 2020 EEO-5 data for public elementary and secondary schools. In addition, the Commission moved previously static data tables for earlier years to EEOC Explore, which the agency touts as “a more dynamic platform.” This platform allows for improved access and customized data results. It will, for the first time, allow users to access a charge visualization tool that provides a new way to look at aggregated data about charges of discrimination filed with the EEOC from fiscal years 1997-2021. The EEOC will continue to add new data to EEOC Explore as the data becomes available.

“We are pleased to take the next steps in implementing Executive Order 13985: Advancing Racial Equity and Support for Underserved Communities Through the Federal Government, which calls on federal agencies to measure and advance equity by gathering the data necessary to inform that effort,” said EEOC’s Chief Data Officer Chris Haffer in a press release. “By introducing the new interactive EEO-3, EEO-4, EEO-5, and Charge Data Dashboards [via EEOC Explore], the EEOC continues our commitment to publicly releasing aggregate data that may be used for evidence-based decision-making, transparency, accountability, and to inform DEIA initiatives,” Dr. Haffer added.

Looking Ahead:

Upcoming Date Reminders

Thursday, October 6, 2022 (2:00 PM – 03:30 PM Eastern): EARN and Cornell University will jointly host a virtual listening session on “Intersectional Considerations in Workplace Mental Health”

Thursday, October 13, 2022: Deadline to submit comments on USDOL proposal to amend union “Persuader Reports” to add federal contractor identification (RIN 1245-AA13) – https://www.regulations.gov/search?filter=RIN%201245-AA13

Thursday, October 13, 2022: USDOL/ODEP National Disability Employment Awareness Month Employer Chat on Workplace Mental Health and Well-Being – https://www.eventbrite.com/e/ndeam-employer-chat-on-workplace-mental-health-and-well-being-tickets-428714956977

Tuesday, October 18, 2022: DE Webinar – “Forming and Sustaining Partnerships to Improve Employment of People with Disabilities”

Tuesday, October 18, 2022: Deadline to submit comments on FAR Council’s proposed Rule mandating Project Labor Agreements on large federal construction projects – https://www.regulations.gov/document/FAR-2022-0003-0001

Wednesday, October 19, 2022: Deadline to submit objections to OFCCP regarding EEO-1 Data (Component 1, Type 2) FOIA disclosure request (previous September 19 deadline extended) – https://www.dol.gov/agencies/ofccp/submitter-notice-response-portal

Thursday, October 20, 2022 (2:00 PM Eastern Time): DE Masterclass Roundtable – “Report of Successful DE&I Programs That Are Lawful And Won’t Get You Into Trouble”

Tuesday, October 25, 2022 (3:00 PM Eastern Time): DE Webinar – “Inclusive & Accessible Recruitment: 3 Steps to Secure Leadership Buy-in”

Tuesday, November 1, 2022: Deadline to submit comments on US General Services Administration’s future rulemaking regarding union solicitations of federal contractor employees in GSA-controlled buildings – https://www.regulations.gov/docket/GSA-FMR-2022-0011

Monday, November 21, 2022: Deadline to submit comments on National Labor Relations Board’s proposed Rule to Determine Joint Employer Status – https://www.regulations.gov/docket/NLRB-2022-0001

Friday, November 25, 2022: US DOL Final Rule rescinding Industry-Recognized Apprenticeship Programs and shifting department resources to Registered Apprenticeship Programs takes effect – http://www.federalregister.gov/d/2022-20560

Sunday, January 1, 2023: The minimum wage for federal contracts covered by Executive Order 13658 (“Establishing a Minimum Wage for Contractors”) (contracts entered into, renewed, or extended prior to January 30, 2022), will increase to $12.15 per hour, and the minimum cash wage for tipped employees increases to $8.50 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20905/minimum-wage-for-federal-contracts-covered-by-executive-order-13658-notice-of-rate-change-in-effect

Sunday, January 1, 2023: The minimum wage for federal contractors covered by Executive Order 14026 (“Increasing the Minimum Wage for Federal Contractors”) (contracts entered into on or after January 30, 2022, or that are renewed or extended on or after January 30, 2022), will increase to $16.20 per hour, and the minimum cash wage for tipped employees increases to $13.75 per hour – https://www.federalregister.gov/documents/2022/09/30/2022-20906/minimum-wage-for-federal-contracts-covered-by-executive-order-14026-notice-of-rate-change-in-effect

Wednesday, April 12 – Friday, April 14, 2023: DEAMcon23 Chicago (Registrations open now; Agenda coming late October!)

THIS COLUMN IS MEANT TO ASSIST IN A GENERAL UNDERSTANDING OF THE CURRENT LAW AND PRACTICE RELATING TO OFCCP. IT IS NOT TO BE REGARDED AS LEGAL ADVICE. COMPANIES OR INDIVIDUALS WITH PARTICULAR QUESTIONS SHOULD SEEK ADVICE OF COUNSEL.

SUBSCRIBE.

Compliance Alerts

Compliance Tips

Week In Review (WIR)

Subscribe to receive alerts, news and updates on all things related to OFCCP compliance as it applies to federal contractors.

OFCCP Compliance Text Alerts

Get OFCCP compliance alerts on your cell phone. Text the word compliance to 55678 and confirm your subscription. Provider message and data rates may apply.